Buffett bought a stake in miner Barrick Gold

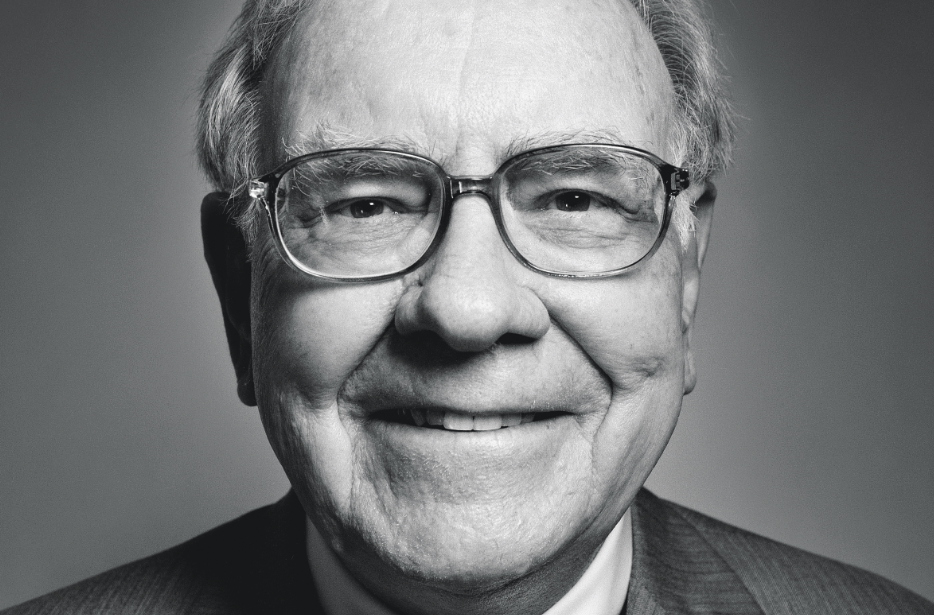

Warren Buffett has famously disparaged gold but evidently he’s had a change of heart.

According to a Q2 13F filed today, The Oracle of Omaha added 20.9 million shares of Barrick Gold, which is the world’s second largest gold miner. He paid $563.5 million for the stake, which equates to $26.95 per share and his Berkshire Hathaway owns 1.2% of the company. It was the only new company he bought in the second quarter.

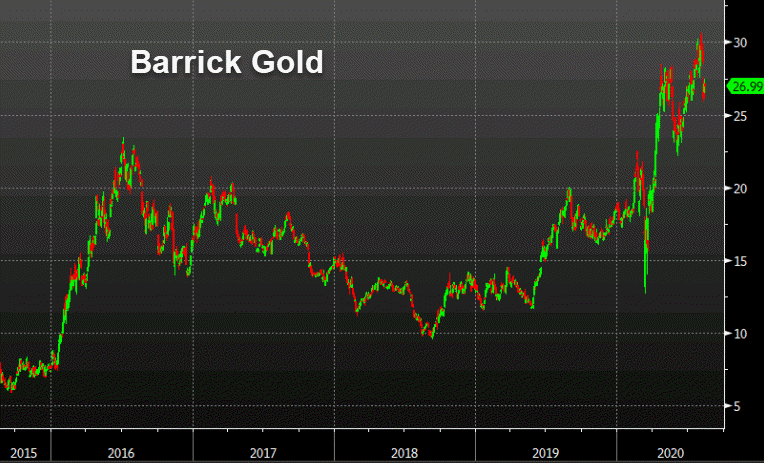

The shares closed at $26.99 on Friday but jumped about $1.00 in after hours trading.

This could indicate a massive change of heart from the world’s most famous investor, or one of his deputies.

His most-famous musing on gold was from back in 1998:

“(Gold) gets dug out of the ground in Africa, or someplace. Then we

melt it down, dig another hole, bury it again and pay people to stand

around guarding it. It has no utility. Anyone watching from Mars would

be scratching their head.”

As recently as 2018 he repeated his misgivings about gold.

“The magical metal was no match for the American mettle,” he wrote in his annual letter while comparing the returns of both since he first invested in stocks in 1944.

Now this doesn’t necessarily mean he has a new view on gold. Barrick’s cash flows with gold steady at these levels are compelling (and other miners are even more compelling). Still, expect much more interest in the space now that Warren Buffett has given it his blessing.

Other highlights from his Q2 13F:

- Exited Occidental Petroleum, but added to Suncor Energy

- Cut JPMorgan stake by 62%

- Cut Mastercard stake by 7%

- Aside from SU, only added to STOR and KR

- Reduced WFC, SIRI, PNC, MTB, BK

- Exited DAL, LUV, UAL, AAL, QSR, GS, OXY

In terms of the ones he reduced. In general Buffett doesn’t sell shares unless he plans to sell out. However at times he has to sell to stay below ownership limits.

Overall, his investment mix doesn’t exactly show confidence in the economic or stock market recovery.