Sterling gains fade

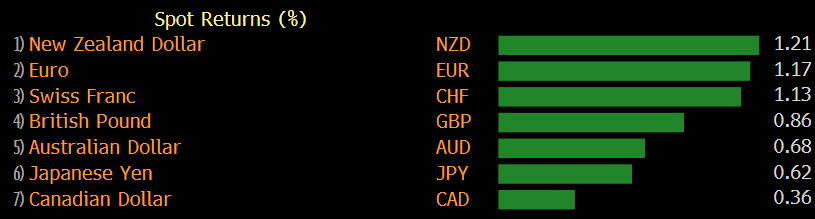

The New Zealand dollar is the top performer this week while the US dollar was the laggard. Even today with USD staging a bit of a comeback, it’s not sticking as the kiwi pushes back into positive territory.

The break above the October highs is constructive for a retest of 0.6800 in the short term but over all the kiwi is right in the middle of the range it’s carved out since June.

Sterling had been atop the FX leaderboard this week but the enthusiasm about Brexit negotiations has quickly faded. I think the news and prognosis are better than ever but sterling traders have been burned by headlines too many times. GBP is going to be a rare ‘buy the fact’ trade if/when a deal is finally in reach.

This article was originally published by Forexlive.com. Read the original article here.