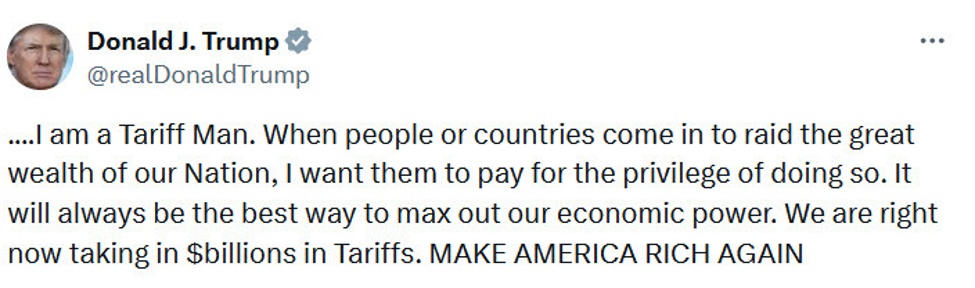

The classic tweet from Dec 2018

The fear in markets is that Trump is going to be hitting everyone with tariffs. He’s a very tough guy to predict but I’m growing more optimistic.

1) The threats to Mexico and Canada are solvable

One of his first post-election tweets talked about 25% tariffs on Mexico and Canada but the important detail was he wanted action on fentanyl and border security. That’s an easy deal to make and Trump already highlighted improvement from Mexico.

2) Europe

The FT today reports that Trump wants NATO countries to spend 5% of GDP on defense. That’s some real war-time spending with many failing to hit the 2% NATO target. The report though says that he’s only really aiming for 3 or 3.5%. If that’s the trade for four-years free of tariffs then there is a deal to be made there, especially if those targets have long lead times.

3) China

This is the whale of the tariff war and he threatened to put on a 10% tariff due to fentanyl and I think that happens but at this point, a 10% tariff would be a relief.

More tellingly, Jim Cramer interviewed Trump and the NYSE last week and this comment was largely missed:

Well, we’re going to be having a lot of talks with China. We have a good

relationship with China. I have a surprising relationship. Now, when

the COVID came in, I sort of cut it off. That was a step too far. That

was, as they say, a bridge too far. But we’ve been talking and

discussing with President Xi, some things, and others, other world

leaders, and I think we’re going to do very well all around and we are,

we’ve been abused as a country.

He wasn’t specifically asked about tariffs here but he doesn’t sound like a guy who wants to go wild on tariffs.