The USD is trading mixed as Dow stocks soar on Pfizer vaccine results

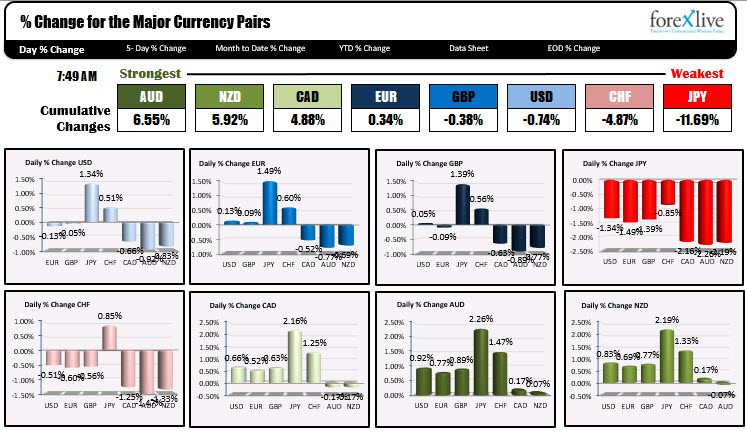

The AUD is the strongest and the JPY is the weakest as traders react to the election and the new that Pfizer vaccine is 90% effective. The news has investors piling into Dow related stocks including banks and energy, along with beaten down industries like banks, airline, hotels, cruise lines, fast food. Gold is falling. Other shares that benefitted from Covid are getting hit including Peleton, Zoom. The USD is mixed through the volatility. The Dow futures are implying a gain of 1500 points. The Nasdaq is back trading higher after moving lower on flow data in volatile trading.

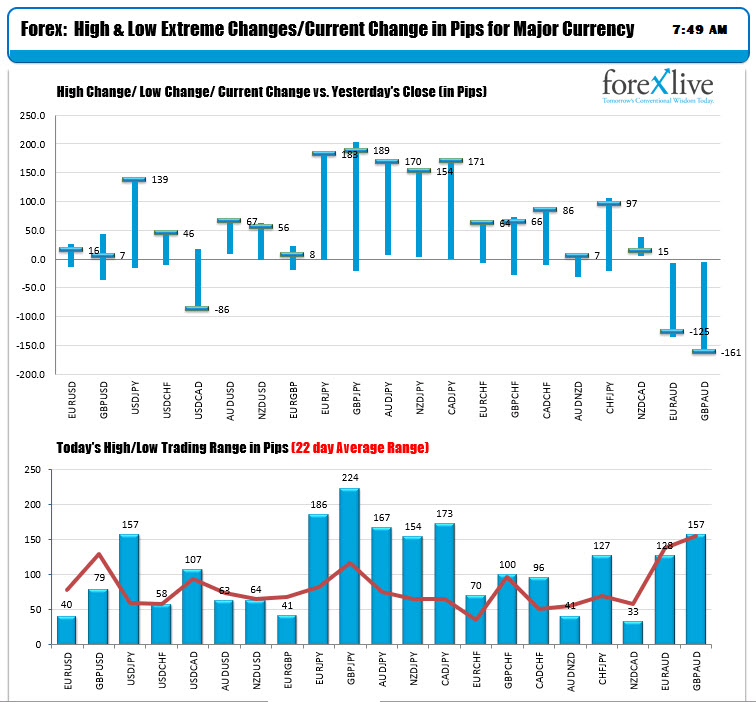

The ranges and changes are showing buying in the “risk-on” currencies like the JPY, AUD, NZD and CAD. The JPY cross currency pairs are surging and trading near the highs for the day.

In other markets:

- Spot gold is trading down -$50 or -2.65% at $1899

- Spot silver is trading down -$1.00 or -3.89% at $24.60

- WTI crude oil futures are surging with the front contract trading up $3.58 or 9.59% at $40.72

In the premarket for US shares, the futures are implying sharply higher levels for Dow and S&P stocks. The Nasdaq shares are lagging.

- Dow +1568 points

- S&P, +142 points

- Nasdaq +10.90 points

In the European markets, the major indices are surging to the upside after the 4 day win streak was broken on Friday.

- German Dax +5.14%

- France’s CAC, +6.56%

- UK FTSE 100, +5.0%

- Spain’s Ibex +7.1%

- Italiy’s FTSE MIB, +4.81%

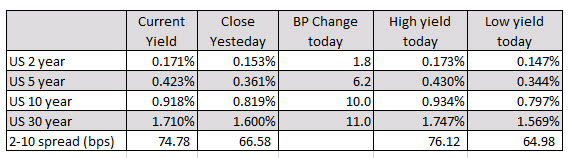

In the US debt market, yields are surging with a steeper yield curve:

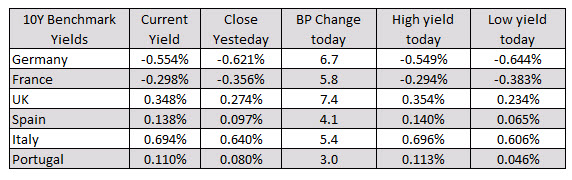

In Europe, the benchmark 10 year yields are also sharply higher.