Dollar and Yen saw modest recoveries in Asian session, driven by the cautious tone in financial markets as traders positioned themselves ahead of a crucial week for economic data and central bank announcements. Risk sentiment was subdued, with equities weakening on concerns over weaker inflation data from China. Adding to the caution, Fitch Ratings downgraded its growth forecasts for China for 2025 and 2026, citing risks from US tariffs and persistent domestic economic weaknesses.

In South Korea, political uncertainty has further weighed on investor sentiment. President Yoon Suk Yeol survived an impeachment vote over the weekend but faces mounting calls for resignation from within his own People Power Party. Yoon is also reported to be under criminal investigation for charges of treason and abuse of power related to his brief imposition of martial law last week. The turmoil has dragged KOSPI to its lowest level in over a year, exacerbating regional market jitters.

Looking ahead, the week’s major highlights include rate decisions from the RBA, BoC SNB, and ECB, alongside the pivotal release of US CPI data on Wednesday. With expectations of significant central bank action and economic data releases, volatility across forex markets is anticipated.

A focal point will be the performance of EUR/CHF, as traders assess the relative dovishness of ECB and SNB. Both central banks are expected to cut rates, but any dovish surprises from the ECB, particularly in its updated economic projections, could weigh heavily on Euro.

Technically, EUR/CHF staged a quick rebound after diving through 0.9209 key support back in November, but lacked follow through momentum for rally beyond 0.93 mark. The down trend from 0.9928 remains in force with the cross staying well clear of falling 55 D EMA. Any extra dovishness in this week’s ECB meeting, particular around the new economic projections, would drive EUR/CHF for at least a retest of 0.9209 low.

In Asia, at the time of writing, Nikkei is down -0.10%. Hong Kong HSI is down -0.58%. China Shanghai SSE is down -0.22%. Singapore Strait Times is down -0.11%. Japan 10-year JGB yield is down -0.0084 at 1.045.

China’s CPI falls to 0.2% yoy in Nov, PPI down -2.5% yoy, deflation pressures persist

China’s CPI decelerated from 0.3% yoy to 0.2% yoy in November, below market expectations of 0.5% yoy, and marking its lowest level in five months. Persistent deflationary pressures highlight the urgency for stronger fiscal measures to reinvigorate the economy.

Food prices was the primary driver of inflation, surging by 1% yoy, with notable increases in vegetable and pork prices at 10% yoy and 13.7% yoy, respectively. However, core inflation, which excludes volatile food and energy prices, edged up only marginally to 0.3% yoy from 0.2% yoy.

Meanwhile, PPI improved, registering a -2.5% yoy decline in November compared to -2.9% in October, beating expectations of -2.9% yoy. While this marked the 26th consecutive month of negative readings, the moderation was attributed to a combination of existing and incremental policy measures alongside a recovery in domestic demand for industrial goods.

RBA hold, ECB and SNB cut, plus US CPI

This week’s financial calendar is packed four central bank meetings from RBA, BoC, SNB, and ECB, alongside key economic data such as US CPI, UK GDP, Japan’s Tankan survey, and Australia’s employment report.

RBA is widely anticipated to leave its cash rate unchanged at 4.35%. October’s monthly CPI held steady at 2.1%, a welcome development for policymakers concerned about resurgence in inflation pressures. However, with trimmed mean CPI jumping from 3.2% to 3.5%, there is no immediate catalyst for RBA to shift its cautious stance.

The decision for RBA to commence policy easing cycle would hinge on the upcoming quarterly CPI data for Q4, due in late January. By the February meeting, RBA will have a clearer picture of inflation trends and updated economic projections.

This week’s Australian employment report will also be critical, as RBA has consistently flagged tight labor market conditions as a significant obstacle to achieving disinflation.

BoC is widely expected to continue with aggressive policy easing, with another 50bps rate cut to 3.25%. Recent data indicated that unemployment rate spiked to an 8-year high (outside of the pandemic period) of 6.8^ in November. This at the same time inflation, including headline and core measures, were relatively steady at or be slightly above 2%. There is enough room for BoC to expedite interest rate to neutral. The key going forward is whether there is any indication on where the terminal rate would be.

SNB is likely to cut its policy rate, but the magnitude remains uncertain—either 25bps or a more aggressive 50bps. November inflation ticked up slightly to 0.7% but remains muted, while growth continues to lag due to weak demand from neighboring economies. A 25bps cut seems more probable, especially with ECB leaning toward a modest 25bps reduction rather than a 50bps move. SNB might prefer to conserve its monetary ammunition to counter any upward pressure on the Swiss Franc if ECB accelerates its easing pace later.

ECB faces a similarly delicate balancing act. While a 25bps cut to the deposit rate to 3.00% is broadly expected, since recent commentary suggests a 50bps move is unlikely to gain majority support. ECB is expected to reiterate its data-dependent, meeting-by-meeting approach. Nevertheless, the new economic projections may reveal how much downside risks are there for growth and inflation in 2025, providing hints about the urgency—or lack thereof—behind more aggressive easing measures.

In the US, November CPI report is the centerpiece of the economic docket. Headline inflation is expected to inch up from 2.6% to 2.7%, with core inflation holding steady at 3.3%. Such results, barring a significant upside surprise, are unlikely to prevent Fed from delivering a 25bps rate cut at its December meeting. However, the sticky steady inflation figures would strengthen the argument for a pause in January. That would also offer Fed an opportunity to assess the economic impact of the incoming administration’s policies.

Here are some highlights for the week:

- Monday: Japan GDP final; China CPI, PPI; Swiss SECO consumer climate; Eurozone Sentix investor confidence.

- Tuesday: RBA rate decision, Australia NAB business confidence; China trade balance; Germany CPI final; US NFIB small business index.

- Wednesday: New Zealand manufacturing sales; Japan BSI manufacturing index, PPI; US CPI; BoC rate decision.

- Thursday: Australia employment; SNB rate decision; ECB rate decision; Canada building permits; US PPI.

- Friday: New Zealand BNZ manufacturing; Japan Tankan survey; Germany trade balance; UK GDP, production, trade balance; Eurozone industrial production; Canada manufacturing sales, wholesale sales; US import prices.

GBP/USD Daily Outlook

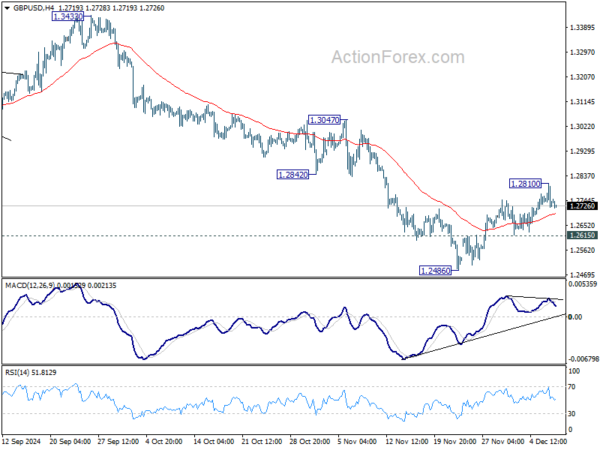

Daily Pivots: (S1) 1.2704; (P) 1.2758; (R1) 1.2793; More…

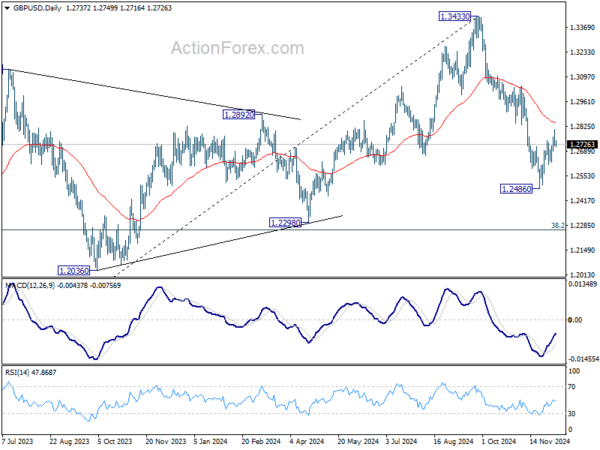

Intraday bias in GBP/USD is turned neutral again with current retreat. Rebound from 1.2486 short term bottom could still extend higher. But outlook will stay bearish as long as 55 D EMA (now at 1.2846) holds. On the downside, below 1.2615 minor support will bring retest of 1.2486 first. Firm break there will target 1.2298 cluster support zone. However, sustained break of 55 D EMA will argue that the near term trend has reversed, and targets 1.3047 resistance for confirmation.

In the bigger picture, price actions from 1.3433 medium term are seen as correcting whole up trend from 1.0351 (2022 low). Deeper decline could be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. But strong support is expected there to bring rebound to extend the corrective pattern.