New lows for EUR, JPY, CHF, AUD, NZD him

There is some more dollar buying as London traders exit. The EUR, JPY, CHF, AUD and NZD have all just moved to new session lows vs. the greenback. The USDCAD has moved back higher after quickly dipping below the 100 hour moving average and failing. The GBPUSD is reluctantly moving lower but trading at North American session lows.

EURUSD. The EURUSD has moved down to a low of 1.1786 and looks toward its rising 100 hour moving average at 1.17753. The price has not traded below its 100 hour moving average since July 20

GBPUSD: The GBPUSD has move back below the Monday low at 1.31046 and also below a broken trend line just above that level.

USDJPY: The USDJPY has broken through its 200 hour moving average at 105.829 and the 50% retracement of the move down from the July 20 high at 105.85 3. The price trades up to 105.989. Stay above the 200 hour moving average in the buyers have the tilt.

USDCHF: The USDCHF is peaking above a topside trend line on the hourly chart AND the 38.2% retracement of the week’s trading range. Both those levels come in around the 0.9122 level. On the topside since the 100 hour moving average at 0.91456 currently (and moving lower). The price is not traded above its 100 hour moving average since July 17.

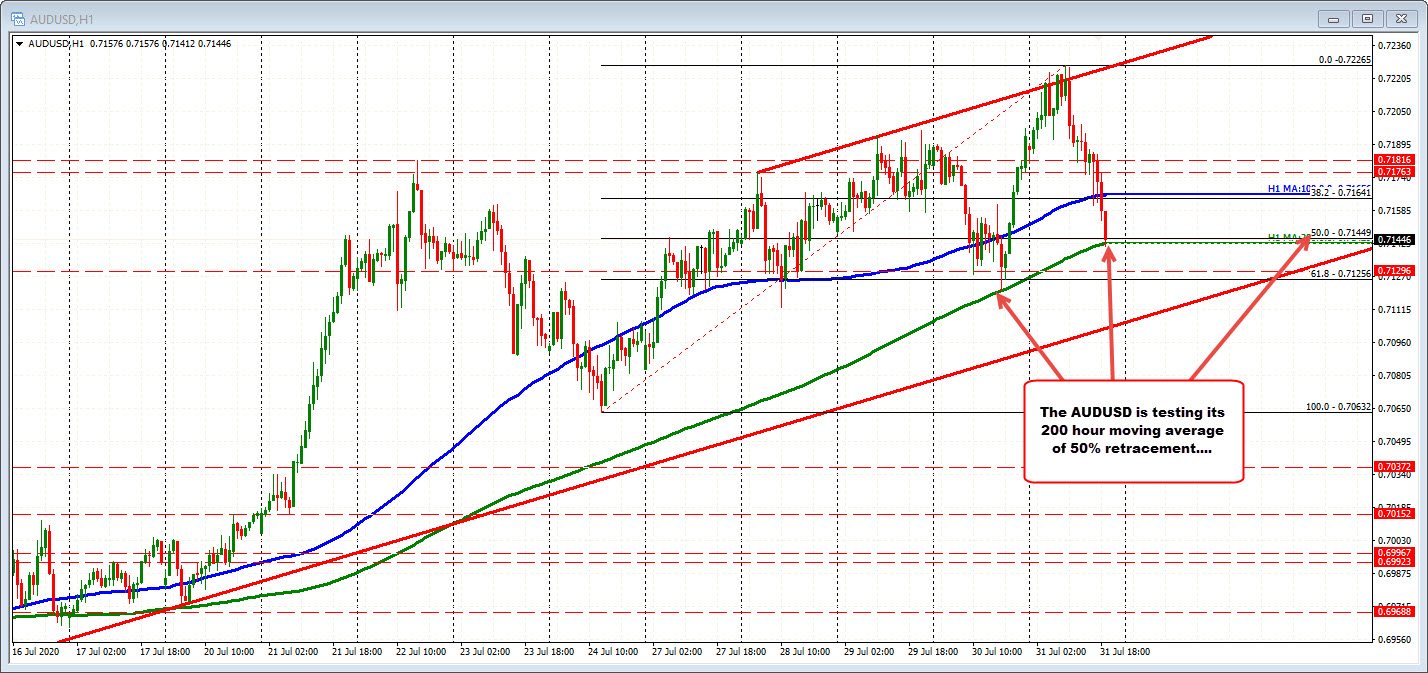

AUDUSD: The AUDUSD it’s a down testing its 200 hour moving average and 50% retracement from the low last Friday at 0.7143-449 area. Recall from yesterday the price bounced off its 200 hour moving average (at a lower level).

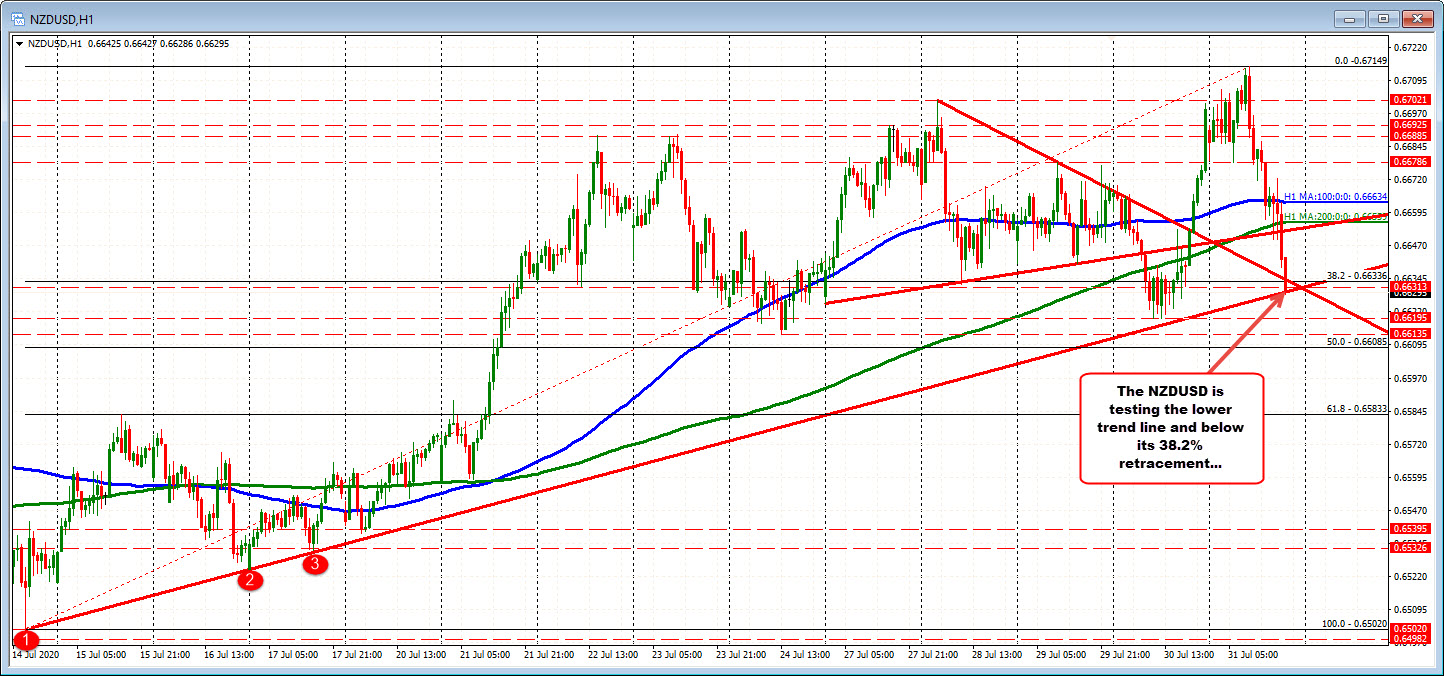

NZDUSD: The NZDUSD is testing a lower trend line starting back on July 14. The price is also below the 38.2% retracement of the move up from the July 14 low at 0.66336.