Levels to eye in the new trading day

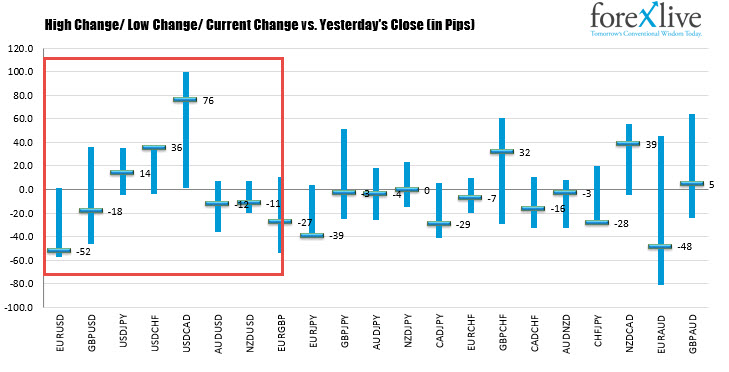

The dollar rose for the day, but is ending off the highs for the day with the exception of the USDCHF. The pair is rising to a new high as the day comes to an end in that pair.

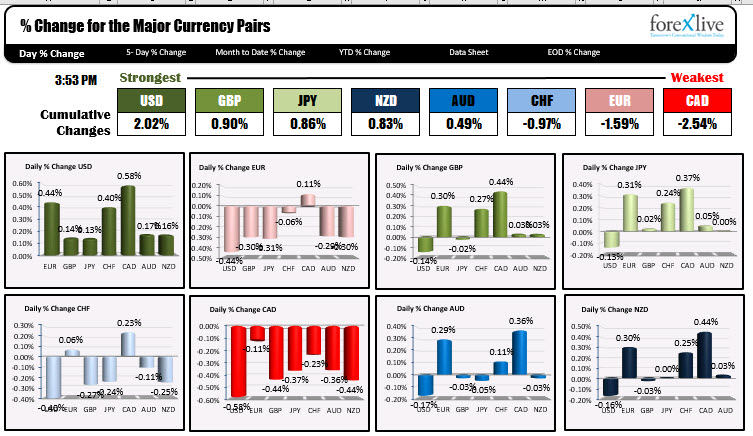

The USD is the strongest of the majors while the CAD is ending as the weakest.

Some technical levels for the key pair shows:

- EURUSD: The EURUD traded to the 38.2% retracement of the move up from the October 15 low at 1.18067 today. The low price in the London morning session reach 1.1803. The New York session low reached 1.1805. The pair is trading at 1.1809 into the last hour of trading for the day. In the new day, moving below and staying below the 38.2% retracement level, would open the door for the next support tested at the 200 hour moving average at 1.17883 (and rising). Below that is the 50% retracement and near the low from Friday’s trade at 1.1784. If support holds here (stays above 1.1800). A move back up toward resistance at 1.1830 and its 100 hour moving average at 1.18352 would be the next upside targets in the new trading day. Move back above the 100 hour moving average increases the bullish bias.

- GBPUSD: The GBPUSD is closing lower on the day but had lots of ups and downs intraday. At the low, the price traded below its 200 hour moving average on 2 separate occasions (one in the London session and one in the New York session). The 1st dip reached 1.2992. The 2nd dip reached 1.92935 (only a pip and a half separated the two). The inability to break the 200 hour moving average and run lower is a little bit of the advantage to the buyers – but only a little as the pair remains below its 100 hour moving average above at 1.30581. It would take a move back above that 100 hour moving average in the new trading day to give the buyers more control. On the downside, break the 200 hour moving average at 1.3004 and then the 1.2992 level, and the sellers take would be in full control.

- USDJPY: The USDJPY was trading near highs for the day and above the 105 level in the morning North American session. The high price reached 105.05. That was just short of its 200 hour moving average (currently at 105.098). The subsequent fall took the price back toward its broken 100 hour moving average at 104.837. The last 6 trading hours of the day traded above and below that 100 hour moving average by a few pips on either side. The pair is currently trading right at that moving average level as we head into the close. In the new trading day, the 100 hour moving average will be the barometer for the buyers and sellers. Move below -and then below the swing low from the London session at 104.78 and a trendline on the hourly chart connecting lows from last week at 104.70 - would increase the bearish bias. On the topside, move above 105.00 and then the 200 hour moving average at 105.098, and the buyers feel more confident.

- AUDUSD: The AUDUSD fell in New York session toward key support defined by a cluster of moving averages and a retracement level. More specifically the 100 hour moving average comes out 0.7108. The 100 day moving average comes in at 0.7106. The 38.2% retracement of the move from the October 9 high comes in at 0.7105 finally the 200 hour moving average comes in at 0.7099. The low in the New York session reached 0.7104 between that cluster of support and bounced back higher. The pair is trading just below its 50% retracement of the move down from the October 9 high at 0.71313. It will take a move above that level, and then the high for the day at 0.71457 and the high from last week at 0.715752 give buyers more control. Needless to say on the downside breaking below the cluster support (down to 0.7099) is needed to tilt the bias more in that direction.

This article was originally published by Forexlive.com. Read the original article here.