A look at bond rates

The battle for the election, the battle for economic stimulus and the battle for the economy are captured best right now by the US long bond.

30-year yields are at a pivotal spot, fighting to break the 200-day moving average for the first time since 2018 and fighting to break the late-June and August highs.

It looked to be breaking out on Monday on hopes for a stimulus deal then dropped back when that fell apart. But now the market appears to be looking towards a smaller deal or a blue wave in the election that will mean more spending and a pickup in inflation.

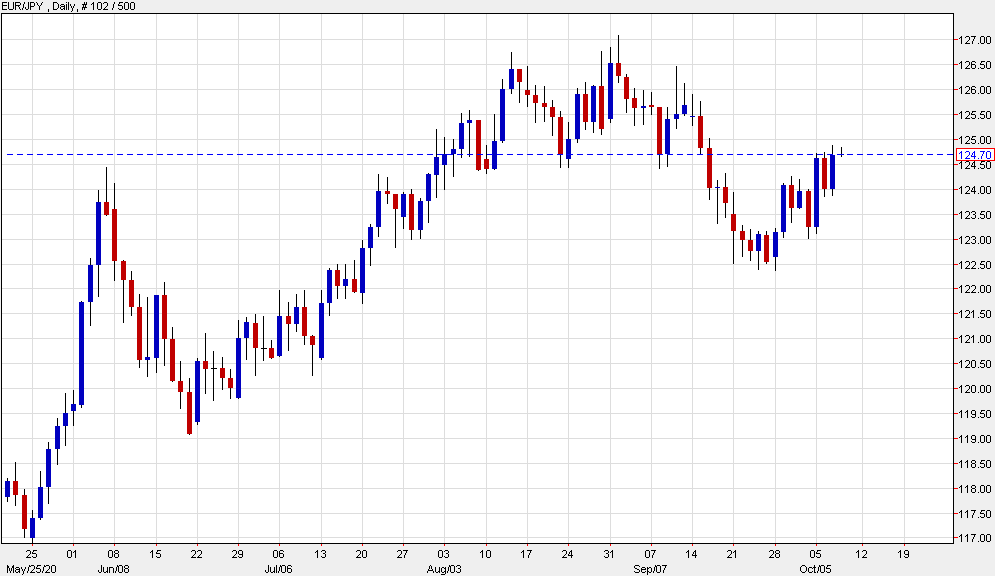

There’s a similar dynamic in EUR/JPY as it broke higher Monday, stumbled Tuesday but is now attempting to restablish itself.

This article was originally published by Forexlive.com. Read the original article here.