Fits and starts

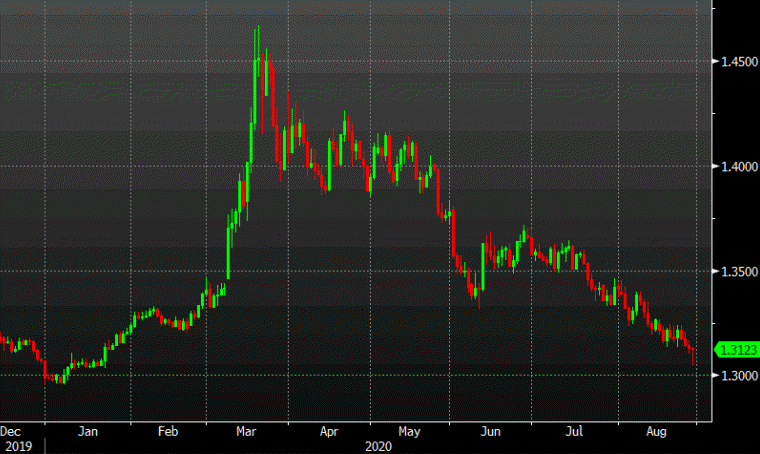

USD/CAD earlier today looked like it was finally making a definitive break of the late-August rally but a few hours later, it’s 75 pips from the lows and unchanged on the day.

The loonie has been a tough trade in the pandemic and that continues to be the case.

For those looking for inflation coming out of the pandemic, there is a lot to like about Canada given the abundant resources. Relative rates are also a tailwind and the stability of the economy.

There was plenty of noise about a housing collapse at the peak of the virus (including from the Canadian regulator) but with people scrambling for homes everywhere, that’s less of a risk.

In the short term, today’s rebound is a bit of a puzzle but I think USD/CAD eventually gets to 1.30. But something about 1.29 in this environment doesn’t feel quite right.

This article was originally published by Forexlive.com. Read the original article here.