Spain’s Ibex also higher on the day

The major European indices are closing the day with mixed results. The gains were led by the FTSE 100. The Spanish Ibex also moved higher. The German DAX lagged.

The provisional closes are showing:

- German DAX, -0.55%

- France’s CAC, unchanged

- UK’s FTSE 100, +1.2%

- Spain’s Ibex, +1.0%

- Italy’s FTSE MIB, -0.5%

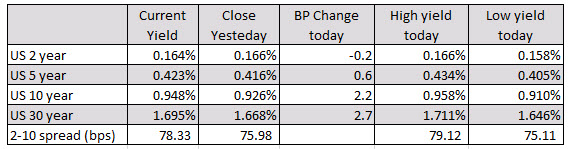

In other markets as London/European traders look to exit:

- spot gold is trading up $13.78 or 0.76% at $1829.02.

- Spot silver is trading down $0.01 or -0.05% at $23.99

- WTI crude oil futures are up $0.94 or 2.11% at $45.48. That is just off the high price of $45.69. The low price extended to $43.92. Talks between Opec Plus continued today and vibe appears to be a lot more diplomatic and delegates say that they are positive consensus will be reached tomorrow.

- Bitcoin on Coinbase is trading down $140 and $18,919

In the US stock market, the major indices are going back earlier declines:

- S&P index is now up 2.14 points or 0.05% at 3664.47. The low price reached 3644.84

- NASDAQ index is still down 17.3 points or -0.14% 12337.50. The low price reached 12217.34

- Dow industrial average is down 8 points or -0.03% at 29815. The low price reached 29599.29

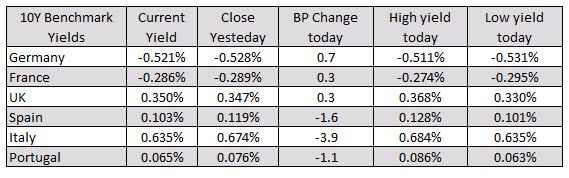

In the European debt market, the benchmark 10 year yields are mixed with Germany, France and the UK up marginally, while investors moving into Spain, Italy, and Portugal.

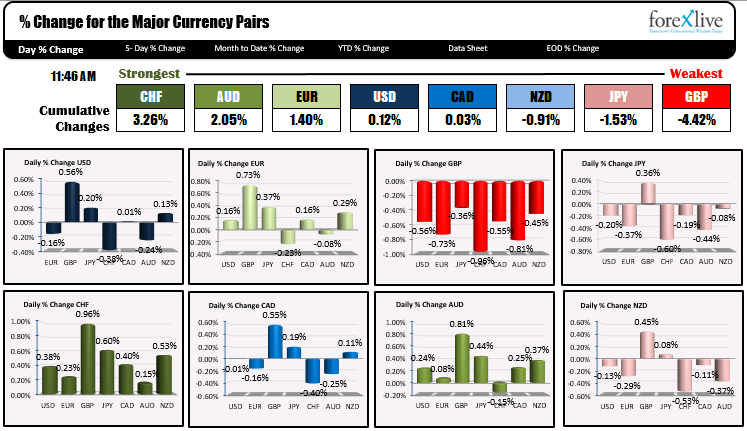

In the forex market, the CHF remains the strongest and the GBP remains the weakest (that was the ranking at the beginning of the trading day). The USD was just behind the CHF as one of the strongest currencies at the start of the New York session, but is now weaker verse the EUR, and AUD and unchanged vs. the CAD as London traders exit for the day (see the ranking at the start of the trading day).

In the forex market, the CHF remains the strongest and the GBP remains the weakest (that was the ranking at the beginning of the trading day). The USD was just behind the CHF as one of the strongest currencies at the start of the New York session, but is now weaker verse the EUR, and AUD and unchanged vs. the CAD as London traders exit for the day (see the ranking at the start of the trading day).

The ADP employment change came in weaker than expected at 307K vs.440K estimate. The prior month was revised higher to 404K from 365K previously reported. On Friday the change nonfarm payrolls is expected to rise by 478K vs. 638K last month.