The EUR/USD pair continued its downward trend today, extending a week-long selloff as bearish momentum carried the price through key technical levels. Weak European flash PMI data and concerns from ECB officials over growth and inflation pressured the euro, while stronger-than-expected US PMI data (offset slightly by weaker University of Michigan data) provided support for the dollar. The pair broke below the 50% retracement of the trading range at 1.0405, reaching a low of 1.03322 before bouncing slightly.

After significant selling, a corrective bounce is expected, but the strength of that correction will determine the next move. Today’s recovery took the price back above the 50% level to a post-low high of 1.0436, just 1 pip shy of the 38.2% retracement of the week’s range at 1.04372. Failure to breach the 38.2% level signals continued seller dominance.

The price is now back below the 50% level, further reinforcing bearish control. If the price remains below 1.04372 and sellers push it back under 1.0405, a retest of the low at 1.03322 is likely, with potential for further downside if that level breaks.

Conversely, a move back above 1.04372 could invite more upside probing. Initial targets include 1.04697, followed by the falling 100-hour MA at 1.0535 and the 200-hour MA at 1.0551. For now, the pair remains in a seller-driven market, with the focus on whether bearish momentum can extend or if buyers can stage a more meaningful recovery

———————————————

EURUSD Technical Analysis

The EURUSD has continued its downward trend this week, with selling pressure intensifying after weak European flash PMI data and concerns about growth and inflation from ECB officials. In contrast, the US PMI data was stronger than expected.

Key Levels:

-

50% Midpoint of the range since 2022 : 1.0405 (broken today)

-

38.2% Level of the weeks trading range: 1.04372 (resistance)

-

100-hour Moving Average: 1.0535 (falling)

-

200-hour Moving Average: 1.0551 (falling)

Trading Strategy:

-

If the price stays below 1.04372 (38.2% of the week’s trading range) and breaks below 1.0405 (50% of the range since 2022 low), expect a run toward the lows for the day at 1.0332.

-

A break below the lows could lead to further downside probing.

-

If the price moves back above 1.04372 (38.2% of the week’s range), expect further upside probing.

-

Targets on the upside include 1.04697, 1.0535, and 1.0551.

Current Situation:

The current price is ticking back below the 50% midpoint, indicating sellers are in full control.

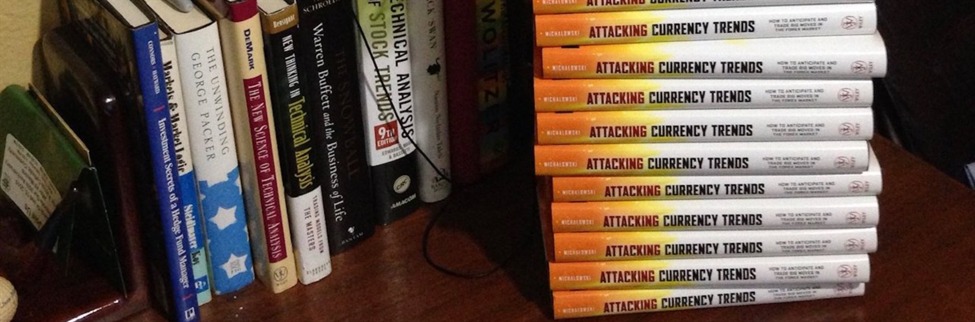

Have you read my book Attacking Currency Trends. You can buy it on Amazon.com https://www.amazon.com/Attacking-Currency-Trends-Anticipate-Market/dp/0470874384/ref=cm_cr_arp_d_product_top?ie=UTF8

Attacking Currency Trends