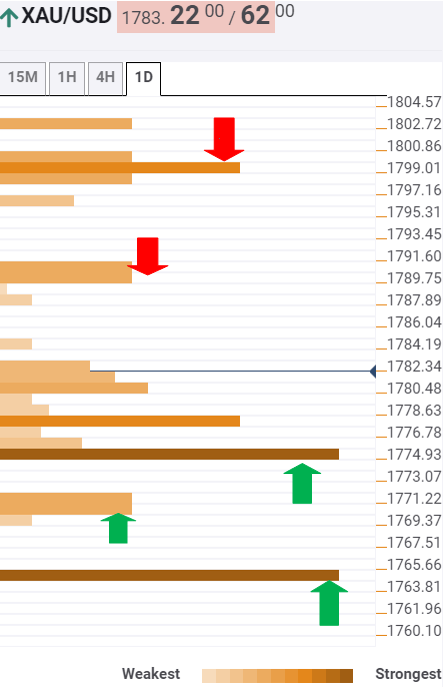

Gold Price Analysis: XAU/USD braces for a bumpy road to recovery above $1775 – Confluence Detector

Gold (XAU/USD) is making another recovery attempt from five-month lows of $1765 as the US dollar dips on improved market mood amid coronavirus vaccine and US stimulus hopes. US Treasury Secretary Steve Mnuchin’s push for utilizing $455 billion from the CARES Act also bodes well for gold.

Although, gold’s corrective advance could lose steam, in the wake of hopes for an imminent vaccine rollout. Optimism over a swift vaccine-driven economic recovery diminishes gold’s attractiveness as a safe-haven. Focus shifts to the US data dump and Fed Chair Powell’s testimony.

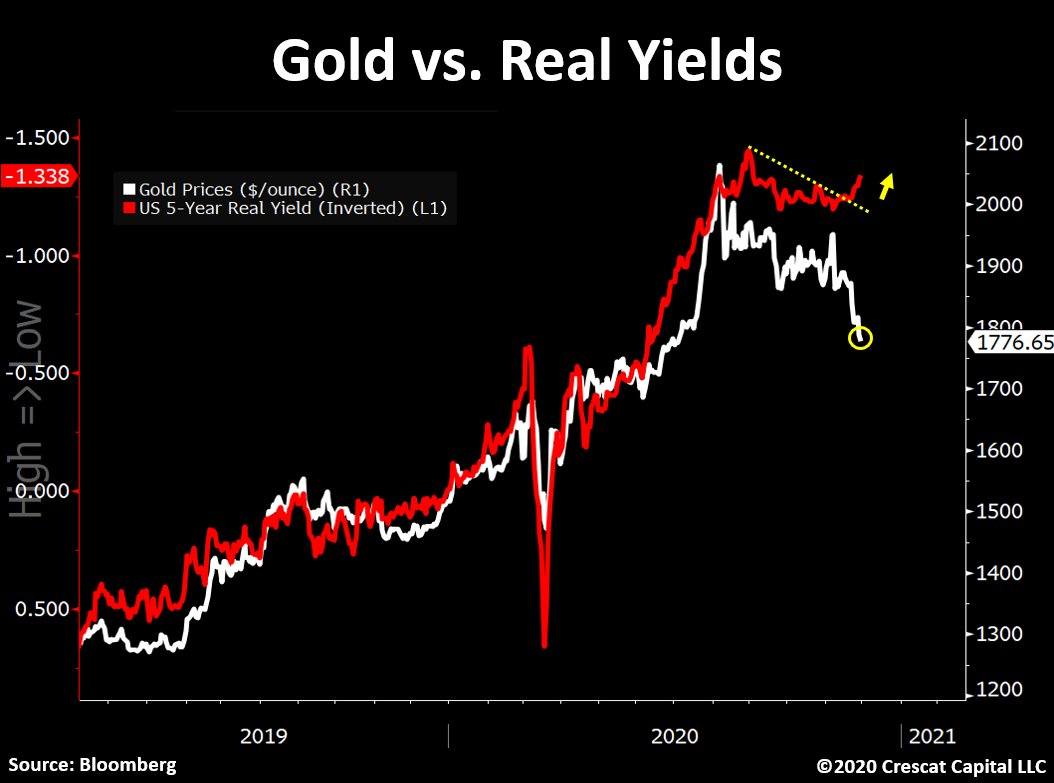

Gold Price Analysis: US real yields suggest XAU/USD close to a major bottom

Gold could be close to bottoming out and may soon resume the broader uptrend, as real or inflation-adjusted yields look set to dive deeper into the negative territory.

According to the chart tweeted by Crescat Capital Portfolio Manager Otavia Costa, the US five-year real or inflation-adjusted yield (inverted) has breached a trendline, marking an end of a minor consolidation and resumption of the slide from 0.5 to -1.41% seen in the five months to August. As such, demand for gold, a store of value asset, could again spike. However, according to Kyle Rodda, Market Analyst at IG Australia, gold’s next move depends on flows in and out of exchange-traded-funds (ETFs).