Dollar saw a modest pullback in Asian session today, easing off its sharp post-election rally as market enthusiasm stabilized. US equities, including DOW, S&P 500, and NASDAQ, all closed at record highs overnight on strong gains, with DOW particularly outperforming. Meanwhile, 10-year Treasury yield surged to a crucial Fibonacci resistance level that could prove pivotal. The focus now shifts to today’s FOMC rate decision, where Chair Jerome Powell’s stance will be closely scrutinized for indications of rate cuts, especially amid market adjustments following the election outcome.

In the currency markets, Kiwi and Aussie are currently the strongest performers of the day, buoyed by improved risk sentiment. This positive mood was further supported by robust trade data from China, which reported a 12.7% yoy increase in exports for October—the fastest pace in 19 months. The surge is attributed “front-loading” shipments ahead of escalating trade tensions when Donald Trump assumes office. Sterling also showed resilience, with market focusing on BoE rate decision. There is speculation that policy easing might proceed at a slower pace than initially anticipated due to the government’s new inflationary budget.

Conversely, Euro is trailing behind, following the greenback as the second weakest currency for the day, with Swiss Franc not far behind. Yen sits in the middle of the pack alongside Loonie. Japan’s top currency diplomat, Atsushi Mimura, expressed concern over recent sharp rise in USD/JPY, characterizing the movement as “one-sided and drastic”. He indicated that the government is closely monitoring currency developments, including speculative activities, and is prepared to take necessary measures if required. However, it is unclear what possible actions Japan could implement to counter the “one-sided” strength of Dollar.

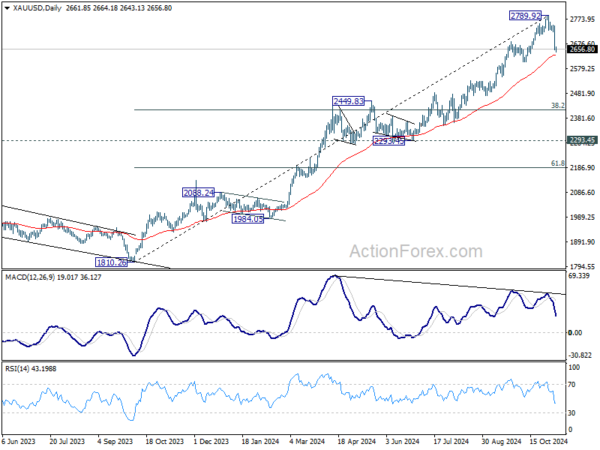

Technically, considering bearish divergence condition in D MACD, Gold might have formed a medium term top at 2789.92 as rise from 1810.26 completed a give wave impulsive move. Firm break of 55 D EMA (now at 2633.42) will strengthen this case, and bring deeper correction to 38.2% retracement of 1810.26 to 2789.92 at 2415.68, which is located inside 2293.45/2449.83 support zone.

In Asia, at the time of writing, Nikkei is down -0.26%. Hong Kong HSI is up 1.43%. China Shanghai SSE is up 1.61%. Singapore Strait Times is up 2.04. Japan 10-year JGB yield is up 0.0314 at 1.012. Overnight, DOW rose 3.57%. S&P 500 rose 2.53%. NASDAQ rose 2.95%. 10-year yield rose 0.137 to 4.426.

Fed rate cut expected with Powell’s tone on inflation in focus

Fed is widely anticipated to announce a 25bps rate cut today, lower the federal funds rate to 4.50%-4.75%. While Fed Chair Jerome Powell is likely to sidestep any definitive remarks about the implications of Donald Trump’s election win, the market will be watching closely for any signs of how Fed might respond to inflationary impacts from new fiscal policies.

Powell’s stance on inflation will be particularly scrutinized in light of expected policy shifts under Trump, especially on any indications that Fed is adopting a more vigilant approach toward inflation given that Trump’s policies could drive up spending, which might, in turn, fuel price increases. Any hint of a shift to a more defensive stance against price pressures could influence expectations for the rate path in 2025.

Although fed funds futures still reflect around a 67% probability of another 25 bps cut in December, this is slightly down from over 70% before the election. More importantly, Fed may move more conservatively in 2025, cutting rates only twice to reach a target range of 3.75%-4.00% by mid-year, then pausing for further assessment.

A key development to watch is the 10-year Treasury yield, which has been in a sustained rally since September. After gapping up yesterday, the yield is testing a critical technical level at 61.8% retracement of 4.997 to 3.603 at 4.464. Sustained break there will further solidify the case that correction from 4.997 has completed with three waves down to 3.603. Further rally should then be seen to retest 4.997 high next.

BoE rate cut expected as Reeves’ budget clouds future policy path

BoE is widely anticipated to reduce its benchmark interest rate by 25bps to 4.75% today. While the decision is likely to be unanimous, with known hawk Catherine Mann the only probable dissenting voice. Nevertheless, BoE’s direction for future policy has been complicated by recent domestic and international developments

Governor Andrew Bailey had previously signaled openness to more aggressive policy easing to support the slowing economy. However, after a week spent analyzing Chancellor Rachel Reeves’ recent budget—which is considered inflationary—Bailey could revert back to a more measured approach. The budget’s emphasis on increased spending could stoke inflationary pressures, limiting the central bank’s appetite for rapid rate cuts.

Market expectations have shifted too in response to these developments. Investors are now pricing in between two and three additional 25 basis point cuts by the end of 2025, down from nearly four cuts anticipated before Reeves delivered her budget.

Economists are looking to BoE’s new economic projections for clarity on how the central bank plans to navigate these challenges. However, it’s uncertain to what extent the forecasts will incorporate the potential inflationary impact of Reeves’ fiscal plans. If the projections do not fully account for the new budget measures, market participants may find limited guidance on the BoE’s policy outlook, leaving questions about the pace and extent of future rate cuts.

In the currency markets, a key focus today is EUR/GBP’s reaction to BoE’s decision and communications. The down trend from 0.9267 (2022 high) remains intact. Break of 0.8294 will target 0.8201 support (2022 low). The question is whether this level could provided enough support for EUR/GBP to form a bottom and stage a medium term reversal.

Japan’s real wages dip again in Sep, despite continued nominal wage growth

Japan’s real wages declined by -0.1% yoy in September, marking a second consecutive monthly drop as inflation erodes purchasing power. This dip follows a record 26-month downturn that ended in May, with wages briefly turning positive in June and July. However, the fading impact of summer bonuses led to another decline in August.

Nominal wages, reflecting total monthly earnings including base and overtime pay, rose by 2.8% yoy in September, marking the 33rd consecutive month of growth, but missed expectation of 3.0% yoy. When excluding bonuses and unscheduled payments, average wages grew by 2.6% yoy, the highest increase in nearly 32 years. Despite this, overtime pay and allowances declined by -0.4% yoy.

Separately, a Nikkei Research poll indicates optimism among companies for wage increases in the upcoming fiscal year. Approximately 42% of surveyed firms plan to raise wages by 3% to 5% for the fiscal year starting in April 2025, while 9% consider a larger increase of 5% to 7%. However, a significant portion (41%) of companies anticipate more conservative hikes in the range of 1% to 3%, suggesting that while wage pressures may continue, the scope and impact could vary widely across sectors.

RBA’s Bullock: Waiting for clear signals before assessing Trump’s win

At a Senate session today, RBA Governor Michele Bullock indicated that the central bank has not yet conducted detailed scenario analyses on how Donald Trump’s US presidential victory might impact Australia’s monetary policy.

Bullock emphasized that the effects could go different directions. She pointed out that while a Trump presidency might be “inflationary in some ways,” particularly if it leads to increased global demand or fiscal stimulus, it could also be “deflationary” if China, a key trading partner for Australia, is negatively affected.

Bullock stressed the importance of basing policy decisions on concrete developments rather than speculation. “We cannot be setting policy on the basis of things that could happen or might not happen,” she remarked. She added that the central bank intends to “wait and see what actually does happen” before making any adjustments.

As it stands, RBA has not revised its inflation outlook. Bullock reiterated that inflation is expected to return to the target band of 2-3% sustainably by 2026.

ECB’s Villeroy: US election calls for stronger European unity amid rising global risks

French ECB Governing Council member Francois Villeroy de Galhau emphasized the heightened economic risks following the US presidential election results, urging Europe to respond with a united stance.

Speaking at a conference overnight, Villeroy noted, “The result of the American election increases both risks for the global economy and the necessity for Europe to rally together.”

While acknowledging that the specifics of Trump’s policy agenda remain to be seen, Villeroy expressed concerns over the potential for rising deficits and inflation within the US economy, both of which could have broader global consequences.

Villeroy warned that more protectionist measures, such as higher tariffs, could contribute to inflationary pressures domestically in the US while simultaneously straining global economic growth, affecting Europe in particular.

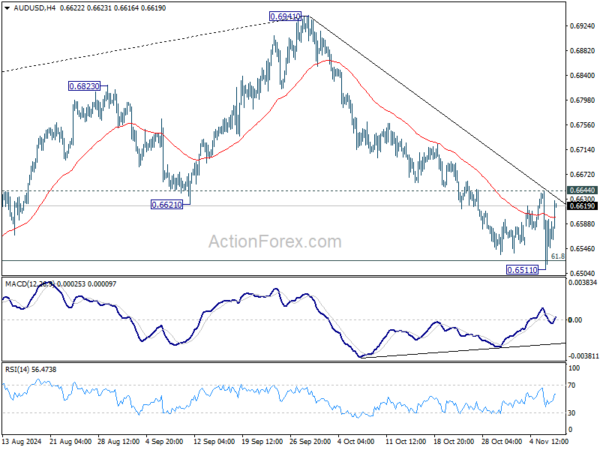

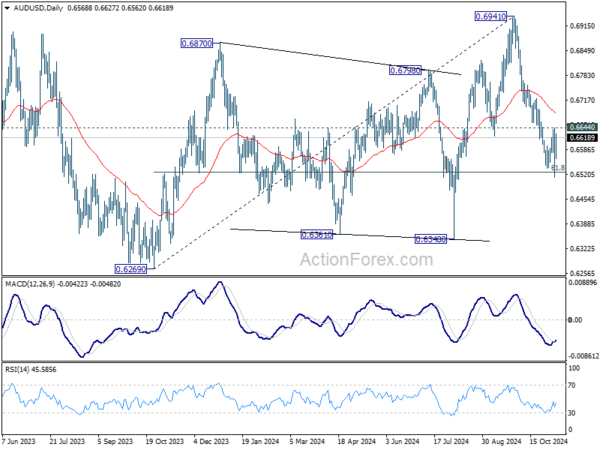

AUD/USD Daily Report

Daily Pivots: (S1) 0.6508; (P) 0.6577; (R1) 0.6640; More...

AUD/USD failed to sustain below 61.8% retracement of 0.6269 to 0.6941 at 0.6526 will target 0.6348, and recovered after dipping to 0.6511. Intraday bias is turned neutral again first. Further fall is still expected as long as 0.6644 resistance holds. Firm break of 0.6526 will pave the way to 0.6348 support next. However, considering bullish convergence condition in 4H MACD, break of 0.6644 will indicate short term bottoming, and turn bias back to the upside for 55 D EMA (now at 0.6682).

In the bigger picture, rise from 0.6269 (2023 low) should have completed with three waves up to 0.6941. Corrective pattern from 0.6169 (2022 low) is now extending with another falling leg. Deeper decline would be seen back to 0.6269 as sideway trading extends.