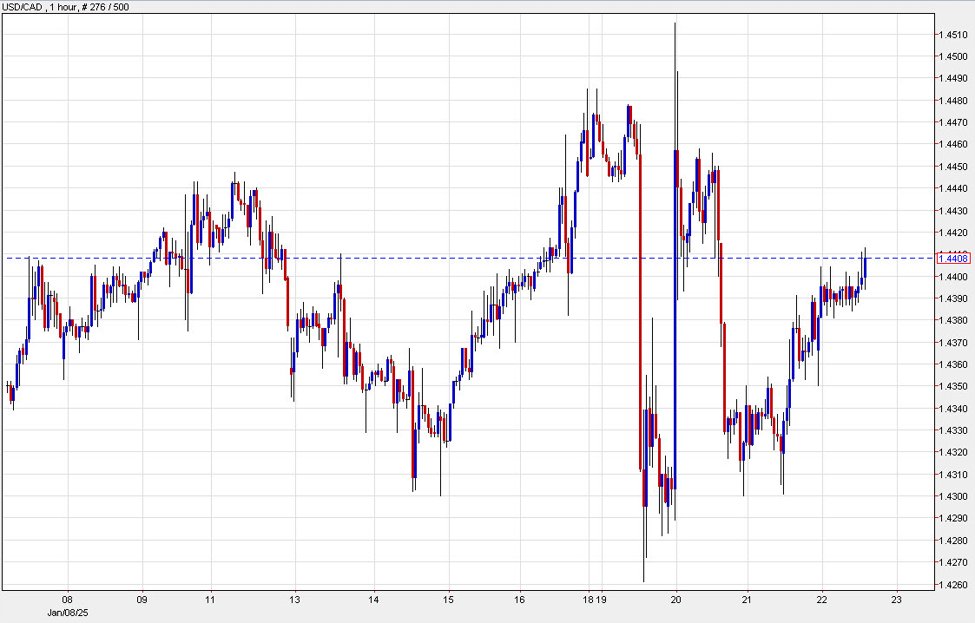

USDCAD 1 hour

USD/CAD reached a session high at 1.4408 shortly before the release of Canadian retail sales but has been largely unmoved since.

Canadian economic data is quickly falling to the backburner in terms of market-moving impact for two reasons:

1) Tariff risks

The entire economy could be upended if Trump follows through on his 25% tariff threat on February 1. The market thinks it’s mostly bluster but you never know with Trump. Deutsche Bank yesterday said USD/CAD could rise as high as 1.61 in a trade war.

2) The GST holiday

Canada removed its VAT on many items for a tax holiday from December 15-February 15. That’s going to put a kink in consumer spending and it will filter down to many other economic indicators as well. It’s going to make it difficult to get a clear read on retail sales and inflation for at least a few months.

All this makes the Bank of Canada’s job doubly difficult but I would expect them to err on the side of easing as most of the risks are to the downside.