Trading 101

Understanding the USD centric nature of the FX markets is a key concept to get down early in your trading experience. The latest moves in the major pairs (over the last few weeks) have mainly been dollar driven. Namely a weaker dollar on the huge stimulus measures out of the US and the virtually unlimited QE programme. The dollar weakness story has been driving the major pairs higher. So, a couple of things to nail down in your trading are:

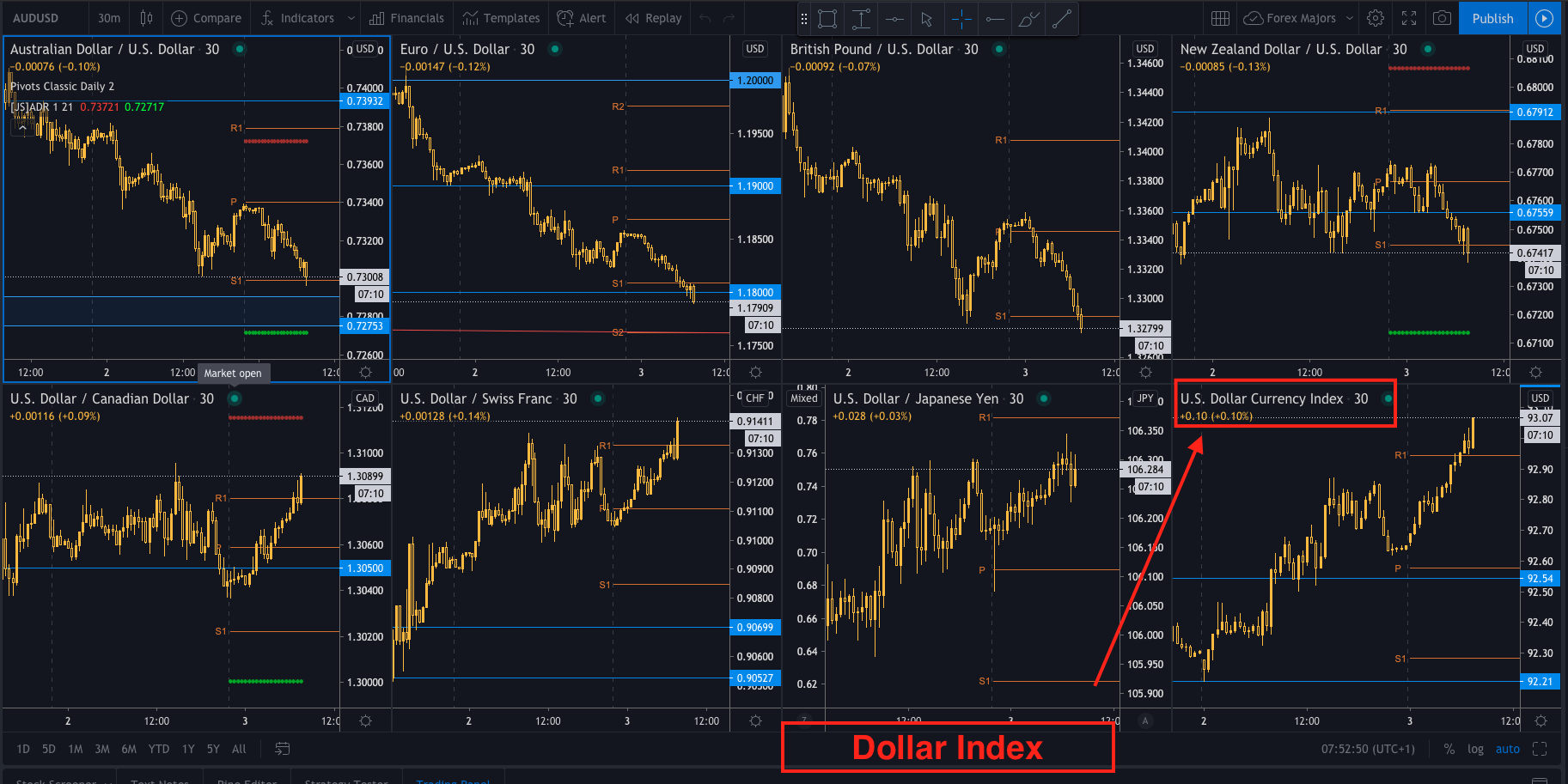

1. Firstly, when you are trading major pairs, always have an eye on the US dollar Index. Overall USD strength or weakness will help show you near term expected direction in the pairs. I use a setup like this each day with the Dollar Index in the bottom right of the charts and the majors visible at a glance. It is helpful.

2. Secondly, when trading the EURUSD you need to know that the DXY and EURUSD always move in opposite direction. DXY up, EURUSD down. EURUSD up, DXY down. This is why the Dollar Index is also knows as the ‘anti-EURUSD index’. (check out chart – DXY orange line, candlestick chart is the EURUSD). So you never want to be trading the EURUSD higher if the DXY is moving higher and vice versa.

Grasping the USD centric nature of the FX world is important to understand. Use this lesson to improve your handling of the major pairs, especially the EURUSD pair.