Yen resumed its broad-based rally during the Asian session, lifted by stronger-than-expected Tokyo inflation data. The accelerated inflation figures have reignited market speculation about another rate hike by BoJ as early as December. Overnight index swaps now suggest there is over 60% probability of a 25bps increase at this upcoming meeting.

A key highlight from the inflation report is the continued uptick in services inflation, indicating that price pressures are becoming more entrenched in the domestic economy. The rise in core-core CPI also signaled that underlying inflation is gaining momentum beyond volatile food and energy prices.

However, the less-than-stellar retail sales growth raises questions about the robustness of domestic demand. This softness in retail activity may temper BoJ’s urgency to act immediately, as policymakers might seek more concrete evidence of sustained demand-pull inflation before making a policy shift.

Nevertheless, a recent Bloomberg poll showed that over 80% of economists surveyed expect BoJ to adjust its policy by January. Similarly, a Reuters survey showed that 90% of economists anticipate an increase in the policy rate from the current 0.25% to 0.50% by the end of March. This widespread expectation suggests that while the exact timing remains uncertain, a rate hike is likely to occur within the next few months.

Overall in the currency markets, Yen continues to outperform its peers, maintaining its position as the best performer of the week. Swiss Franc ranks as the second strongest currency, while Euro holds the third spot. Conversely, Loonie remains the weakest. Dollar has slipped to the second weakest position, while Aussie follows as the third weakest. Sterling and Kiwi continue to occupy middle positions.

Looking ahead, Swiss GDP and Eurozone CPI flash are set to take center stage. These data could determine whether Swiss Franc or Euro finishes the week stronger.

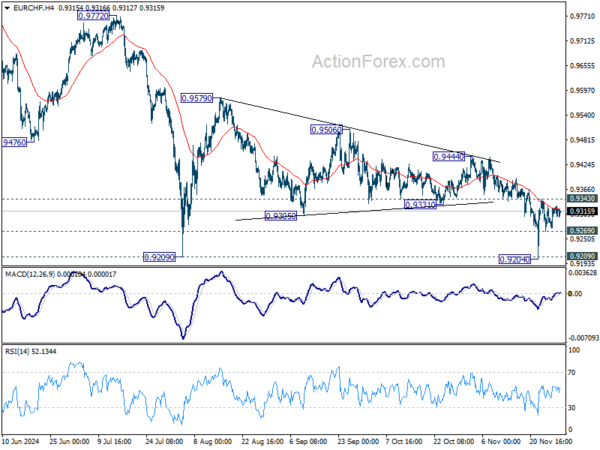

Technically, break of 0.9269 minor support in EUR/CHF will indicate another rejection by 55 4H EMA and bring retest of 0.9204/9 support zone. Firm break there will resume larger down trend. However, firm break of 0.9343 resistance will argue the near term down trend might be reversing, and target 0.9444 resistance and possibly above.

In Asia, at the time of writing, Nikkei is down -0.40%. Hong Kong HSI is down -0.15%. China Shanghai SSE is up 0.87%. Singapore Strait Times is down -0.49%. Japan 10-year JGB yield is down -0.0005 at 1.057.

Tokyo CPI core accelerates to 2.2%, boosting speculation of BoJ rate hike

Tokyo’s November CPI data pointed to resurgence of inflation pressures in Japan, raising expectations for BoJ to tighten policy further.

Tokyo Core CPI, excluding food, climbed from 1.8% yoy to 2.2% yoy, beating expectations of 2.1%, driven largely by the reduction in energy subsidies.

Core-core CPI, excluding food and energy, edged higher from 1.8% yoy to 1.9% yoy from 1.8%. Services prices, a key indicator of domestic demand-driven inflation, also increased, rising from 0.8% yoy to 0.9% yoy.

Headline CPI surged significantly, jumping from 1.8% yoy to 2.6% yoy.

Japan’s industrial output grows 3% mom in Oct, but contractions expected ahead

Japan’s industrial production rose by 3.0% mom in October, marking the second consecutive month of growth but falling short of market expectations of a 3.9% mom increase. This uptick is nonetheless an improvement from September’s 1.6% mom growth.

Out of the 15 industrial sectors surveyed, 11 sectors—including production machinery and motor vehicles—reported increased output, while four sectors, such as electronic parts and devices, experienced declines.

The Ministry of Economy, Trade and Industry maintained its previous assessment, stating that industrial production is fluctuating “indecisively.”

Looking ahead, the ministry projects that industrial output will decrease for two consecutive months, by -2.2% mom in November and a further -0.5% mom in December, likely dragged down by sectors like production machinery and transport equipment.

A ministry official expressed concern over “downside risks from overseas demand,” which could significantly impact the output of products like semiconductor manufacturing equipment and motor vehicles.

In additional economic data, retail sales increased by 1.6% yoy in October, missing expectations of a 2.1% yoy rise. Unemployment rate edged up from 2.4% to 2.5%, matching forecasts.

Looking ahead

Swiss GDP and KOF economic barometer will be released in European session. Eurozone CPI flash is another focus. Germany import prices, retail sales and unemployment France GDP revision, and UK M4 money supply will also be featured. Later in the day, Canada’s GDP data is the only focus.

GBP/JPY Daily Outlook

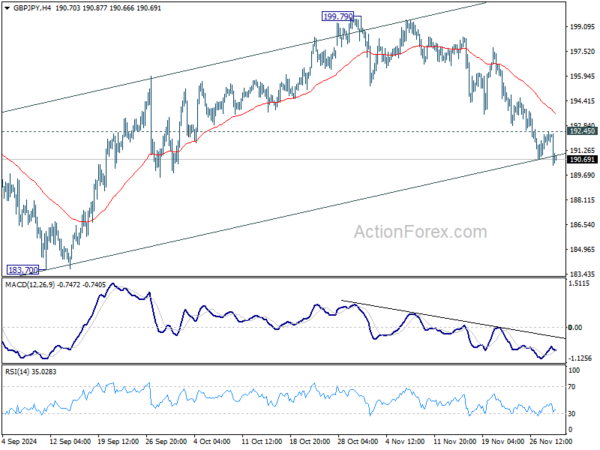

Daily Pivots: (S1) 191.58; (P) 192.03; (R1) 192.73; More…

GBP/JPY’s decline from 199.79 continues today and intraday bias stays on the downside. As noted before, corrective rise from 180.00 could have completed with three waves up to 199.79. Deeper decline would be seen to 183.70 support next. On the upside, above 192.45 minor resistance will turn intraday bias neutral first. But risk will now stay on the downside as long as 55 D EMA (now at 194.88) holds, in case of recovery.

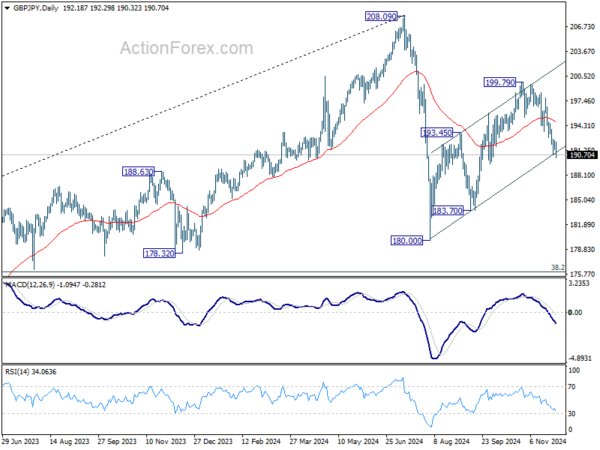

In the bigger picture, price actions from 208.09 are seen as a correction to whole rally from 123.94 (2020 low). The range of consolidation should be set between 38.2% retracement of 123.94 to 208.09 at 175.94 and 208.09. However, decisive break of 175.94 will argue that deeper correction is underway.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending