Trade tensions remain at the forefront of market concerns as the US prepares to roll out another wave of tariffs. Over the weekend, President Donald Trump confirmed plans to impose a 25% tariff on all steel and aluminum imports, adding to the existing duties on these metals. The official announcement is expected today. Meanwhile, “reciprocal tariffs”—which would match the import duties imposed by other countries—are set to be unveiled between Tuesday and Wednesday, with immediate implementation.

The largest suppliers of steel and aluminum to the US are Canada, Brazil, and Mexico, followed by South Korea and Vietnam. Canada, in particular, dominates the aluminum export market to the US, contributing 79% of total imports in the first 11 months of 2024. The announcement raises questions about how these countries might respond, given that Canada and Mexico only recently secured a temporary reprieve from tariffs on other goods.

Interestingly, Hong Kong’s stock market has shown resilience, posting extended gains despite escalating trade tensions. Investors appear unfazed by the recent flurry of US tariff news, as well as China’s retaliatory levies on select American products. The factors supporting Hong Kong’s optimism remain unclear, and more time would be required to assess whether regional equities can maintain this momentum if trade frictions intensify further.

Technically, HSI’s break of 21070.05 resistance last week suggests that correction from 23241.74 has completed at 18671.59 already, despite being deeper than expected. The medium term up trend from 14794.16 should remain intact, with notable support from 55 W EMA too. Retest of 23241.74 resistance should be seen next and firm break there will target 25k handle, which is close to 100% projection of 16964.28 to 23241.74 from 18671.49.

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.

In Asia, at the time of writing, Nikkei is down -0.10%. Hong Kong HSI is up 1.15%. China Shanghai SSE is up 0.23%. Singapore Strait Times is up 0.63%. Japan 10-year JGB yield is up 0.0193 at 1.322, hitting a fresh high since 2011.

China’s CPI picks up to 0.5%, but factory prices remain stuck in deflation

China’s consumer inflation accelerated at the start of 2025, with CPI rising from 0.1% yoy to 0.5% yoy in January, slightly exceeding market expectations of 0.4%. This marked the fastest annual increase in five months. On a monthly basis, CPI surged 0.7% mom, the strongest rise in over three years.

Core inflation, which strips out food and fuel prices, edged up from 0.4% yoy to 0.6% yoy, reflecting a modest pickup in underlying demand. Food prices climbed by 0.4% yoy, while non-food categories also posted a 0.5% yoy increase.

However, despite these gains, consumer inflation remains well below the government’s target, with full-year 2024 CPI growth coming in at just 0.2%, the lowest since 2009, and reinforcing the persistent weakness in domestic consumption.

Meanwhile, producer prices remained firmly in deflationary territory. PPI held steady at -2.3% yoy in January, missing expectations of a slight improvement to -2.2% yoy. This marks the 28th consecutive month of factory-gate deflation, highlighting ongoing struggles within the manufacturing sector and pricing pressures stemming from weak external demand and excess capacity.

Powell’s testimony, US inflation data, and UK GDP in focus this week

Fed Chair Jerome Powell’s upcoming Congressional testimony will be a key event this week as markets seek further clarity on Fed’s path. In particular, the main question is whether Fed’s hold at the last meeting is the start of a longer pause in the easing cycle.

Following January’s FOMC decision to hold rates steady, Powell stated explicitly that Fed is in “no hurry” to cut interest rates. Several Fed officials have since emphasized that declining inflation alone may not be sufficient for additional rate reductions, with the labor market’s performance playing a crucial role. Lawmakers are expected to press Powell for further details on how Fed will balance these factors in shaping monetary policy.

Meanwhile, Friday’s Monetary Policy Report offered minimal commentary on the impact of US tariff policies. It merely noted that “some market participants” cited tariff-related uncertainties as a factor driving the dollar higher in recent months. Given the evolving nature of Trump’s trade strategy and the lack of clear direction, Powell is unlikely to provide definitive answers on how tariffs will influence Fed policy. Nonetheless, market participants will closely follow any indication that trade-related uncertainties might alter the Fed’s rate outlook.

US CPI and retail sales data will also be closely watched. Headline inflation is expected to remain at 2.9% in January, with core CPI easing slightly from 3.2% to 3.1%. Risks remain that inflation could remain sticky as businesses begin adjusting for potential tariff impacts. If inflation prints in line with expectations or surprises to the upside, it would reinforce Fed’s cautious approach and likely prolong the current pause in rate cuts.

Elsewhere, UK GDP report will be another highlight. The economy is expected to contract by -0.1% in Q4, raising concerns about a potential recession. After last week’s dovish 25bps rate cut by BoE, speculation has increased that another cut could come as early as March. While this is not yet the consensus view, any downside surprise in GDP data could fuel expectations of a back-to-back rate reduction, particularly as known hawk Catherine Mann has already shifted to a more dovish stance.

Here are some highlights for the week:

- Monday: Japan bank lending, current account, Eco Watcher sentiment; Eurozone Sentix Investor confidence.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; Canada building permits.

- Wednesday: Japan machine tool orders; US CPI; BoC summary of deliberations.

- Thursday: Japan PPI; New Zealand inflation expectations; Germany CPI final; UK GDP, trade balance; Swiss CPI; Eurozone industrial production; US PPI, jobless claims.

- Friday: New Zealand BNZ manufacturing; Swiss PPI; Eurozone GDP revision; Canada manufacturing sales, wholesales sales; US retail sales, industrial production.

AUD/USD Daily Report

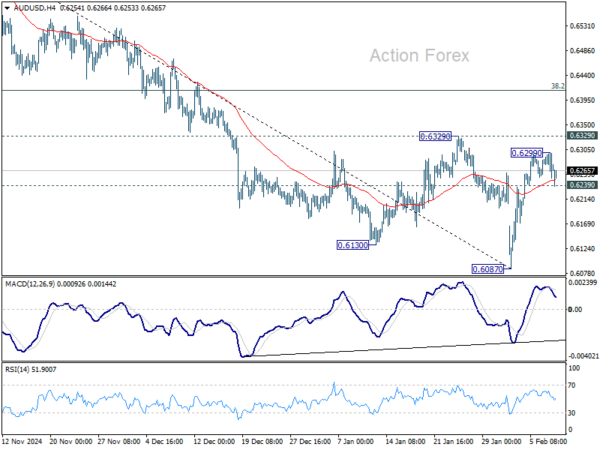

Daily Pivots: (S1) 0.6251; (P) 0.6275; (R1) 0.6296; More...

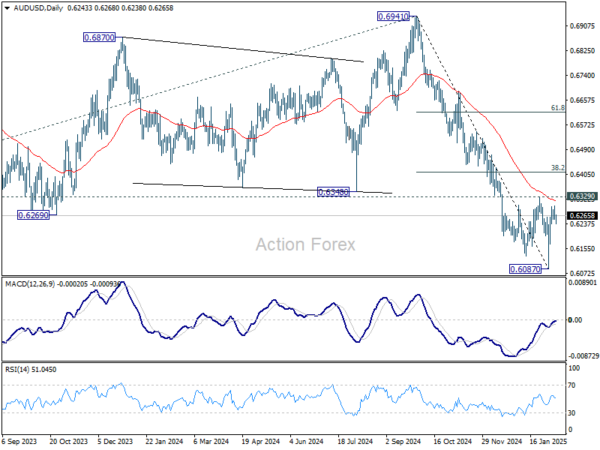

AUD/USD dips mildly today but stays above 0.6239 minor support. Intraday bas stays neutral first. With 0.6329 resistance intact, outlook will stay bearish. On the downside, break of 0.6239 minor support will turn bias back to the downside for retesting 0.6087 low. However, firm break of 0.6329 will bring stronger rebound to 38.2% retracement of 0.6941 to 0.6087 at 0.6413, even just as a corrective move.

In the bigger picture, fall from 0.6941 (2024 high) is seen as part of the down trend from 0.8006 (2021 high). Next medium term target is 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.6516) holds.