Volatile NY session

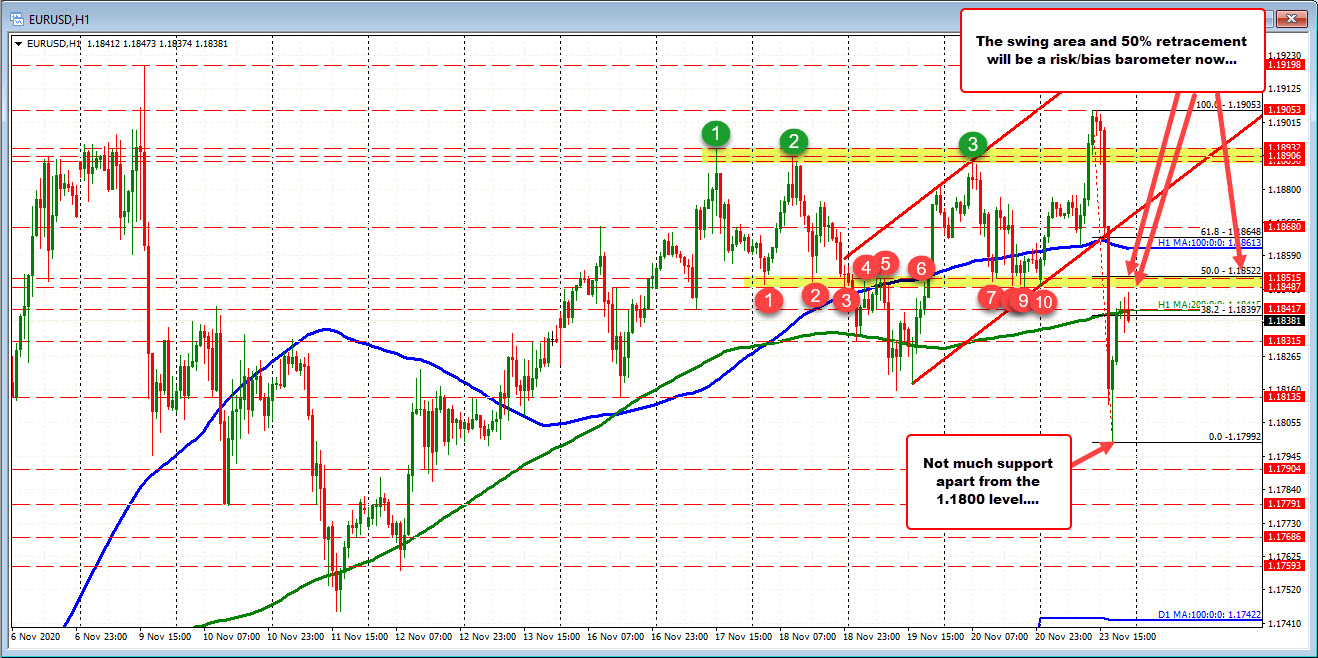

The EURUSD traded to the highest level since November 9th taking out last week’s highs in the process between 1.1890 and 1.18931. The high price reached 1.19053.

Then all hell broke loose. The Markit PMI data came better than expected and there was a run into the USD. That move saw the price crack below the swing highs between 1.1890 to 1.1893, and then the 100 hour MA (blue line).

Another swing area between 1.18487 and 1.18515 (see red numbered circles) was also broken, as was the 200 hour MA (green line). The selling did not stop until reaching the 1.1800 level.

The price has rebounded with the price extending back above the 200 hour MA (at 1.18417), but remained below the swing area at 1.18487 to 1.18515 (see red numbered circles).

So what was accomplished through it all?

The price moved outside the upper extreme from last week (above 1.18932) and below the lower extremes from last week (below 1.18135). Each move FAILED.

Between sits the swing area at 1.18487 and 1.18515. That will be my barometer for bull/bear going forward. Stay below is more bearish. Move above and the buyers are wrestling more control.

Ultimately, getting and staying above 1.18932 or below 1.18135 is needed to get out the range seen last week. Remember that range was only 80 pips. Today’s range surpassed that range but we still failed to run (expect higher and then lower and higher again). What we can say, is the intraday volatility certainly picked up.