Markets opened the week with a dramatic shift in risk sentiment as last week’s record-breaking highs in US equities gave way to sharp declines, driven by tech sector rout. Concerns over US dominance in artificial intelligence surfaced after Chinese startup DeepSeek unveiled a competing AI assistant, leading to fears of heightened competition. Nvidia saw its stock plummet over -12%, dragging NASDAQ down more than -3%. It should be emphasized that the long-term implications of this development remain unclear. Yet, some investors are treating it as an opportunity to take profits in the overheated tech sector, and wait for a sizeable correction, if any, to reenter the market.

Despite the tech selloff, it’s far too early to suggest that equity markets have peaked. The broader macroeconomic backdrop continues to support risk assets, with expectations for continued monetary easing from major global central banks still intact. In the US, President Donald Trump’s lack of action on tariffs, particularly toward allies, has helped contain inflation risks. These factors should help cushion market sentiment even as tech stocks experience turbulence.

Technically, DOW’s retreat today is so far rather shallow. As long as 55 H EMA (now at 43907) holds, DOW’s rally from 41884.98 should still be in progress. A serious test 45703.63 key near term resistance should at least be seen before any more sustained correction can be considered.

10-year yield’s correction 4.809 resumed earlier than expected by gapping through last week’s low of 4.552. But that’s not so much a surprised and was inline with the outlook mentioned in our weekly report. Deeper correction looks more likely than not for now, but downside should still be contained by 38.2% retracement of 3.603 to 4.809 at 4.348. That’s supported by expectations inflation in the US would remain sticky that keep Fed’s easing much shallower than its global peers.

Overall in the currency markets, Yen and Swiss Franc are the strongest ones today, supported both by risk aversion in the stock markets and fall in US and European benchmark yields. Commodity currencies are all in red with Aussie being the worst, followed by Kiwi and then Loonie. Euro and Sterling are trading mixed in the middle with Dollar. The greenback is at a disadvantage with the deeper decline in US yields.

German Ifo rises to 85.1, slightly improvement but still pessimistic

German Ifo Business Climate ticked up from 84.7 to 85.1 in January. Current Situation Index also rose form 85.1 to 86.1. But Expectations Index fell from 84.4 to 84.2.

By sector, manufacturing fell from -24.9 to -25.3. Services rose from -5.6 to -2.2. Trade was unchanged at -29.5. Construction dropped notably from -26.2 to -28.2.

Ifo said that despite the slight improvement, “companies continue to be pessimistic”.

China’s PMI manufacturing falls to 49.1, weak start to 2025

China’s manufacturing activity slipped into contraction in January, with NBS Manufacturing PMI falling from 50.1 to 49.1, missing expectations of 50.1. This marks the first contraction since October and the lowest reading since August.

The decline was attributed to Lunar New Year holiday, as workers left early, according to NBS senior statistician Zhao Qinghe. Analysts also noted potential effects from slowing export demand after earlier front-loading tied to trade concerns.

The services sector showed similar weakness, with the Non-Manufacturing PMI dropping from 52.2 to 50.2, below the expected 52.0. Composite PMI, combining manufacturing and services, slipped to 50.1 from 52.2, reflecting a broad deceleration.

While some of this is likely seasonal, the magnitude of the slowdown raises concerns about underlying economic momentum, especially with external pressures like trade tensions still in play.

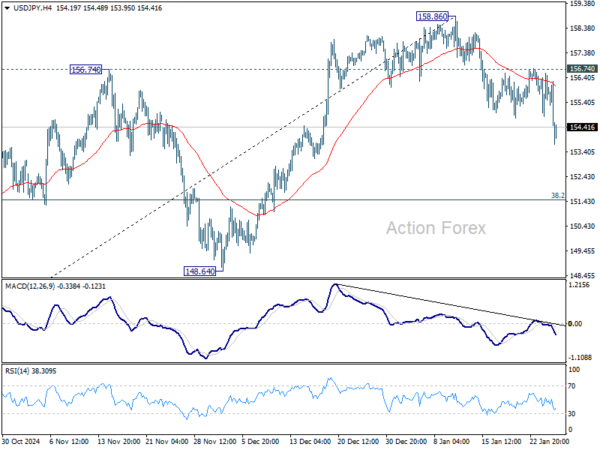

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 155.03; (P) 155.81; (R1) 156.77; More…

Intraday bias in USD/JPY stays on the downside this point. Fall from 154.77 is in progress for 38.2% retracement of 139.57 to 158.86 at 151.49. Sustained break there will suggest that whole rally from 138.57 has completed already. For now, risk will stay on the downside as long as 156.74 resistance holds, in case of recovery.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.