The German IFO Business Survey Overview

The German IFO survey for October is due for release later today at 0900 GMT. The headline IFO Business Climate Index is seen decelerating to 92.7 versus 93.4 previous.

The Current Assessment sub-index is seen arriving at 89.7 this month vs. 89.2 prior while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to come in at 96.0 in the reported month vs. 97.7 last.

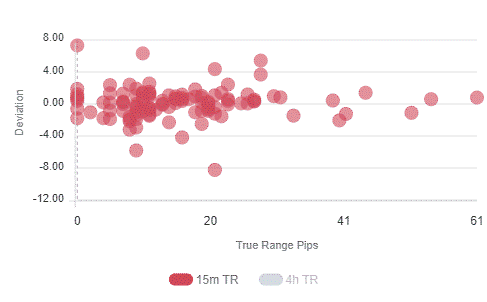

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

EUR/USD is consolidating near daily lows of 1.1829 before resuming the next leg lower. Surging coronavirus cases in Europe and the resultant fresh lockdowns imposed in the key economies such as France, Italy and Spain are weighing negatively on the shared currency.

Meanwhile, the US dollar cheers safe-haven demand amid coronavirus resurgence and fading US fiscal hopes, collaborating with the downside in the main currency pair.

Ahead of the German IFO Survey, the spot drops 0.23% to 1.1831, with the immediate support seen at the 10 and 50-DMAs confluence of 1.1798/95. The next cushion awaits at 1.1778 (20-DMA). To the upside, the spot will resistance around 1.1850 (5-DMA/ pivot point), above which Friday’s high of 1.1866 could be tested.

Key notes

EUR/USD Forecast: Bulls await sustained move beyond 61.8% Fibo. hurdle

Euro falls as Spain and Italy unveil sweeping circuit-breaker rules

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).