S&P index now negative on the day. NASDAQ index with declines

the US stocks have slipped into the negative. The S&P index is currently down 3.4 points or -0.10% at 3397.65. The NASDAQ index is down -85 points or -0.76% at 11104.

The Dow industrial average remains up by 87 points or 0.32% at 28085.

Looking at the NASDAQ hourly chart below, the price has moved down toward its 50 hour moving average at 11083.27 (making new lows as I type). A move below that moving average (white moving average line in the chart below) would tilt the bias more to the downside from a technical perspective.

Powell did not allude to more QE or extending bond purchases out the curve. That may have been disappointing to some who wanted to see the Fed keep a lid on longer rates. The 30 year bond is currently up about 1.5 basis points at 1.445%. The Fed chair did signaled that he felt fiscal policy was still needed.

Spot gold is moved lower and currently trades up around $3 or 0.15% $1957.50. The high price reached $1973.60. The low price has extended to $1949.93.

WTI crude oil futures have moved above the $40 level and trades at $40.23 up $1.95 15.09%

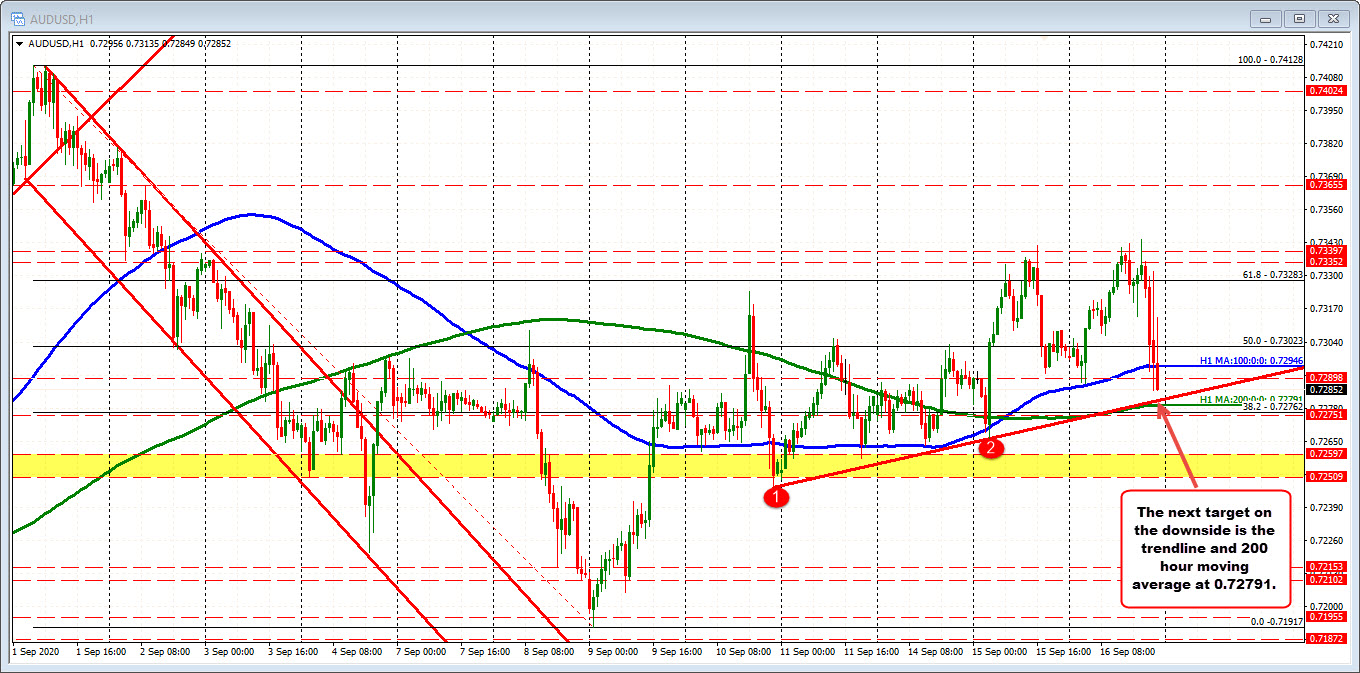

IN the forex, there is some minor moves into risk off. The AUDUSD has moved to a new session low at 0.7285 (but it is also choppy). That took the pair back below it’s 100 hour MA at 0.72946 . Traders will look toward the 200 hour moving average at 0.7279. An upward sloping trendline comes in just above that level on the hourly chart (see chart below). A move below that level would next look toward a swing area between 0.72509 and 0.72597.