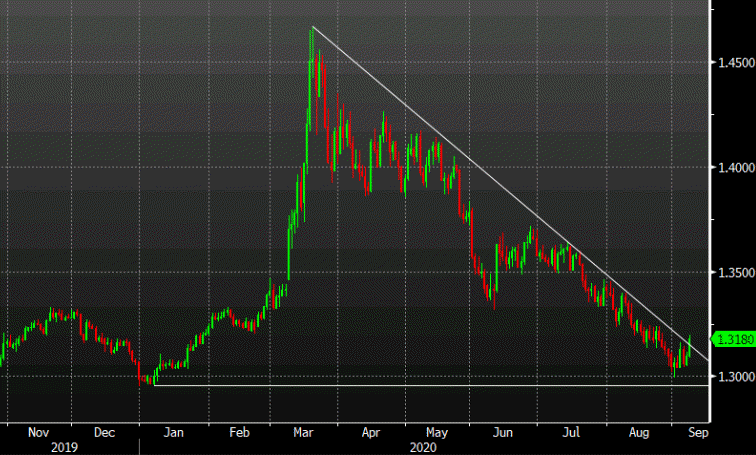

Time for a retracement

USD/CAD is the most interesting chart out there right now.

The pair retraced the entire year-to-date move in a 1600 pip round trip that briefly broke 1.30 last week.

However that level may be setting up a double bottom on the chart. In addition, the downtrend that started March 19 has also broken in today’s 80-pip move.

The correlation to watch is oil. The selling in crude today is relentless on renewed demand worries. WTI is down 8.45% to $36.43. Lumber prices have also been positive for CAD but they’re limit down for the third consecutive day today.

In terms of event risk, the Bank of Canada decision is tomorrow. Expectations are modest, but if there is a surprise it will be on the dovish side as Mackelm looks to put his stamp on the central bank.