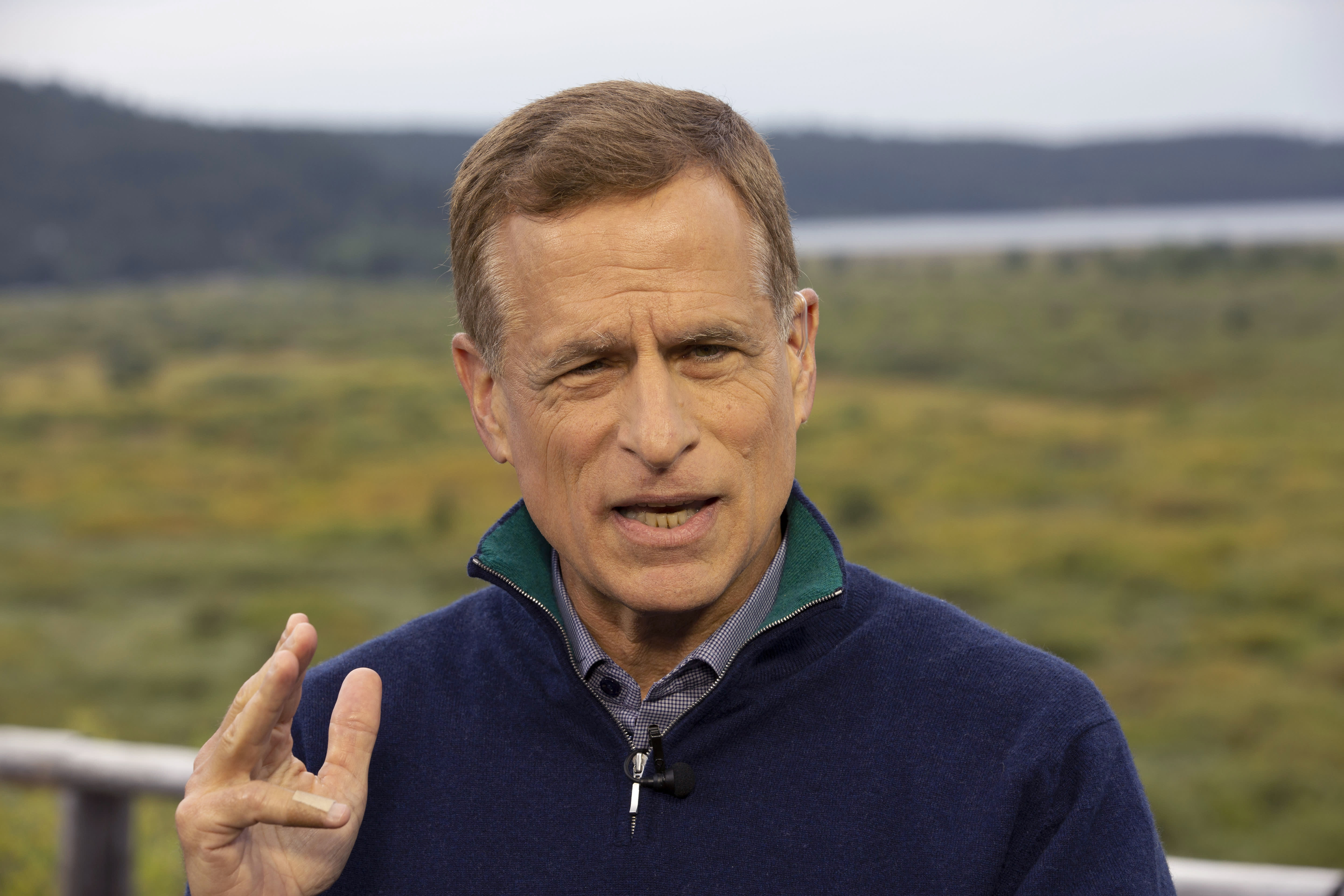

Gerard Miller | CNBC

Amid historically aggressive policy moves from the U.S. central bank and Congress, Dallas Federal Reserve President Robert Kaplan said the most important thing for the economy now is wearing protective face coverings.

Masks in public, Kaplan said, are key to stopping the coronavirus spread, which is increasing in record numbers and threatening to roll back the progress made since the U.S. went into lockdown in mid-March.

“The main message I’d have today about the economy from here and how to grow it probably has to do with managing this virus,” he told Fox Business’s Maria Bartiromo in an interview Friday morning. “While monetary and fiscal policy are very important, they’re not as important right now as us doing a good job flattening the curve on this virus. If we do that, we’ll grow faster.”

The Fed has instituted programs that could provide $2.3 trillion in liquidity and lending while taking its key interest rate down to near zero. At the same time, Congress has provided more than $2 trillion in rescue funds and is debating adding more.

Still, Kaplan said “the primary economic policy from here is broad mask-wearing and good education of the health care protocols.”

“If we all wore a mask, it would substantially mute the transmission of this disease and we would grow faster,” he added. “We would have a lower unemployment rate … and we would be less likely to slow more of our reopenings.”

The U.S. recorded nearly 58,836 new Covid-19 cases Thursday, a 1.9% increase from the day before, according to the COVID Tracking Project. Hospitalizations rose 2.1% and deaths increased 0.7% to 125,590.

Stay-at-home measures implemented to contain the virus may have caused second quarter GDP to contract by as much as 35%, Kaplan said. He expects growth to pick up in the second half but still sees a full-year decline of 4.5% to 5%, with that rate to be influenced by how the virus spreads.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)