Latest Chinese credit data for July has been released – 11 September 2020

- New yuan loans ¥1,280.0 bn vs ¥1,250.0 bn expected

- Aggregate financing ¥3,580.0 bn vs ¥2,585.0 bn expected

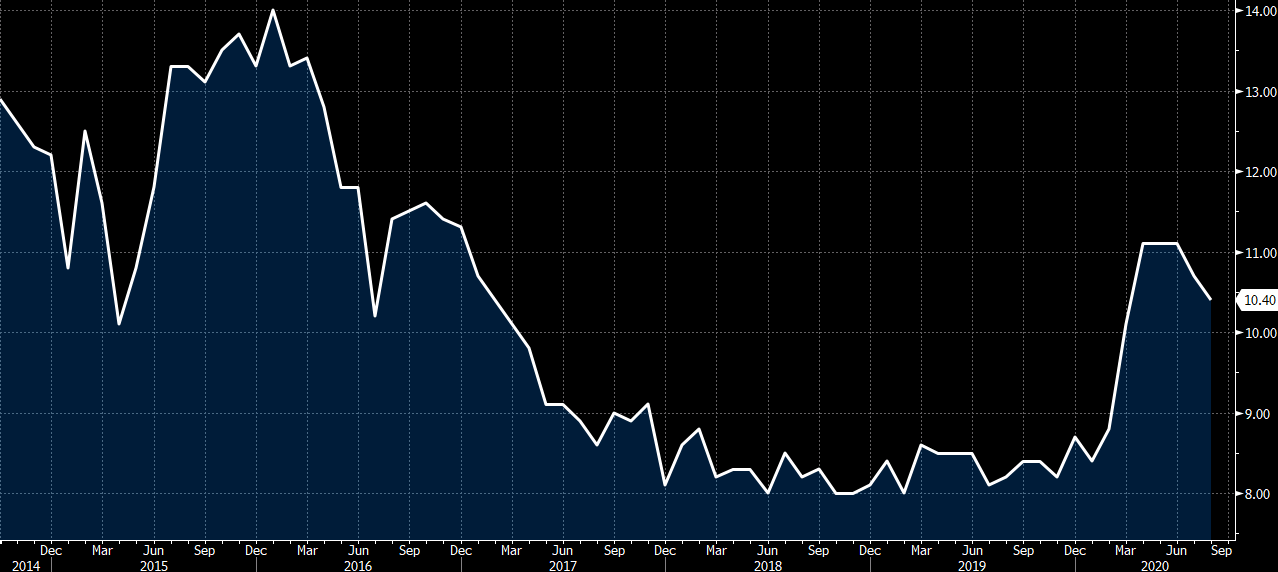

Broad money growth is seen easing a little more as China continues to try and strike a balance between healthy credit growth and not going too easy on deleveraging efforts.

But credit financing continues to pick up (the end-August outstanding social aggregate financing is up 13.3% on the year) and that shows that they are still very much keeping the focus on bolstering economic conditions at the moment.

This article was originally published by Forexlive.com. Read the original article here.