79 pip range for the week is the lowest since early January

The AUDUSD has had an up and down week of trading. On the topside the pair peaked on Tuesday and again on Thursday at 0.6996 and 0.7000. The high on Thursday should have solicited more buying on the new break higher, but that break failed to extend above the natural resistance at 0.7000.

On the downside this week, the lows came in the 0.69219 to 0.69252 area on Monday, Tuesday, Wednesday and again today.

The range of 79 pips is the lowest since early January (when the range was a meager 63 pips). The midpoint of the range is 0.6961. The current price is trading just above that level at 0.6964. PS the 100 hour MA has turned sideways right at that midpoint level at 0.69605.

It is safe to say, that traders are unsure of the next shove for the pair. The week is non trending. The price has settled near the midpoint of the range. However, traders have also defined a high and low ceiling and floor as risk/bias defining levels going forward. Some point the non-trend up and down will move away and trend. The market traders look for the catalyst for the next move.

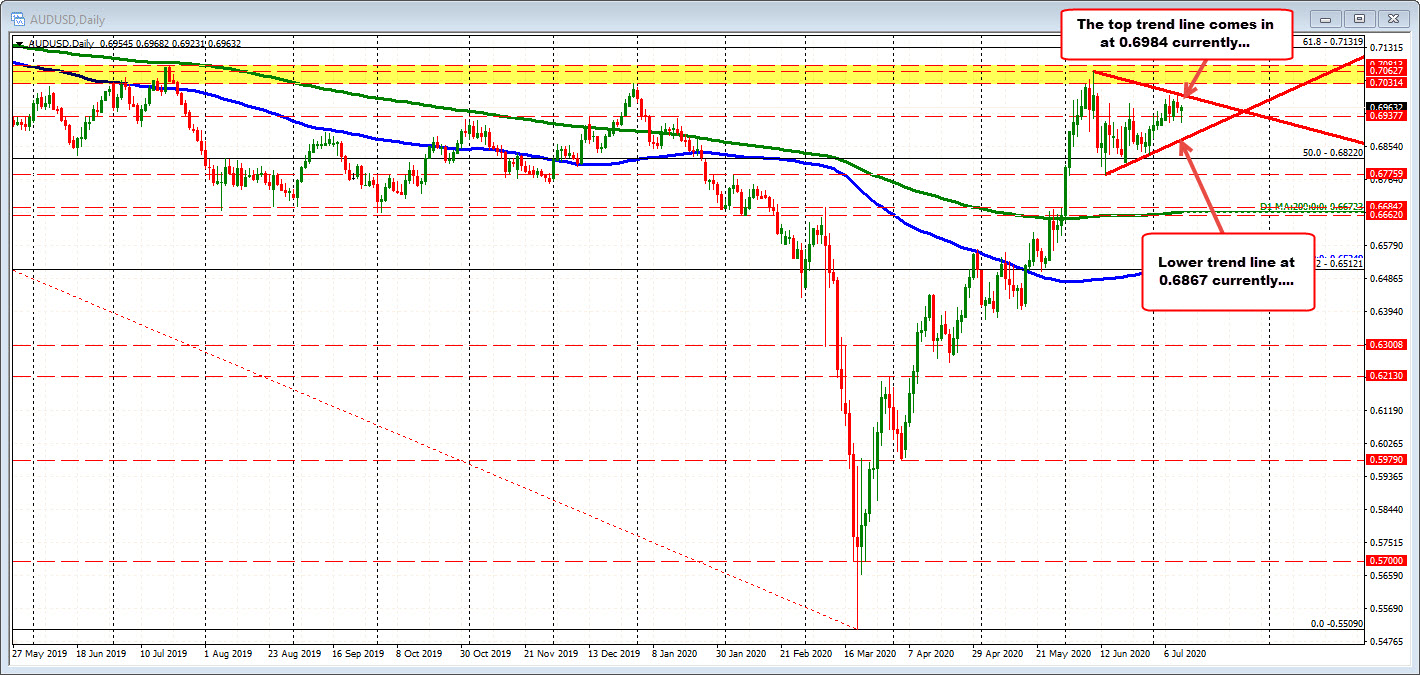

Taking a broader look at the daily chart below, the price over the last few months is also non-trending. The high over the last few months has reached 0.70627. The low over the period has reached 0.67759. The high in June was the high this level going back to July 2019 when the price peaked at 0.70813.

Technically, the formation is looking like a bull pennant. The topside trend line comes in at 0.6984. Getting above that level should solicit more buying however there are a number of swing levels to get through starting at 0.70314 and extending to 0.70627 and 0.70813.

On the downside on the daily chart, the lower trend line currently comes in at 0.68675 (and moving higher).