Yen is asserting dominance in today’s markets, benefiting from notable decline in US and European benchmark treasury yields. US 10-year yield, in particular, is seeing a renewed drop, which is gaining momentum alongside the weakening USD/JPY. This raises the risks that both could be reversing their rallies that began in mid-September. However, with reduced liquidity during the US Thanksgiving holiday, current price actions could be exaggerated, leaving markets to await next week for more definitive trend signals.

Overall in the currency markets, New Zealand Dollar is the second-best performer today after Yen, as investors continue to digest RBNZ’s latest rate projections. The central bank’s guidance has left markets divided on whether February will bring another 50bps rate cut or a more modest 25bps adjustment. Meanwhile, Euro ranks third, partly supported by hawkish remarks from a senior ECB official. Despite this, Euro’s movement still appears more like consolidation of its recent losses rather than a clear trend reversal. On the weaker side, Dollar leads the day’s losses, followed by Loonie and Aussie. Both currencies remain under pressure from trade and domestic growth concerns. Sterling and Swiss Franc are holding middle positions.

Technically some attention is now on whether Dollar’s current pullback could evolve into a broader bearish reversal. Key levels to watch include 1.0609 resistance in EUR/USD, 1.2713 resistance in GBP/USD, and 0.8800 support in USD/CHF. A decisive break of these levels across multiple pairs would signal that Dollar’s recent rally is over, paving the way for more sustained downside.

In Europe, at the time of writing, FTSE is down -0.11%. DAX is down -0.37%. CAC is down -0.89%. UK 10-year yield is down -0.0588 at 4.296. Germany 10-year yield is down -0.019 at 2.172. Earlier in Asia, Nikkei fell -0.80%. Hong Kong HSI rose 2.32%. China Shanghai SSE rose 1.53%. Singapore Strait Times fell -0.12%. Japan 10-year JGB yield is up 0.0047 at 1.075.

US initial jobless claims falls to 213k, vs exp 220k

US initial jobless claims fell -2k to 213k in the week ending November 23, below expectation of 220k. Four-week moving average of initial claims fell -1k to 217k.

Continuing claims rose 9k to 1907k in the week ending November 16, highest since November 13, 2021. Four-week moving average of continuing claims rose 13.5k to 1890k, highest since November 27, 2021.

US durable goods orders rises 0.2% mom, ex-transport orders up 0.1% mom

US durable goods orders rose 0.2% mom to USD 286.6B in October, below expectation of 0.4% mom. Ex-transport orders rose 0.1% mom to USD 189.5B, below expectation of 0.2% mom. Ex-defense orders rose 0.4% mom to USD 266.6B. Transportation equipment orders rose 0.5% mom to USD 97.1B.

ECB’s Schnabel advocates gradual approach, cautions against over-easing

ECB Executive Board member Isabel Schnabel stressed the importance of a cautious approach to monetary easing, warning against shifting policy into “accommodative territory.”

Speaking to Bloomberg, Schnabel stated that ECB could “gradually move toward neutral” if incoming data continue to align with the bank’s baseline projections. However, she rejected market expectations for accommodative policy, remarking, “From today’s perspective, I do not think that would be appropriate.”

Schnabel also dismissed speculation about larger rate moves, such as half-point cuts, expressing “a strong preference for a gradual approach.”

She cautioned that cutting rates prematurely, even if inflation were to fall short, could be counterproductive if deeper structural issues underlie the economic weakness.

In her view, “the costs of moving into accommodative territory could be higher than the benefits,” particularly as it would deplete policy options needed for future shocks that monetary measures could address more effectively.

Schnabel estimates the neutral interest rate to fall within the 2% to 3% range. With the deposit rate currently at 3.25% after three quarter-point cuts this year, she noted, “we may not be so far” from neutrality now.

Germany’s Gfk consumer sentiment plunges to -23.2, rising concerns over job security

Germany’s GfK Consumer Sentiment Index fell sharply for December, dropping from -18.4 to -23.3, far below expectations of -18.8. This marks the lowest level since May 2024 (-24.0) and reflects a significant deterioration in household confidence as the year ends.

November saw economic expectations decline from 0.2 to -3.6, marking the fourth consecutive drop and the weakest level since February. Income expectations also plunged, falling from 13.7 to -3.5, while willingness to buy slipped further from -4.7 to -6.0. In contrast, willingness to save increased from 7.2 to 11.9, highlighting a defensive shift in household behavior.

“Consumer sentiment in Germany is therefore currently at a level comparable to the end of 2023,” noted Rolf Bürkl, consumer expert at NIM, adding that “consumer uncertainty has increased again recently, as evidenced by the rising willingness to save.” Bürkl highlighted several contributing factors, including rising concerns over job security due to reported job cuts, production relocations, and an uptick in insolvencies.

RBNZ cuts rates by 50bps; projections indicate slower easing ahead

RBNZ delivered a widely expected 50bps cut to its Official Cash Rate, bringing it down to 4.25%. The central bank maintained easing bias, stating that if economic conditions align with projections, “the Committee expects to be able to lower the OCR further early next year.”

Governor Adrian Orr did not rule out another large cut in February during the post-meeting press conference. But RBNZ now forecasts the cash rate will drop to around 3.5% by the end of 2024, signaling smaller moves or pauses to assess the impact of prior easing.

On the economic front, RBNZ expects -0.2% contraction in Q3 2024, followed by recovery to 0.3% growth in Q4. Growth is anticipated to strengthen to a steady 0.6% quarterly rate through 2025 and 2026. “Economic growth is expected to recover during 2025, as lower interest rates encourage investment and other spending,” the central bank noted. .

Inflation is projected to slow from 2.2% currently to 2% by early 2025, but RBNZ forecasts show it picking up again and remaining between 2.0% and 2.5% through early 2027.

Australian CPI steady at 2.1% in Oct, underlying inflation shows mixed trends

Australia’s monthly CPI was unchanged at 2.1% yoy in October, below expectations of a rise to 2.5% yoy. This marks the lowest annual inflation rate since July 2021.

Core inflation metrics presented mixed signals, with CPI excluding volatile items and holiday travel slowing from 2.7% yoy to 2.4% yoy. However, trimmed mean CPI, a preferred gauge of underlying inflation, rose from 3.2% yoy to 3.5% yoy, signaling persistent inflationary pressures in certain sectors.

At the group level, notable price increases were observed in Food and non-alcoholic beverages (+3.3%), Recreation and culture (+4.3%), and Alcohol and tobacco (+6.0%). These were partly offset by a sharp decline in Transport prices, which fell -2.8%, driven by lower fuel costs.

Michelle Marquardt, head of prices statistics at the Australian Bureau of Statistics, noted that “the falls in electricity and fuel had a significant impact on the annual CPI measure this month.” She highlighted the value of core inflation measures, such as the trimmed mean, in offering deeper insights into inflation trends amid significant price fluctuations.

USD/JPY Mid-Day Outlook

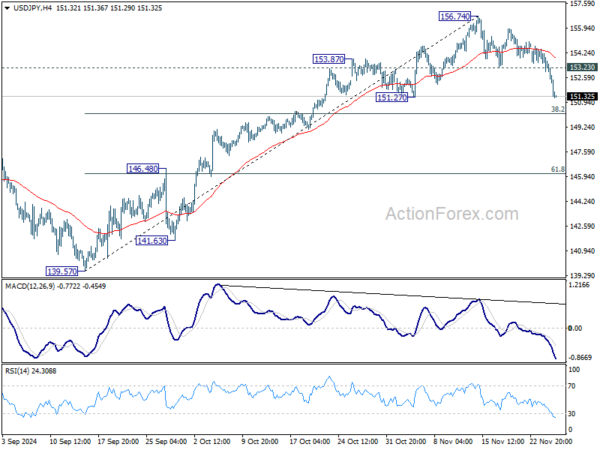

Daily Pivots: (S1) 152.57; (P) 153.53; (R1) 154.07; More…

USD/JPY’s corrective fall from 156.74 is extending lower and intraday bias stays on the downside. Deeper fall should be seen to 38.2% retracement of 139.57 to 156.74 at 150.18, but strong support is expected there to bring rebound. On the upside, above 153.23 minor resistance will turn intraday bias back to the upside for retesting 156.74. However, decisive break of 150.18 will argue that whole rise from 139.57 could have completed, and bring deeper fall to 61.8% retracement at 146.12 next.

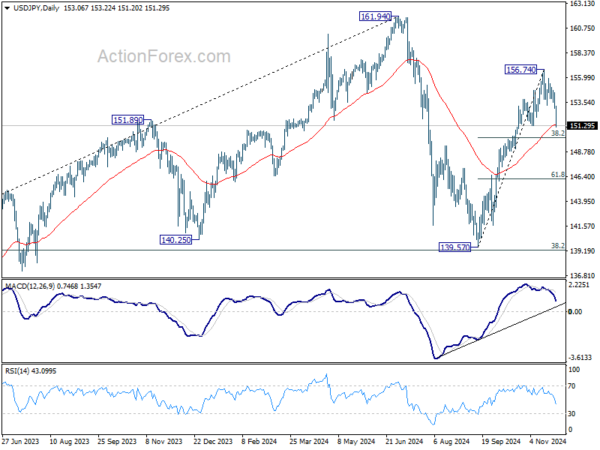

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.