Bank of England (BoE) Governor Andrew Bailey explains the decision to lower the policy rate by 25 basis points to 4.75% in November and responds to questions from the press.

BoE press conference key quotes

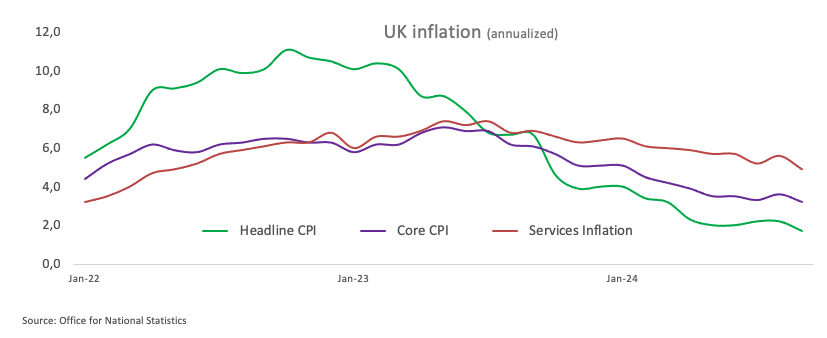

“We still need to see services price inflation come down more broadly to keep CPI at 2%.”

“Gradual approach to cutting rates will help give us time to assess impact of national insurance rise and other risks.”

“UK labour market is giving mixed signals.”

“BoE survey shows firms’ pay growth expectations stabilising at 4% in recent months.”

“There could be lingering persistence in wage inflation pressures beyond what is in our forecast.”

“Budget does have upward impact on inflation but it does return to target, allowed us to cut rates today.”

“We will need to see more on how budget affects inflation.”

“I do not think it is right to conclude that path of interest rates will be very different due to budget.”

“Rise in bond yields since this is budget is very different to after some other fiscal events in past two years.”

“We work with all US administrations on financial regulation, look forward to working with new Trump administration.”

“We do not make any presumptions about policy of future Trump administration.”

“We will watch very closely what Trump administration does on trade.”

“I’m sure there will be very open dialogue between UK and US administration.”

This section below was published at 12:00 GMT to cover the Bank of England’s monetary policy decisions and the immediate market reaction.

The Bank of England (BoE) announced on Thursday that it lowered the policy rate by 25 basis points (bps) to 4.75% following the November policy meeting, as expected. This decision came in line with the market expectation. Eight policymakers voted in favor of the rate cut, Catherine Mann voted to leave the policy rate unchanged at 5%.

Follow our live coverage of the BoE policy decisions and the market reaction.

BoE monetary policy statement key takeaways

“BoE forecast shows CPI in one year’s time at 2.7% (August forecast: 2.4%), based on market interest rates and modal forecast.”

“BoE forecast shows CPI in two years’ time at 2.2% (August forecast: 1.7%), based on market interest rates.”

“Budget is provisionally expected to boost inflation by just under 0.5 percentage points at peak between mid 2026 and early 2027.”

“Market rates imply more BoE loosening than in August, show bank rate at 4.8% in Q4 2024, 3.7% in Q4 2025, 3.7% in Q4 2026, 3.6% in Q4 2027 (August: 4.9% in Q4 2024, 4.1% in Q4 2025, 3.7% in Q4 2026).”

“BoE forecast shows CPI in three years’ time at 1.8% (August forecast: 1.5%), based on market interest rates.”

“BoE estimates GDP +0.2% QQ in Q3 2024 (Sept forecast: +0.3%), sees +0.3% QQ in Q4 2024.”

“BoE forecasts unemployment rate 4.2% in Q4 2024 (August forecast: 4.4%); Q4 2025 4.1% (August: 4.7%); Q4 2026 4.3% (August: 4.7%); Q4 2027 4.4%.”

“Forecast includes boost from budget to level of GDP of around 0.75 percentage points in a year’s time.”

“Rise in employer national insurance contributions in budget likely to have small upward impact on prices, small downward impact on wages and company profits.”

“A gradual approach to removing policy restraint remains appropriate.”

“Likely interest rates will continue to fall gradually if economy evolves as expected.”

“BoE forecasts GDP growth in 2024 +1% (August forecast: 1.25%), 2025 1.5% (August: 1%), 2026 1.25% (August: 1.25%), 2027 1.25%, based on market rates.”

“BoE estimates private sector wage growth ex-bonuses 5% YY in Q4 2024 (August forecast: 5%), Q4 2025 3.25% (August: 3%); Q4 2026 3.25% (August: 2.75%); Q4 2027 3%.”

“Combined impact of higher nics and minimum wage likely to increase employment costs, net impact on inflation uncertain.”

“BoE expects around 0.5% of GDP in slack in medium term, less slack than before budget especially in 2025 and H1 2026.”

“The MPC will ensure that bank rate is restrictive for sufficiently long until the risks to inflation returning sustainably to 2% target have dissipated further.”

“Need to make sure inflation stays close to target, can’t cut rates too quickly or by too much.”

Market reaction to BoE policy announcements

GBP/USD edged slightly higher with the immediate reaction to the BoE’s policy decisions and was last seen gaining 0.4% on the day at 1.2928.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.26% | -0.33% | -0.35% | -0.32% | -0.95% | -0.76% | 0.03% | |

| EUR | 0.26% | -0.07% | -0.07% | -0.06% | -0.69% | -0.49% | 0.30% | |

| GBP | 0.33% | 0.07% | 0.00% | 0.01% | -0.62% | -0.43% | 0.38% | |

| JPY | 0.35% | 0.07% | 0.00% | 0.00% | -0.62% | -0.47% | 0.37% | |

| CAD | 0.32% | 0.06% | -0.01% | -0.00% | -0.62% | -0.44% | 0.37% | |

| AUD | 0.95% | 0.69% | 0.62% | 0.62% | 0.62% | 0.20% | 1.01% | |

| NZD | 0.76% | 0.49% | 0.43% | 0.47% | 0.44% | -0.20% | 0.81% | |

| CHF | -0.03% | -0.30% | -0.38% | -0.37% | -0.37% | -1.01% | -0.81% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

This section below was published as a preview of the Bank of England’s monetary policy decisions at 07:00 GMT.

- Investors expect the Bank of England to cut its policy rate by 25 bps.

- UK disinflationary pressure gathered further steam in September.

- The 200-day SMA near 1.2810 holds the downside in GBP/USD.

Market consensus points to further easing by the Bank of England’s (BoE) upcoming interest rate decision on Thursday. The BoE has held rates steady at 5.00% in the previous gathering, but shifting investor sentiment now suggests a possible 25-basis-point cut this week.

No surprises are expected at the BoE meeting

At the bank’s September 19 meeting, policymakers stuck to quarterly rate cuts for now, with a November cut the most likely outcome. Regarding quantitative tightening, the committee voted unanimously to maintain the pace of reducing bond holdings by GBP 100 billion over the next 12 months, which again was in line with expectations.

The only dovish elements were the slight downgrades to Q3 GDP and Q4 CPI, though this is more a case of marking to market, which of course is subject to change depending on incoming data.

Looking ahead, indicators of inflation persistence—labour market tightness, private pay growth, and services CPI—should continue to guide policy.

Back to inflation, the headline Consumer Price Index (CPI) receded to 1.7% YoY in September, while the core CPI (which excludes food and energy costs) eased to 3.2% over the last twelve months, and Service inflation remained elevated at 4.9% from a year earlier.

Following the September BoE event, policymaker Catherine Mann expressed a cautious stance on the likelihood of multiple interest rate cuts in the coming months, emphasizing the importance of keeping policy restrictive.

However, early in October, Governor Andrew Bailey indicated that the Bank of England could take a “more activist” approach to rate cuts if there is continued positive news on inflation. Aligning behind Mann’s approach, Chief Economist Huw Pill stated that the British central bank should adopt a gradual approach when reducing interest rates.

Ahead of the BoE’s meeting, TD Securities analysts noted: “We anticipate a 7-2 majority to cut Bank Rate by 25bps and little change from September’s guidance. Incoming growth and inflation data has been softer than the MPC expected in their August projection, but the budget will force some tweaks to the projection (but these will be less positive than markets expect). We do not expect any signal about December’s policy decision.”

How will the BoE interest rate decision impact GBP/USD?

As inflation slowed in September, market participants appear to favour a rate cut at the BoE’s monetary policy meeting on November 7 at 12:00 GMT.

FXStreet’s Senior Analyst, Pablo Piovano, notes that a rate cut could put further pressure on the British Pound, which could see additional downside if GBP/USD falls below its November low of 1.2833 (November 6). In that case, the next contention should emerge at the key 200-day SMA at 1.2811, prior to the July low of 1.2615.

“On the upside, bulls will be initially eyeing the provisional 55-day SMA at 1.3119. The breakout of that region could put a potential visit to the 2024 peak at 1.3434 (September 26) back into focus”, Pablo concludes.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.