Daily thread to exchange ideas and to share your thoughts

It is a bit of a quiet start and may stay that way until we get to North American trading later today. It will be the last ‘real’ trading day of the week, with thinner liquidity conditions set to overshadow the final two days amid the Thanksgiving holiday.

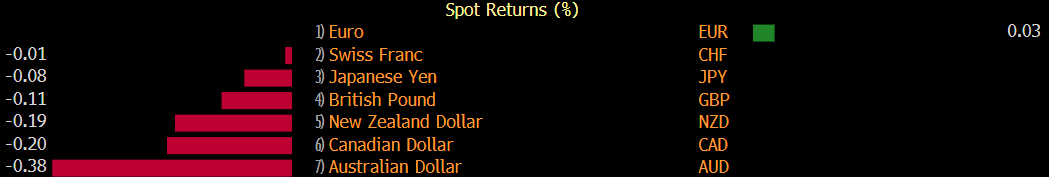

The aussie and kiwi are mildly weaker as we see a bit minor pullback with S&P 500 futures erasing gains to keep near flat levels currently.

USD/CAD is also getting a mild lift just above 1.3000 for the time being.

Elsewhere, EUR/USD is still contesting with 1.1900 and GBP/USD continues to drift around 1.3300 to 1.3370 since European trading yesterday.

Gold remains an interesting one to watch as $1,800 is called into question, while oil is looking to secure a stronger technical breakout above its August highs – now @ $45.15.

Is the Santa Claus rally starting to come together to push risk trades higher? Or is this a shot in the arm followed by a fizzle? The risk push and pull continues.

The technicals in the equities space suggests the former may be the case but FX remains more guarded in that regard, with AUD/JPY also still below 77.00.