Latest data from the Mortgage Bankers Association for the week ending 17 July 2020

- Market index 848.8 vs 815.5 prior

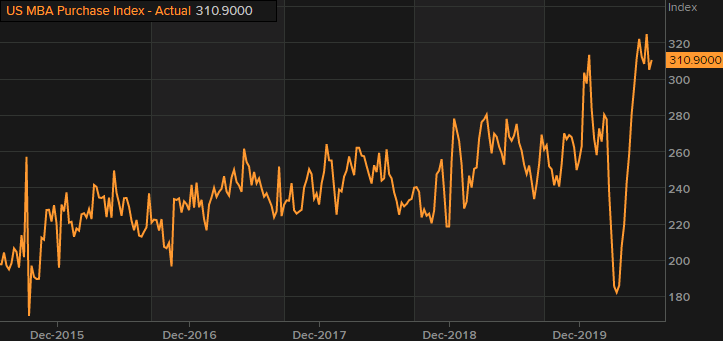

- Purchase index 310.9 vs 305.4 prior

- Refinancing index 3,973.3 vs 3,774.3 prior

- 30-year mortgage rate 3.20% vs 3.19%

The positive takeaway from the report here is that purchases crept higher once again, and the rise is in mortgage activity is also supporting by another jump in refinancing activity last week as well. This continues to allude to the fact that the housing market is keeping rather resilient despite overall economic conditions in the US.

This article was originally published by Forexlive.com. Read the original article here.