Risk aversion is back in the markets today. On the one hand, US stocks are set to open sharply lower as they return from holiday. Tech rout is continuing with NASAQ futures down more than -3% at the time of writing. On the other hand, no-deal Brexit worries intensify as UK continues with its hard-line rhetorics. Sterling is overwhelmingly the worst performing one today, followed by Canadian Dollar and then Kiwi. Yen is the strongest one, followed by Dollar.

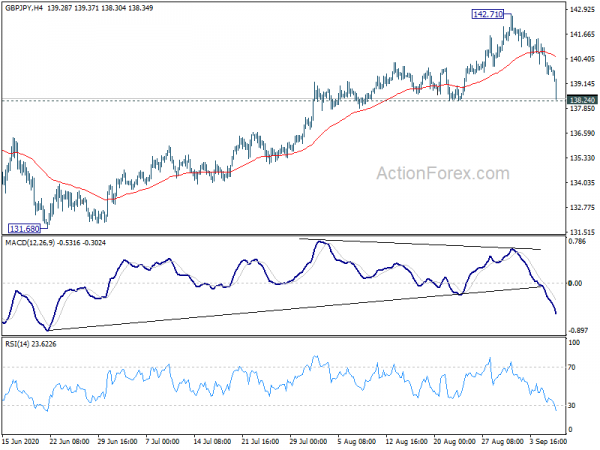

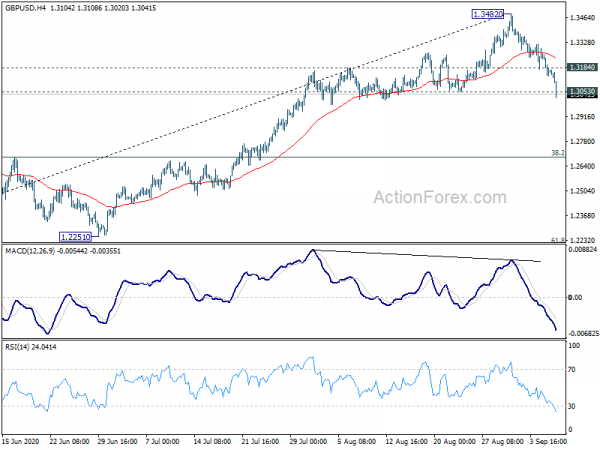

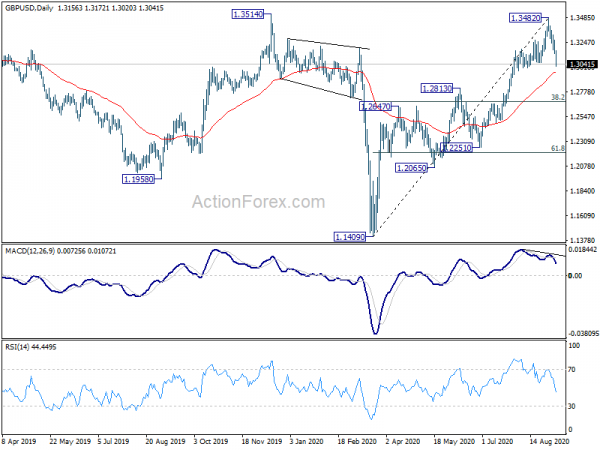

Technically, EUR/GBP’s rebound gathers more momentum is set to taken on 0.9148/75 resistance zone. GBP/CHF is on track to test 1.1849 support and break will pave the way back to 1.1630 low. GBP/USD breaches 1.3053 support, indicate that it’s now at least correcting the rise from 1.2251. to 1.3482. 138.24 support in GBP/JPY is now a focus and break will target 131.68 support next. That will further affirm the Pound’s broad based weakness.

– advertisement –

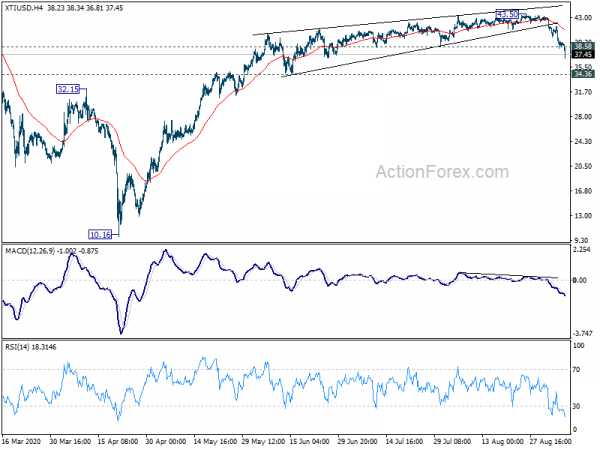

Another development to now is the steep fall in WTI crude oil. 38.58 support is taken out decisively. Fall from 43.50, as a correction to the rebound in the last few months, would target 34.36 support before finding a bottom.

In Europe, currently, FTSE is down -0.67%. DAX is down -1.51%. CAC is down -1.99%. German 10-year yield is down -0.040 at -0.497, back pressing -0.5 handle. Earlier in Asia, Nikkei rose 0.80%. Hong Kong HSI rose 0.14%. China Shanghai SSE rose 0.72%. Singapore Strait Times dropped -0.26%. Japan 10-year JGB yield dropped -0.0035 to 0.038.

UK ramping up no-deal Brexit preparations

Sterling’s selloff accelerates today as concerns over no-deal Brexit intensifies, while talks between UK and the EU enter into the 8th round. Ahead of that, UK’s chief negotiator David Frost called for “more realism from the EU.

He said in a statement, “we have now been talking for six months and can no longer afford to go over well-trodden ground. We need to see more realism from the EU about our status as an independent country.”

“If they can’t do that in the very limited time we have left then we will be trading on terms like those the EU has with Australia, and we are ramping up our preparations for the end of the year,” Frost added.

Eurozone Q2 GDP finalized at -11.8%, worst contraction in Spain

Eurozone GDP contracted -11.8% qoq in Q2, slightly better than prior estimate of -12.1% qoq. EU GDP contracted -11.4% qoq. Both were the sharpest declines since record started back in 1995. Over the year, Eurozone GDP dropped -14.7% yoy while EU GDP dropped -13.9% yoy, also worst since 1995.

Among the member states where data were available, (-18.5%) recorded the sharpest decline of GDP compared to the previous quarter, followed by Croatia (-14.9%), Hungary (-14.5%), Greece (-14.0%), Portugal (-13.9%) and France (-13.8%). The lowest declines of GDP were observed in Finland (-4.5%), Lithuania (-5.5%) and Estonia (-5.6%), followed by Ireland (-6.1%), Latvia (-6.5%) and Denmark (-6.9%).

Employment growth was finalized at -2.9% yoy in Eurozone and -2.7% yoy in EU. Employment in persons decreased in all Member States compared with the previous quarter, except in Malta (+0.6%). The largest decreases were recorded in Spain (-7.5%), Ireland (-6.1%), Hungary (-5.3%) and Estonia (-5.1%).

Also released, Germany trade surplus widened to EUR 18.0B in July, above expectation of EUR 14.9B. France trade deficit narrowed to EUR -7.0B in July, matched expectations. Italy retail sales dropped -2.2% mom in July, much worse than expectation of 1.1% mom rise.

Australia NAB business conditions dropped to -6, as employment deteriorated

Australia NAB Business Confidence improved to -8 in August, up from -14. However, Business Conditions dropped to -6, down from 0. All conditions components deteriorated, with trading down from 1 to -2, profitability down from 1 to -3, employment down form -2 to -13.

Alan Oster, NAB Group Chief Economist said the weakness in conditions was “primarily driven by a deterioration in the employment index – suggesting that while the economy has generally begun to open up, the labour market is still weakening”. The deteriorations was also “broad-based across the states”, suggests that the “virus continues to pose a risk everywhere, not just states with significant containment measures in place”. Confidence also “remains fragile”, still negative. it will “continue to be impacted by news around the virus”

“Given the sheer magnitude of the fall in activity in Q2 and the subsequent lockdowns in Victoria, it’s is likely we will see a protracted recovery and a rise in the unemployment rate before it gets better. Policy makers have provided unprecedented support – but we think there will need to be more. This would help businesses and the economy recover more quickly and the focus can again return to growth”, Oster added.

Japan Q2 GDP contraction finalized at -7.9% qoq, -28.1% annualized

Japan Q2 GDP contraction was revised down to -7.9% qoq, from -7.8% qoq. In annualized term, GDP contracted -28.1% versus preliminary reading of -27.8%. GDP deflator was finalized at 1.3% yoy. In July, labor cash earnings dropped -1.3% yoy, versus expectation of -1.6% yoy. Household spending dropped -7.6% yoy, versus expectation of -3.7% yoy. Current account surplus narrowed to JPY 0.96T. Bank lending rose 6.7% yoy in August, versus expectation of 6.3% yoy.

Economy Minister Yasutoshi Nishimura said “the economy was in a severe state in April-June because we intentionally halted activity to contain the coronavirus “. Nevertheless “it has recently shown signs of picking up”.

“Some positive corporate spending to adapt to a new lifestyle is seen, such as capex to boost production capacity, spending on telecom equipment,” he added. On the other hand, “household income is rising so the economy likely to continue recovering but must watch impact on the renewed rise in infection numbers, hot temperatures on consumption.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3115; (P) 1.3192; (R1) 1.3242; More….

GBP/USD’s decline accelerates to as low as 1.3020 so far today. The break of 1.3053 support confirms short term topping at 1.3482. Intraday bias is back on the downside and deeper fall should be seen through 55 day EMA to 38.2% retracement of 1.1409 to 1.3482 at 1.2690. Reactions from there will decide whether it’s a corrective decline or reversal. On the upside, above 1.3184 minor resistance will turn intraday bias neutral first.

In the bigger picture, immediate focus is still on 1.3514 resistance. Decisive break there should at least confirm medium term bottoming at 1.1409. Further rise should be seen to 1.4376 resistance first. Though, rejection by 1.3514 will retain bearishness for resuming the down trend from 2.1161 (2007 high) at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Aug | 4.70% | 4.30% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | -1.30% | -1.60% | -2.00% | |

| 23:30 | JPY | Household Spending Y/Y Jul | -7.60% | -3.70% | -1.20% | |

| 23:50 | JPY | Bank Lending Y/Y Aug | 6.70% | 6.30% | 6.30% | 6.40% |

| 23:50 | JPY | GDP Q/Q Q2 F | -7.90% | -8.10% | -7.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | 1.30% | 1.50% | 1.50% | |

| 23:50 | JPY | Current Account (JPY) Jul | 0.96T | 1.44T | 1.05T | |

| 1:30 | AUD | NAB Business Confidence Aug | -8 | -14 | ||

| 1:30 | AUD | NAB Business Conditions Aug | -6 | 0 | ||

| 5:00 | JPY | Eco Watchers Survey: Current Aug | 43.9 | 41 | 41.1 | |

| 6:00 | EUR | Germany Trade Balance (EUR) Jul | 18.0B | 14.9B | 14.5B | |

| 6:45 | EUR | France Trade Balance (EUR) Jul | -7.0B | -7.0B | -8.0B | -8.1B |

| 8:00 | EUR | Italy Retail Sales M/M Jul | -2.20% | 1.10% | 12.10% | 10.20% |

| 9:00 | EUR | Eurozone GDP Q/Q Q2 F | -11.80% | -12.10% | -12.10% | |

| 9:00 | EUR | Eurozone Employment Change Q/Q Q2 F | -2.90% | -2.80% | -2.80% | |

| 10:00 | USD | NFIB Business Optimism Index Aug | 100.2 | 98 | 98.8 |