Gold futures have remained trading within previous ranges on Tuesday, trapped between $1,900 and $1,915, with the market awaiting the outcome of the US stimulus negotiations.

US House Representative, Nancy Pelosi, who set Tuesday as the deadline to reach an agreement, said she was optimistic about a stimulus deal, although senate republicans have shown their opposition to the spending figures proposed by the democrats, which cast serious doubts about the chances for the legislation to be passed before the Election Day.

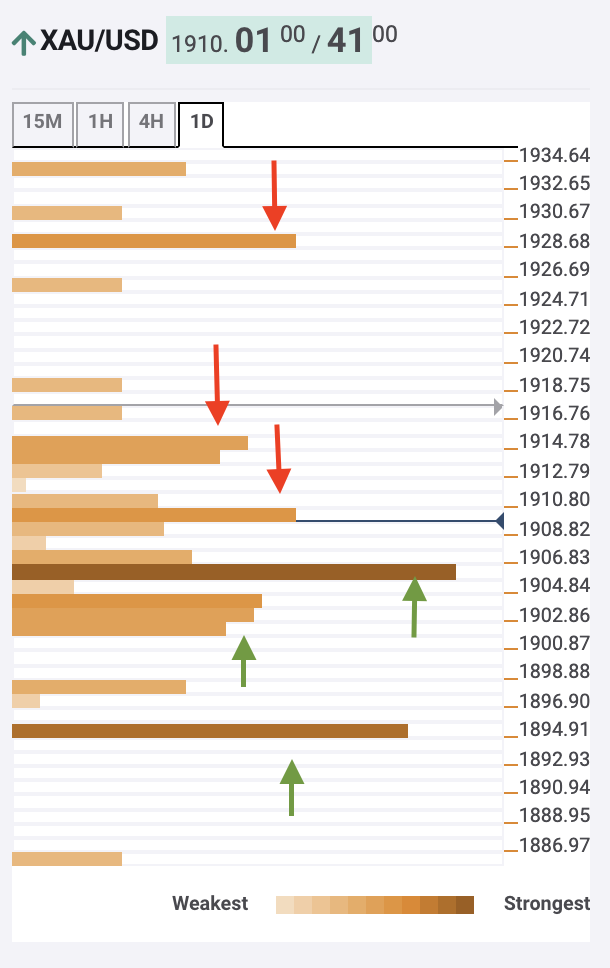

How is XAU/USD positioned on the charts?

The Technical Confluences Indicator shows the yellow metal trading below a cluster of lines at $1,910, that include previous lows at 15 min and hour charts, 38,2% Fibonacci retracement one day and 5 SMA in 15 min and one-hour charts.

Beyond that level, the precious metal will find $1,9013 with the confluence of the 200-SMA on 4h charts, the Bollinger Band 4h-Upper, and the Fibonacci 38.2% one-day.

Finally, at $1,928 the pair will find pivot point 1-day R2 and pivot point 1-week R1.

On the downside, initial support lies at $1,905, where the 50-SMA in 1-hour charts converges with the 200 SMA in 15M and 5 SMA in 4H plus the Bollinger Band 4H middle and 61.8 Fibonacci 1H.

Below here at $1,901 we find the confluence of 5-SMA on 1D, 100-SMA on 4H and Fibonacci 38,2% 1W.

Finally, at $1,895 gold futures might find support at the 23,6% Fibonacci 1W confluence with pivot point 1 Day S1 and Bollinger Band 1D Middle.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence