Forex news for North American trade on September 25, 2020:

Markets:

- Gold down $6 to $1861

- US 10-year yields down 1.3 bps to 0.65%

- S&P 500 up 52 points to 3298

- WTI crude down 21-cents to $40.10

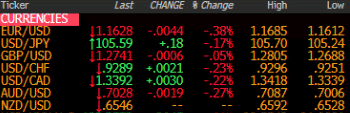

- USD leads, EUR lags

We came into the day on a delicate footing and with stock futures lower. The early going was more of the negativity and the commodity currencies and euro continued to struggle while the dollar made fresh highs.

EUR/USD made a double top in Asia at 1.1685 and it was all downhill from there in a steady slide to 1.1612 at the London close. It bounced 20 pips from there but that was uninspiring considering the positive tone in stocks.

It was a similar story of big falls and small bounces elsewhere. AUD/USD tested the 0.7000 and held it but could only get back 0.7031 to wrap up a miserable week and a losing streak that’s now at 6 days.

USD/CAD rose as high as 1.3418 but could break yesterday’s high and drifted back to 1.3380 as we await the Canadian fiscal onslaught.

The EU is trying to put pressure on the UK to move along Brexit negotiations but progress remains painfully slow. There are some minor positive signs so weekend risks might be to the upside; or maybe I’ve learned nothing from the past two years of squabbling. Cable had some twists and turns but finished flat.

Have a great weekend.