Global markets kicked off February under heavy strain as US President Donald Trump’s long-anticipated tariffs on Canada, Mexico, and China came into full effect. Investor sentiment turned sharply negative, with Japan’s Nikkei tumbling over 1,000 points in response. Dollar opened the week with a strong gap higher and maintained solid gains throughout Asian session. Commodity-linked currencies bore the brunt of the selloff, particularly New Zealand and Australian Dollars, which struggled even more than Canadian Dollar—despite Canada being directly targeted by the new tariffs. Meanwhile, Euro and Pound also weakened, though not as severely as the major commodity currencies.

Looking ahead, the trade dispute theme should continue to dominate market sentiment for the foreseeable future. The US administration has hinted at the likelihood of expanding tariffs to Europe and possibly the UK, though there appears to be some willingness to discuss matters further with London. Beyond trade tensions, upcoming events such as BoE’s policy decision—which is widely expected to involve a 25bps rate reduction—will also command attention. Additionally, a series of key US data releases, including the ISM manufacturing and services indexes plus non-farm payrolls, could further influence the risk mood.

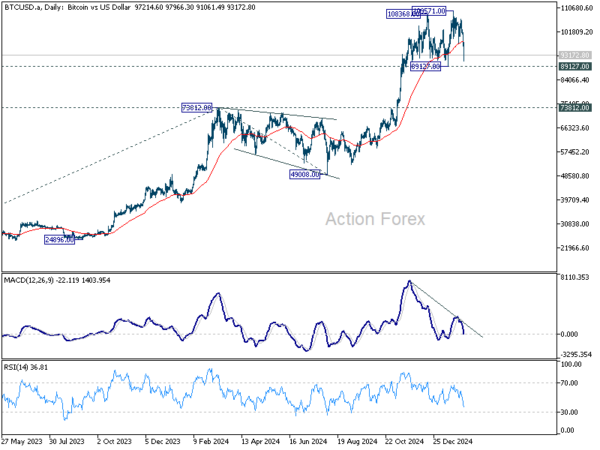

Another noteworthy shift is taking shape in the cryptocurrency market, where both Bitcoin and Ethereum have taken a steep hit. Although the new tariffs reaffirm Trump’s commitment to his promises—such as turning the US into a major crypto hub—virtual currencies have not benefitted. Instead, global uncertainty has driven investors toward safer assets, prompting a retreat from riskier corners of the market.

Technically, for now, there’s no panic for Bitcoin yet as 89127 support remains intact. The recent up trend is still in favor to resume for another take on 100k market at a later stage. However, firm break of 89127 support will complete a double top pattern, and could trigger deeper correction back to 73812 resistance turned support and possibly below.

In Asia, at the time of writing, Nikkei is down -2.74%. Hong Kong HSI is down -0.74%. China is on holiday. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is down -0.0118 at 1.230.

Trade War 2.0 kicks off, USD/CAD breaks key resistance with 1.50 in sight

The long-anticipated escalation in trade tensions has officially materialized as US President Donald Trump imposed sweeping tariffs over the weekend. A 25% tariff is now in effect on imports from Canada and Mexico, while China faces a 10% levy on its exports to the US. The move, widely expected, marks the formal start of what is being called Trade War 2.0.

In immediate response, Canada announced retaliatory tariffs of 25% on USD 155B worth of US goods, while China indicated that it would file a case against the US at the World Trade Organization.

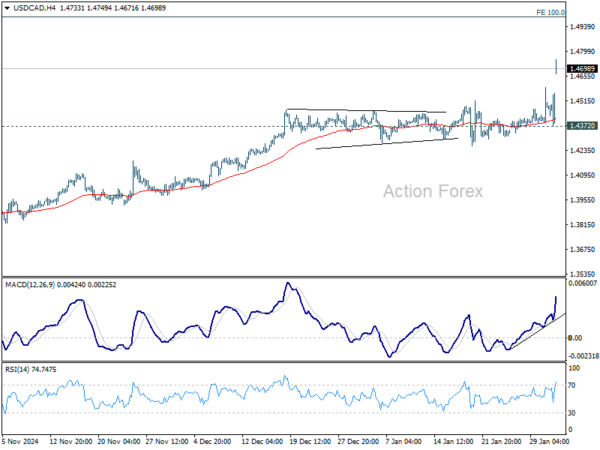

Dollar gapped higher as the week started in response to the development. USD/CAD broke through 1.4689 key resistance (2016 high) to resume the long term up trend. Technically, the next medium term target for USD/CAD is 100% projection of 1.2401 to 1.3976 from 1.3418 at 1.4993.

Though given the scale of uncertainty surrounding the trade dispute, further upside cannot be ruled out. A lack of near-term resolution could see USD/CAD extend even higher toward 61.8% projection of 0.9406 to 1.4689 from 1.2005 at 1.5270 before topping.

BoJ opinions signal more rate hikes as inflation risks tilt higher

BoJ’s Summary of Opinions from the January 23-24 meeting indicates a growing shift toward policy normalization, as multiple board members highlighted mounting inflationary pressures.

Rising import costs driven by the weak yen have led more businesses to raise prices, prompting concerns that inflation could overshoot expectations.

One member noted that with economic activity and prices remaining stable, “risks to prices have become more skewed to the upside,” emphasizing that rate hikes should be “timely and gradual.”

Some policymakers warned that continued Yen depreciation and excessive risk-taking could lead to an overheating of financial activities. To counter this, one board member argued for additional rate hikes to stabilize the currency and prevent further distortions in market expectations regarding BoJ policy.

At the January meeting, the BoJ raised its short-term policy rate from 0.25% to 0.50%, marking another step away from ultra-loose monetary policy. The central bank also revised its price forecasts higher, reinforcing its confidence that rising wages will sustain inflation near the 2% target.

Japan’s PMI manufacturing finalized at 48.7, deepest contraction in 10 Months

Japan’s PMI Manufacturing was finalized at 48.7 in January, down from December’s 49.6. This marks the sharpest decline in output since March 2024, as firms faced a steeper drop in new orders. Weak demand conditions forced manufacturers to scale back production, reflecting ongoing headwinds for the sector.

According to S&P Global, businesses reacted to falling demand by cutting both inventories and raw material holdings, while also reducing input purchases at the fastest pace in nearly a year. Employment growth also slowed, highlighting a cautious approach to hiring amid economic uncertainty.

Despite the downturn, manufacturers maintained a positive outlook for future output, though confidence fell to its lowest level since December 2022. While firms expect a recovery in demand, concerns persist over when such an improvement will materialize. The slowdown in input price inflation to a nine-month low provides some relief, but overall, sentiment remains fragile.

Australia’s retail sales dip -0.1% mom in Dec, less than expected

Australia’s retail sales turnover edged down by -0.1% mom in December, a smaller decline than the expected -0.7% mom. While the contraction marks a pullback from the strong growth seen in previous months—0.7% mom in November and 0.5% in October mom—it suggests that consumer spending remains relatively resilient.

According to Robert Ewing, head of business statistics at the Australian Bureau of Statistics, retail activity was supported by extended promotional events, helping to smooth spending patterns over the quarter. He noted that Cyber Monday, which fell in early December, boosted demand for discretionary items, particularly furniture, homewares, electronics, and electrical goods.

China’s Caixin PMI manufacturing slips to 50.1, growth momentum weakens

China’s Caixin Manufacturing PMI edged down to 50.1 in January from 50.5 in December.

According to Caixin Insight Group, manufacturers saw improved logistics and a slight pickup in supply and demand. However, employment levels deteriorated notably, and new export orders remained weak, reflecting sluggish global demand.

External risks also remain a key concern, with rising geopolitical uncertainty adding pressure to China’s export environment. Disruptions in global trade policies could further dampen overseas demand, making it difficult for manufacturers to sustain current production levels.

Domestically, consumer spending remains sluggish, highlighting the need for policy measures aimed at boosting disposable income and restoring confidence.

BoE Set to Cut, NFP to Steer Dollar Outlook

This week’s forex market focus will largely center on BoE upcoming policy decision, where a 25bps rate cut to 4.50% is widely anticipated. Along with the rate announcement, traders will closely watch the MPC voting breakdown and the release of new economic projections.

Data from the UK since November’s rate cut have painted a mixed picture: GDP growth has stagnated, inflation has eased, but wage growth has unexpectedly picked up. These conflicting signals leave the door open for surprises when the MPC releases its updated forecasts.

The general consensus favors a gradual easing path for BoE, with a quarterly tempo of 25bps cuts, totaling 100bps for the entire year. However, market expectations are somewhat more conservative, pricing in just over 75bps of easing in 2025.

Heightened uncertainty stems from several factors, including the domestic effects of the Autumn budget and the fallout from US tariff threats. The new projections and the voting details could help clarify the BoE’s assessment of these risks, especially regarding inflation and growth outlooks.

MPC voting will be a prime area of focus. Known hawk Catherine Mann aligning with the broader committee in supporting a cut would send a notably dovish signal. Conversely, if the typically dovish Swati Dhingra refrains from advocating a 50bps cut, markets could interpret that as unexpectedly “hawkish”. The interplay of these votes will likely set the tone for Sterling, as traders decipher how unified or divided the committee is on monetary policy strategy.

Beyond BoE decision, US non-farm payrolls report and ISM manufacturing and services data will grab attention too. After last week’s FOMC hold, Fed Chair Jerome Powell indicated explicitly that the central bank is not in a hurry to cut rates further, even though policy easing remains on course.

The futures market currently suggests a better-than-even chance that Fed will keep policy on pause at least until May. Unless this week’s data delivers significant surprises—either in job growth or wage pressures—this expectation is unlikely to shift meaningfully.

The key question revolves around the pace of easing in the second half of the year and the eventual terminal rate. However, given Powell’s recent comments, it’s unlikely that these questions will be answered in the near term.

Elsewhere, key economic indicators from Eurozone, Japan, Canada, Australia, and New Zealand will also contribute to currency market movements. In particular, Eurozone’s CPI flash, Japan’s wage and household spending, Canada’s employment report, Australia’s retail sales and New Zealand’s employment data will be closely watched.

Here are some highlights for the week:

- Monday: BoJ summary of opinions, Japan PMI manufacturing final; Australia retail sales, build approvals; China Caixin PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final, CPI flash; UK PMI manufacturing final; US ISM manufacturing.

- Tuesday: Japan monetary base; US factory orders.

- Wednesday: New Zealand employment; Japan labor cash earnings; China Caixin PMI services; Eurozone PMI services final, PPI; UK PMI services final; US ADP employment, trade balance, ISM services; Canada trade balance.

- Thursday: Australia trade balance, NAB quarterly business confidence; Swiss unemployment rate; Eurozone retail sales; BoE rate decision; US jobless claims, non-farm productivity; Canada Ivey PMI.

- Friday: Japan household spending, leading indicators; Germany industrial production, trade balance; Swiss foreign currency reserves; Canada employment; US non-farm payrolls.

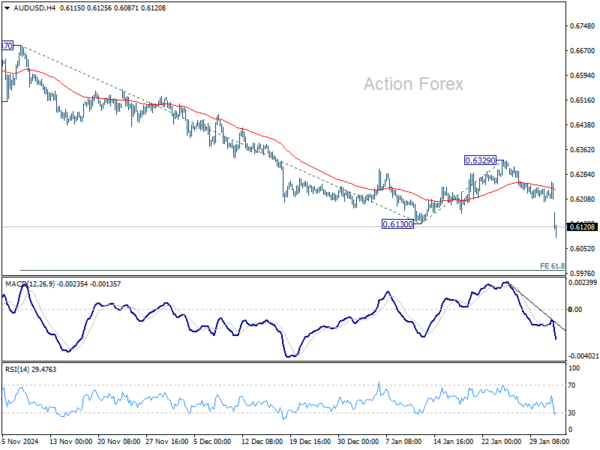

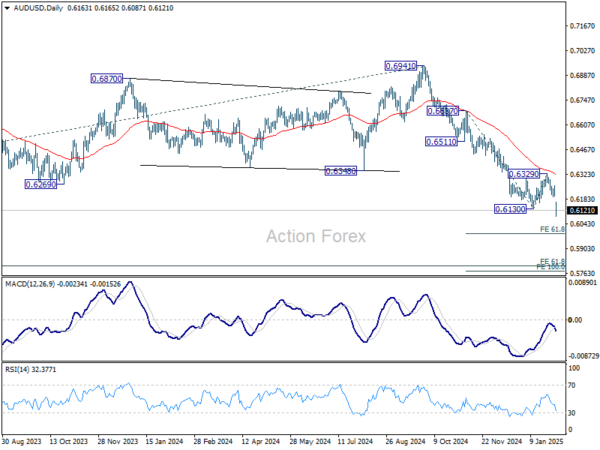

AUD/USD Daily Report

Daily Pivots: (S1) 0.6189; (P) 0.6226; (R1) 0.6249; More...

AUD/USD’s fall from 0.6941 resumed by breaking through 0.6130 support today. Intraday bias is back on the downside fro 61.8% projection of 0.6687 to 0.6130 from 0.6329 at 0.5985 next. For now, outlook will stay bearish as long as 0.6329 resistance holds, in case of recovery.

In the bigger picture, fall from 0.6941 (2024 high) is seen as part of the down trend from 0.8006 (2021 high). Next medium term target is 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.6511) holds.