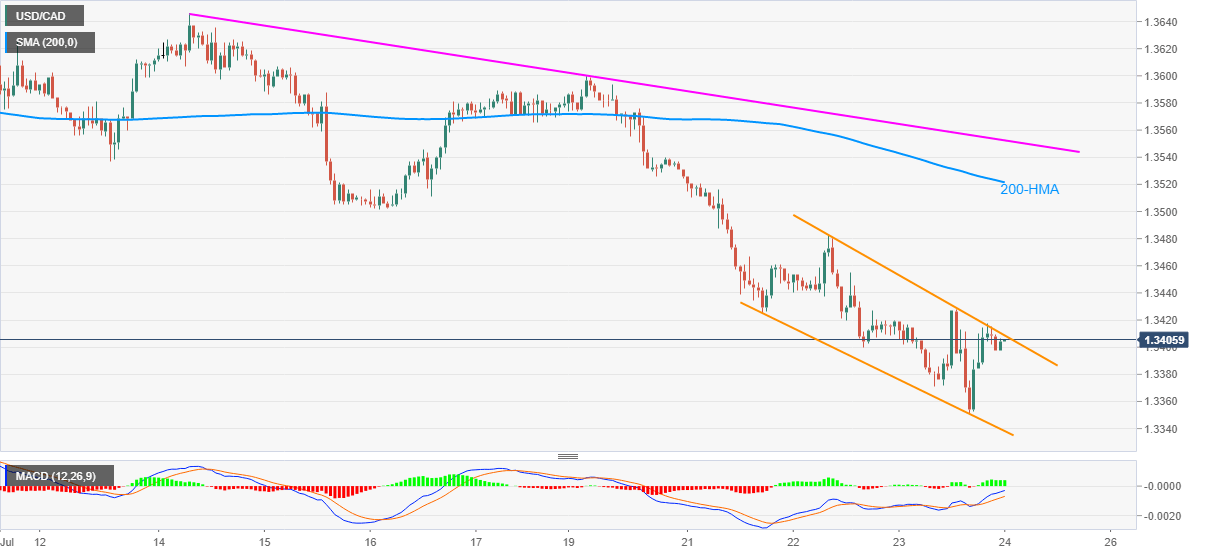

- USD/CAD fails to extend U-turn from 1.3351 beyond 1.3417.

- Bullish MACD raises fears of the channel break and attack to 200-HMA.

- An eight-day-old falling trend line adds to the upside barrier.

- June low becomes the key support holding gates for 1.3200.

USD/CAD seesaws near 1.3400 during the early Friday’s Asian session. The loonie pair bounced off six-week low the previous day but failed to cross a downward sloping trend channel from July 21.

While MACD suggests the quote’s another confrontation to the 1.3410 resistance, there are multiple key upside barriers, like 200-HMA and a falling trend line from July 14, that could keep the bears hopeful.

Other than the 200-HMA level of 1.3522 and the said resistance line near 1.3555, July 16 lows around 1.3500 will also challenge the buyers during the pair’s rise past-1.3410.

On the contrary, 1.3370 and the channel’s support around 1.3340 can please the sellers ahead of diverting them to June month’s low near 1.3315.

Should the USD/CAD prices remain weak below 1.3315, also slip under 1.3300 mark, February 2020 bottom surrounding 1.3200 could gain the market attention.

USD/CAD hourly chart

Trend: Bearish