Dollar took a notable downturn in the Asian session, and picking up downward momentum too, following a weekend poll that showed Democratic presidential candidate Kamala Harris edging ahead of former President Donald Trump in Iowa.

Although Harris’s 47% to 44% lead falls within the 3.4% margin of error, this development marks a significant shift in a state that Trump won by considerable margins in both his previous campaigns—over 9 points in 2016 and 8 points in 2020.

The market interpretation of a Harris lead versus a Trump win are starkly different. Some analysts suggest that a Trump victory, particularly with unified control of Congress, would likely be bullish for Dollar. A unified GOP government could drive a sell-off in Treasuries, pushing yields higher and boosting the greenback.

On the other hand, a Harris victory paired with a split Congress could prompt an unwinding of “Trump trades,” as markets would likely adjust expectations away from pro-growth fiscal policies that would otherwise drive Dollar strength.

Amid Dollar’s retreat, Yen is currently the strongest performer in early trading, followed by Australian and New Zealand Dollars. Meanwhile, Canadian Dollar ranked as the second weakest, trailing the greenback, with Sterling not far behind. Euro and Swiss Franc are holding middle ground.

For now, Yen is leading charge in the background of Dollar weakness, and trades as the strongest one for the day so far. Aussie and Kiwi follow as next strongest. Canadian Dollar is sitting as second worst next to the greenback, while Sterling follows. Euro and Swiss Franc are positioning in the middle.

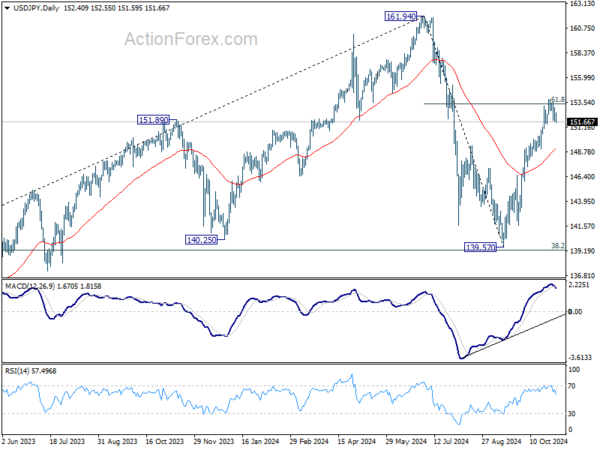

Technically, its not unreasonable for USD/JPY to find resistance and retreat after hitting 61.8% retracement of 161.94 to 139.57 at 153.39. While deeper pullback cannot be ruled out, rise from 139.57 will remain in favor to continue as long as 55 D EMA (now at 149.06). However, sustained break of the 55 D EMA will argue that the near term trend has already reversed.

In Asia, Japan is on holiday. Hong Kong HSI is up 0.22%. China Shanghai SSE is up 0.54%. Singapore Strait Times is up 0.55%.

RBNZ flags geopolitical risks as key threat to New Zealand’s financial stability

RBNZ highlighted significant geopolitical risks as a major concern for New Zealand’s financial stability in a pre-release of findings from its upcoming Financial Stability Report. Key threats stem from global tensions involving Russia, China, and the Middle East, which RBNZ may incorporate into next year’s solvency stress test.

RBNZ noted that in some scenarios, “global supply chains were disrupted,” triggering renewed inflationary pressures and elevated interest rates. The report mentions a “more extreme scenario” involving a conflict in the Asia-Pacific region with one or more of New Zealand’s key trading partners. This may allude to risks of a major disruption if China attempts to assert territorial claims in the South China Sea or to use force in the Taiwan Strait.

Kerry Watt, RBNZ’s Director of Financial Stability Assessment & Strategy, commented on the increased “concern about geopolitical tension,” emphasizing that “as a small open economy, dependent on international trade and investment, geopolitical risks are clearly relevant to our financial system. Their potential impacts cannot be underestimated.”

Oil prices edge up as OPEC+ delays output increase

Oil prices saw a modest uptick during the Asian session following OPEC+’s announcement to delay a planned increase in oil production of 2.2 million barrels per day by one month. On Sunday, the group also reiterated the members’ “collective commitment to achieve full conformity” with the established output targets.

This adjustment comes as part of OPEC+’s broader strategy, which agreed in June, to gradually restore output in controlled monthly increments after significant cuts over the past two years. Before Sunday’s decision, the plan was to start unwinding the 2.2 million bpd cut beginning December 2024, with further increases scheduled into the next year.

Technically, for the near term, considering bullish convergence condition in 4H MACD, WTI could have formed a short term bottom at 67.14. Break of 72.85 resistance will support this case and bring stronger rally back towards 78.87 resistance, as part of the sideway pattern from 65.63 low.

Nevertheless, there is no clear sign that the down trend from 87.84 has completed. As long as 78.87 resistance holds, another fall through 65.63 is still in favor after the consolidation pattern from there completes.

High stakes week with US Election, Fed, BoE and RBA rate decisions

As the US presidential election takes center stage this week, global financial markets are gearing up for heightened volatility. However, the election is not the sole event commanding investor attention. RBA, BoE and Fed will all hold rate meetings, while BoJ and BoC are set to release minutes from their latest sessions. Key economic indicators, including the US ISM Services PMI, employment data from Canada and New Zealand, and China’s Caixin PMI Services, could also sway market sentiment.

On Tuesday, RBA is expected to maintain its benchmark interest rate at 4.35%. Recent progress in disinflation, highlighted by Australia’s Q3 CPI, has brought the prospect of monetary easing closer. The nation’s four major banks—Commonwealth Bank of Australia, Westpac, National Australia Bank, and ANZ—are now forecasting the first rate cut in February 2025. The central bank’s accompanying statement and updated economic projections will be scrutinized for signals supporting this outlook. Regarding the pace of future rate reductions, CBA, Westpac, and NAB anticipate a 25 bps cut each quarter throughout next year, while ANZ predicts three 25 bps cuts over the course of 2025.

BoE is widely anticipated to lower its Bank Rate by 25 bps to 4.75% on Thursday. This move may mark the final rate adjustment for the year. According to a recent Reuters poll, 46 out of 72 economists expect no further changes at the December meeting, with the remaining 26 forecasting another 25 bps reduction. The Labour government’s recently announced budget, perceived as inflationary due to increased spending and borrowing, supports BoE’s cautious stance. Investors will focus on the central bank’s statement, the voting pattern among Monetary Policy Committee members, and the updated economic projections to gauge future policy direction.

Fed will announce its rate decision on Thursday, deviating from its usual Wednesday schedule. A 25 bps cut is widely expected, bringing the federal funds rate to target range of 4.50-4.75%. Another similar reduction is anticipated in December. However, the policy path for 2025 remains less certain. Fed Chair Jerome Powell is likely to emphasize that while the direction of monetary policy is toward easing, the pace will remain data-dependent. Market participants will have to wait for the next meeting to gain more insights from updated economic projections.

Here are some highlights for the week:

- Monday: Eurozone PMI manufacturing final, Sentix investor confidence; US factory orders.

- Tuesday: Japan monetary base; China Caixin PMI services; RBA rate decision; Swiss unemployment rate; France industria production; UK PMI services final; Canada trade balance; US trade balance, ISM services.

- Wednesday: New Zealand employment; BoJ minutes; Eurozone PMI services final, PPI; UK PMI construction; Canada Ivey PMI, BoC summary of deliberations.

- Thursday: Japan average cash earnings; Australia goods trade balance; China trade balance; Germany industrial production, trade balance; Swiss Foreign currency reserves; Eurozone retail sales; BoE rate decision; US jobless claims, non-farm productivity, FOMC rate decision.

- Friday: Japan household spending, leading indicators; France trade balanace; Swiss SECO consumer climate; Canada employment; US U of Michigan consumer sentiment.

AUD/USD Daily Report

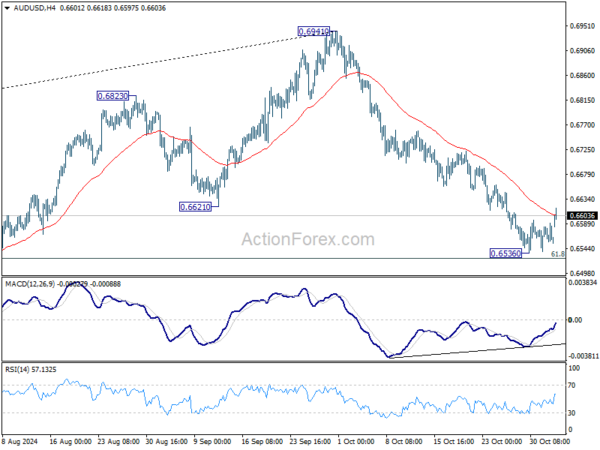

Daily Pivots: (S1) 0.6545; (P) 0.6568; (R1) 0.6583; More...

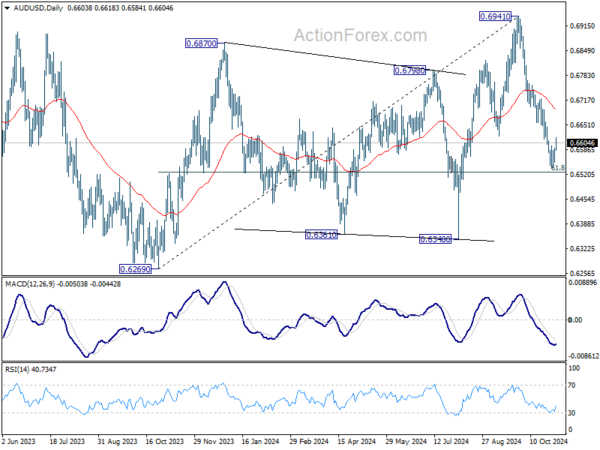

AUD/USD recovers further today as consolidation from 0.6536 continues. Intraday bias stays neutral at this point, and further decline remains expected as long as 55 D EMA (now at 0.6692) holds. On the downside, sustained break of 0.61.8% retracement of 0.6269 to 0.6941 at 0.6526 will target 0.6348 support next.

In the bigger picture, rise from 0.6269 (2023 low) should have completed with three waves up to 0.6941. Corrective pattern from 0.6169 (2022 low) is now extending with another falling leg. Deeper decline would be seen back to 0.6269 as sideway trading extends.