The financial markets are still refusing to commit to a direction. Major European stocks are generally higher despite broad selloff in Asia. US futures point to lower open while 10-year yield is doing its best to hold on to 0.6% handle. Swiss Franc is currently the worst performing one for today, followed by Aussie and Dollar. Yen remains the strongest one, followed by Euro and Sterling.

Technically, many near term levels are not broken. EUR/USD recovers after touching 1.1258 minor support. AUD/USD recovers ahead of 0.6922 minor support. USD/CAD breached 1.3624 minor resistance but retreated. USD/JPY could be the one that’s making its mind. But we’ll see if it could sustain below 106.79 minor support to confirm completion of near term rebound from 106.07.

In Europe, FTSE is up 0.60%. DAX is up 0.66%. CAC is up 0.60%. Germany 10-year yield is down -0.021 at -0.481. Earlier in Asia, Nikkei dropped -1.06%. Hong Kong HSI dropped -1.84%. China Shanghai SSE dropped -1.95%. Singapore Strait Times dropped -0.63%. Japan 10-year JGB yield dropped -0.0014 to 0.019.

– advertisement –

Canada employment rose 953k in June, well above expectation

Canada employment rose 953k, or 5.8% in June, well above expectation of 675k. Full-time jobs rose 488k, or 3.5% while part-time jobs rose 465k, or 17.9%. Still, employment in June was 1.8m or -9.2% lower than in February.

Unemployment rate dropped to 12.3%, down from May’s 13.7%, but missed expectation of 11.9%. That’s still more than double of February’s 5.6%. Labor force participation rate rose 2.4% to 63.8%, which is a positive sign even though it’s below February’s 65.5%.

Fed Kaplan: Broad mask wearing and health care protocols executions key to growth

Dallas Fed President Robert Kaplan said he expects the economy growth in Q3 and Q4. But still, he’s base case is for the economy to contract around -4.5% to -5% for 2020 as a whole. He reiterated that controlling the spread of the coronavirus is the key to economic recovery.

“How the virus proceeds and what the incidence is is going to be directly related to how fast we grow,” Kaplan said. “While monetary and fiscal policy have a key role to play, the primary economic policy from here is broad mask wearing and good execution of these health care protocols; if we do that well, we’ll grow faster.”

US PPI dropped -0.2% mom in June, PPI core dropped -0.3% mom

US PPI dropped -0.2% mom in June versus expectation of 0.4% mom. PPI core dropped -0.3% mom versus expectation of 0.1% mom. Annually, PPI was unchanged at -0.8% yoy, below expectation of -0.4% yoy. PPI core slowed to 0.1% yoy, down from 0.3% yoy, missed expectation of 0.5% yoy.

Italy industrial output rose 42.1% mom in May, well above expectations

Italy industrial output rose 42.1% mom in May, well above expectation of 19.2%. That’s also much more than enough to reverse April’s -20.5% mom decline. Nevertheless, for the last three months over the previous three months, productions still dropped -29.9%. Comparing with May 2019, productions dropped -20.3% yoy.

French industrial production rose 19.6% in May, still down -21.2% from Feb

France industrial production rose 19.6% mom in May, above expectation of 15.0%. It also nearly recovered all of April’s -20.6% decline. Nevertheless, compared to February, the last month before the start of general lockdown, outlook was still down -21.2%.

EUR/USD Mid-Day Outlook

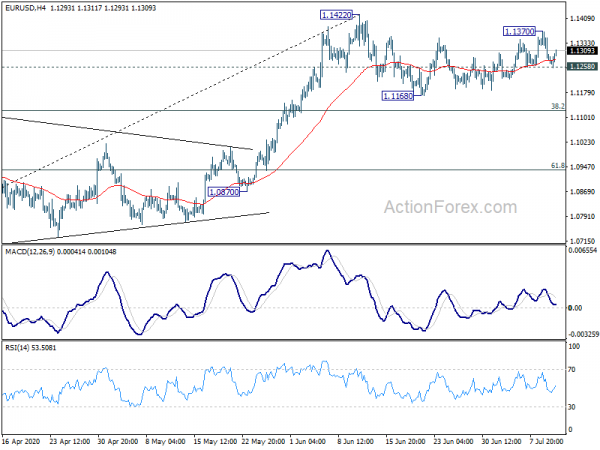

Daily Pivots: (S1) 1.1252; (P) 1.1312; (R1) 1.1343; More….

EUR/USD recovers after drawing support from 1.1258 and intraday bias stays neutral first. On the upside, above 1.1370 will target 1.1422 high. Break will resume larger rise from 1.0635 to 1.1496 key resistance. However, on the downside, break of 1.1258 minor support will turn bias back to the downside, to extend the consolidation to 38.2% retracement of 1.0635 to 1.1422 at 1.1121.

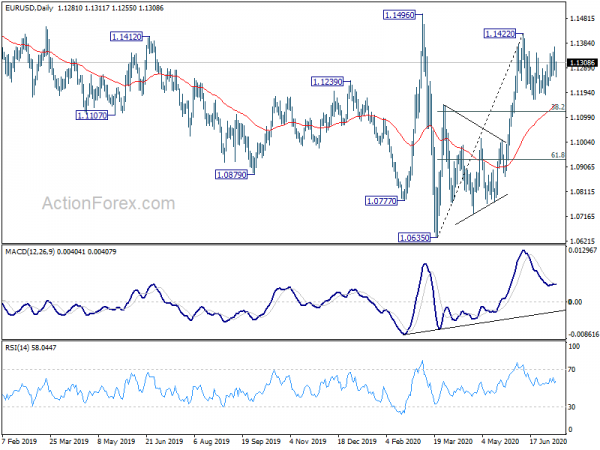

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | -1.60% | -1.90% | -2.70% | -2.80% |

| 06:45 | EUR | France Industrial Output M/M May | 19.60% | 15.00% | -20.10% | -20.60% |

| 08:00 | EUR | Italy Industrial Output M/M May | 42.10% | 19.20% | -19.10% | -20.50% |

| 12:30 | USD | PPI M/M Jun | -0.20% | 0.40% | 0.40% | |

| 12:30 | USD | PPI Y/Y Jun | -0.80% | -0.40% | -0.80% | |

| 12:30 | USD | PPI Core M/M Jun | -0.30% | 0.10% | -0.10% | |

| 12:30 | USD | PPI Core Y/Y Jun | 0.10% | 0.50% | 0.30% | |

| 12:30 | CAD | Net Change in Employment Jun | 952.9 K | 675.0K | 289.6K | |

| 12:30 | CAD | Unemployment Rate Jun | 12.30% | 11.90% | 13.70% |