Dollar appears to be gathering steam for a stronger, sustainable near-term rebound, although the precise catalyst remains unclear. One contributing factor an undercurrent of risk aversion, which is reflected in the broad selloff in the Australian and New Zealand Dollars. Yet, the overall market picture is mixed, as US stock futures inch higher and Treasury yields hold steady, hardly signaling a deep risk-off move or robust safe-haven flows.

Another explanation points to traders positioning ahead of Nvidia’s earnings release, due after the bell. With the AI-driven rally serving as a key theme for tech stocks, any surprise in the results could influence wider market sentiment, thereby affecting the currency markets. Additionally, speculation is building around the upcoming March 4 tariff deadline, when US levies on Canada and Mexico—postponed for a month to address border and fentanyl issues—are set to take effect.

At present, the greenback tops the leaderboard for the day, followed by Sterling and Loonie. Aussie and Kiwi lag, with Swiss Franc also underperforming. Euro and Yen are holding middle ground.

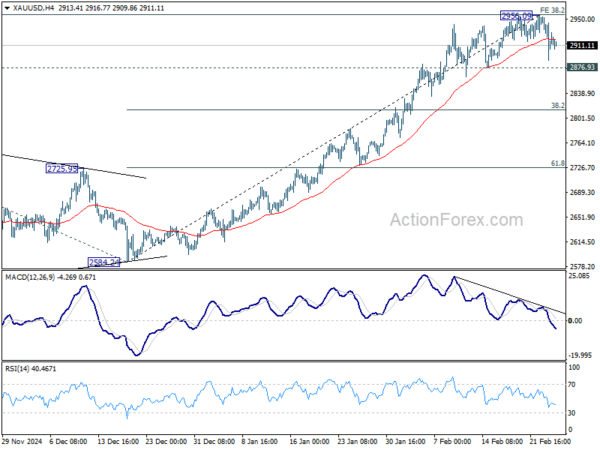

Technically, considering bearish divergence condition in 4H MACD, a short term top could already be in place in Gold at 2956.09, ahead of 3000 psychological level. Firm break of 2876.93 support should confirm this case, and bring deeper correction to 38.2% retracement of 2584.24 to 2956.09 at 2814.04. If realized, that would be a confirmation for Dollar’s rebound.

In Europe, at the time of writing, FTSE is up 0.65%. DAX is up 1.69%. CAC is up 1.32%. UK 10-year yield is down -0.0316 at 4.483. Germany 10-year yield is down -0.032 at 2.429. Earlier in Asia, Nikkei fell -0.25%. Hong Kong HSI rose 3.27%. China Shanghai SSE rose 1.02%. Singapore Strait Times fell -0.20%. Japan 10-year JGB yield fell -0.0098 to 1.367.

German Gfk consumer sentiment drops to -24.7, no sign of recovery yet

Germany’s GfK Consumer Sentiment Index for March declined further from -22.6 to -24.7, missing expectations of -21.1.

February data showed income expectations plunging -4.3 points to -5.4, marking a 13-month low, while the economic outlook for the next 12 months improved slightly by 2.8 points to 1.2.

According to Rolf Bürkl, consumer expert at NIM, the data highlights that “no signs of a recovery” are visible in German consumer sentiment. He noted that headline index has been stuck at a low level since mid-2024, with “great deal of uncertainty among consumers and a lack of planning security”.

Australia’s monthly CPI holds at 2.5%, core measures edge higher

Australia’s monthly CPI was unchanged at 2.5% yoy in January, falling short of expectations for a slight uptick to 2.6%.

However, underlying inflation pressures showed signs of persistence, with CPI excluding volatile items and holiday travel rising from 2.7% yoy to 2.9% yoy. Trimmed mean CPI edged up from 2.7% yoy to 2.8% yoy.

These figures suggest that while headline inflation appears stable, core price pressures are still lingering, reinforcing RBA’s cautious stance on further easing.

The largest contributors to annual inflation included food and non-alcoholic beverages (+3.3% yoy), housing (+2.1% yoy), and alcohol and tobacco (+6.4% yoy).This was partly offset by a notable decline in electricity prices, which fell -11.5% yoy.

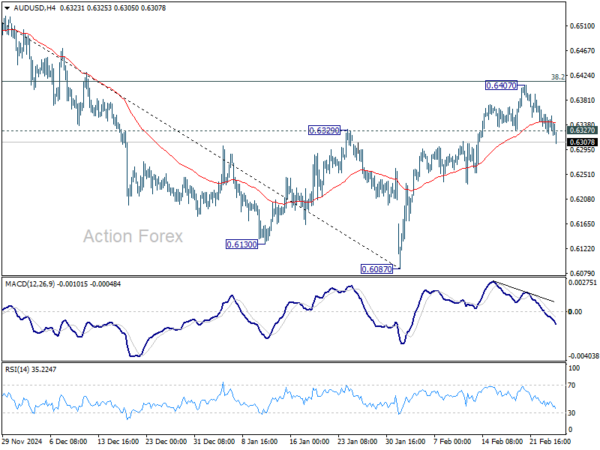

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6325; (P) 0.6341; (R1) 0.6360; More...

AUD/USD’s break of 0.6327 support should confirm short term topping at 0.6407, on bearish divergence condition in 4H MACD. Corrective rebound should have completed just ahead of 38.2% retracement of 0.6941 to 0.6087 at 0.6413. Intraday bias is back on the downside for retesting 0.6087 low. For now, risk will stay on the downside as long as 0.6407 holds, in case of recovery.

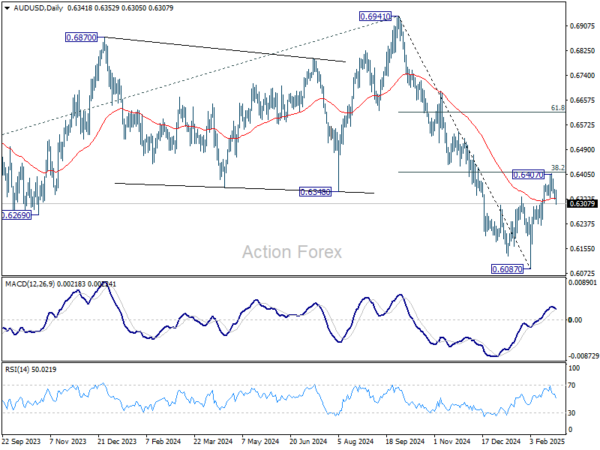

In the bigger picture, fall from 0.6941 (2024 high) is seen as part of the down trend from 0.8006 (2021 high). Next medium term target is 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.6505) holds.