Dollar’s rebound continues in early US session as positive response to better than expected jobless claims data. For the moment, Swiss Franc is the second strongest, followed by Euro, and both surges against the weak Sterling. Commodity currencies follow as the next weakest, as gold and oil soften. Yen turned mixed as rally in European stocks could be offset by pull back in US markets.

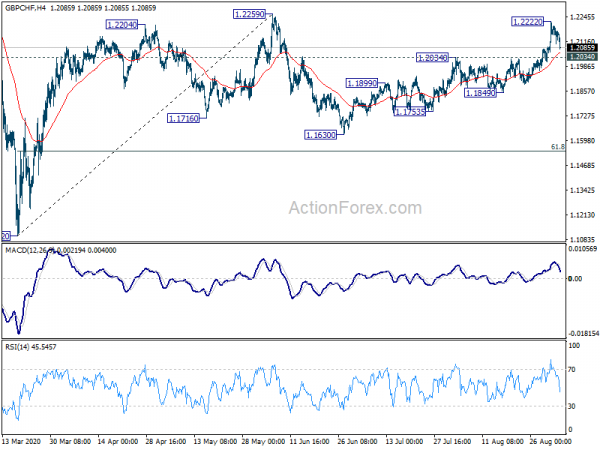

Technically, we’d still maintain that break of 1.1762 support in EUR/USD and 0.9161 resistance in USD/CHF are needed to indicate that Dollar is undergoing a sustainable near term rebound. Swiss Franc could be a tricky one as it’s rebounding strongly against other European majors. Focus in GBP/CHF is now back on 1.2034 resistance turned support with today’s decline. Firm break there should confirm rejection by 1.2259 resistance. Recent sideway trading would then be extending with another falling leg back towards 1.1630 support.

– advertisement –

In Europe, currently, FTSE is up 0.50%. DAX is up 0.94%. CAC is up 1.58%. German 10-year yield is down -0.004 at -0.472. Earlier in Asia, Nikkei rose 0.94%. Hong Kong HSI dropped -0.45%. China Shanghai SSE dropped -0.58%. Singapore Strait Times dropped -0.32%. Japan 10-year JGB yield dropped -0.0116 to 0.034.

US initial jobless claims dropped to 881k, continuing claims down to 13.3m

US initial jobless claims dropped -130k to 881k in the week ending August 29, below expectation of 965k. Four-week moving average of initial claims dropped -77.5k to 991.8k. Continuing claims dropped -1238k to 13254k in the week ending August 22. Four-week moving average of continuing claims dropped -709k to 14496k.

Exports of goods and services rose 8.1% mom to USD 168.1B in July. Imports rose 10.9% mom to USD 231.7B. Trade deficit widened by 18.9% mom to USD -63.6B, larger than expectation of USD -52.2B.

Eurozone PMI composite finalized at 51.9, policymakers need to focus firmly on sustaining recovery

Eurozone PMI Services was finalized at 50.5 in August, down from July’s 54.7. PMI Composite was finalized at 51.9, down from July’s 54.9. Among the states where data are available, Germany PMI composite dropped to 2-month low of 54.4. Ireland dropped to 54.0. France dropped to 51.6. Italy and Spain stayed in contraction at 49.5 and 48.4 respectively.

Chris Williamson, Chief Business Economist at IHS Markit said: “Service sector companies across the eurozone saw growth of business activity grind almost to a halt in August, fueling worries that the post-lockdown rebound has started to fade amid ongoing social distancing restrictions linked to COVID-19… Although the relative strength of the PMI data in July and August mean the autumn is likely to still see the economy rebound strongly from the collapse witnessed in the spring, the survey highlights how policymakers will need to remain focused firmly on sustaining the recovery as we head further into the year.”

Eurozone retail sales dropped -1.3% mom in Jul, non-food products dived

Eurozone retail sales dropped -1.3% mom in July, much worse than expectation of 1.3% mom. Volume of retail trade decreased by -2.9% mom for non-food products, remained unchanged for food, drinks and tobacco and increased by 4.3% mom for automotive fuels.

EU retail sales dropped -0.8% mom. Among Member States for which data are available, the largest decreases in the total retail trade volume were registered in Belgium (-5.1% mom), Finland (-2.0% mom) and Estonia (-1.5% mom). The highest increases were observed in Portugal and Romania (both +3.9% mom) as well as Malta (+3.2% mom).

UK PMI composite finalized at 59.1, mini boom on false reality

UK PMI Services was finalized at 58.8 in August, up from July’s 56.5, signaling fastest expansion since April 2015. PMI Composite was finalized at 59.1, up from July’s 57.0, strongest expansion since August 2014.

Chris Williamson, Chief Business Economist at IHS Markit:

“A further surge in service sector business activity in August adds to signs that the economy is enjoying a mini boom as business re-opens after the lockdowns, but the concern is that the rebound will fade as quickly as it appeared. The current expansion is built on something of a false reality, with the economy temporarily supported by measures including the furlough and Eat Out to Help Out schemes. These props are being removed.

“The burning question is how the economy will cope as these supports are withdrawn. Worryingly, many companies are already preparing for tougher times ahead, notably via further fierce job cutting, the rate of which re-accelerated in the service sector in August to a pace exceeding that seen at the height of the global financial crisis. Policymakers face a huge challenge in sustaining this recovery and avoiding a ‘bounce and fade’ scenario, especially if virus numbers escalate further, in which case we may be looking at a ‘bounce and slump’.”

Australia trade surplus shrank to 4.6B in Jul as exports fell

Australia export of goods and services dropped -4% mom to AUD 34.5B in July. Imports rose 7% mom to AUD 29.9B. Trade surplus shrank to AUD 4.6B, down from AUD 8.2B, missed expectation of AUD 5.0B.

AiG Performance of Construction index dropped -4.8 pts to 37.9 in August. Ai Group Head of Policy, Peter Burn, said: “The sharp fall in activity in Victoria was a major factor in the downturn while border restrictions in other states have hampered builders and constructors who are reliant on interstate supplies and the availability of tradies from across borders.”

China PMI services ticked down to 54.0, but employment grew again

China Caixin PMI Services dropped slightly by -0.1 to 54.0 in August, matched expectations. Markit said new order growth eased further but remained strong. Staff numbers expanded for the first time since January. Output prices rose amid further increase in operating costs. PMI Composite rose to 55.1, up from July’s 54.5.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the recovery of the manufacturing and services sectors from the epidemic remained the main theme of the economy. Supply and demand both expanded. The gauges for orders, purchases and inventories all remained strong. Price measures remained stable. Over the past half year, external demand and employment remained subdued generally, but in August, employment for the services sector started to improve and employment for the manufacturing sector approached a turning point.

” However, there were still uncertainties from Covid-19 overseas, which could constrain the “dual circulation” of domestic and international markets. Improvement in employment in the post-epidemic era requires longer-term market recovery and longer-term stability of business expectations. During this process, support from relevant macroeconomic policies is essential.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 105.93; (P) 106.11; (R1) 106.38; More...

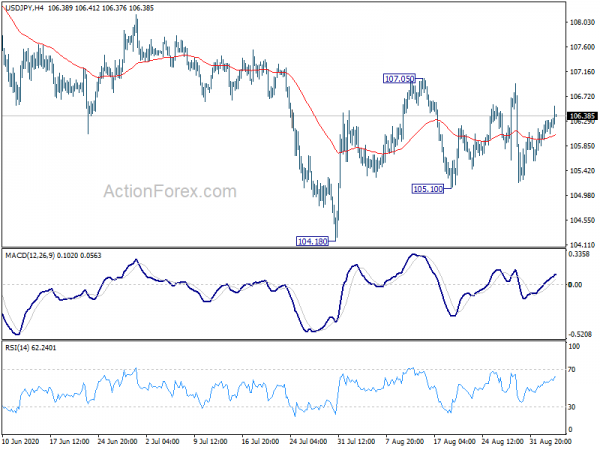

USD/JPY recovers further today but stays in range of 105.10/107.05. Intraday bias remains neutral first. On the downside, break of 105.10 will target a test on 104.18 low. Break there will resume whole decline from 111.71. On the upside, break of 107.05 will revive the case of near term reversal and bring stronger rally towards 109.85 resistance.

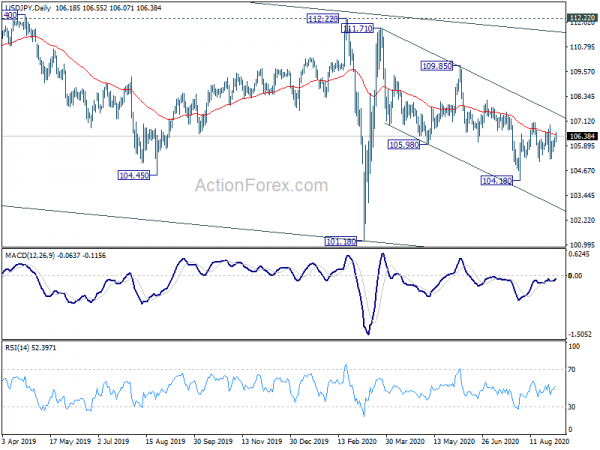

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Aug | 37.9 | 42.7 | ||

| 01:00 | NZD | ANZ Commodity Price Aug | -0.90% | 2.30% | 2.90% | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 4.61B | 5.00B | 8.20B | 8.15B |

| 01:45 | CNY | Caixin Services PMI Aug | 54 | 54 | 54.1 | |

| 06:30 | CHF | CPI M/M Aug | 0.00% | -0.40% | -0.20% | |

| 06:30 | CHF | CPI Y/Y Aug | -0.90% | -1.10% | -0.90% | |

| 07:45 | EUR | Itay Services PMI Aug | 47.1 | 64.7 | 51.6 | |

| 07:50 | EUR | France Services PMI Aug F | 51.5 | 51.9 | 51.9 | |

| 07:55 | EUR | Germany Services PMI Aug F | 52.5 | 50.8 | 50.8 | |

| 08:00 | EUR | Eurozone Services PMI Aug F | 50.5 | 50.1 | 50.1 | |

| 08:30 | GBP | Services PMI Aug | 58.8 | 60.1 | 60.1 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jul | -1.30% | 1.30% | 5.70% | 5.30% |

| 11:30 | USD | Challenger Job Cuts Aug | 116.50% | 262.649K | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Jul | -2.5B | -2.5B | -3.2B | |

| 12:30 | USD | Initial Jobless Claims (Aug 28) | 881K | 965K | 1006K | 1011K |

| 12:30 | USD | Trade Balance (USD) Jul | -63.6B | -52.2B | -50.7B | -53.5B |

| 13:45 | USD | Services PMI Aug F | 54.8 | 54.8 | ||

| 14:00 | USD | ISM Services PMI Aug | 57.1 | 58.1 | ||

| 14:30 | USD | Natural Gas Storage | 37B | 45B |