Sterling has faced significant selling pressure as markets reacted negatively to the Labour government’s budget announcement. Some analysts draw comparisons to the free fall following former Prime Minister Liz Truss’s mini-budget two years ago. Yet, the current selloff is notably milder. The focus now is on whether Sterling can stabilize in the coming days or if further downside looms. Aussie is also underperforming, ranking as the second weakest currency this week after Sterling, while Loonie is the third weakest.

Conversely, Euro is maintaining its position as the week’s strongest performer, bolstered by better-than-expected GDP growth and inflation data. These robust figures have reduced the urgency for ECB to accelerate its rate-cutting cycle, allowing for a steadier monetary policy approach. Swiss Franc is the second strongest currency, benefiting from safe-haven flows and buying interest against Sterling. Kiwi dollar ranks third in strength, supported by the selloff in Aussie, which sometimes affects investor sentiment toward its regional counterpart.

Dollar and Yen are trading in mixed fashion, occupying middle positions among major currencies. Market are now turning their attention to today’s non-farm payroll report in the US, which could influence the greenback’s short-term direction. However, the medium-term trend for Dollar is to be shaped by the upcoming presidential election next week.

Adding to market caution, US equities experienced a significant decline overnight, with both S&P 500 and NASDAQ suffered their worst daily losses in over a month. Should this stock decline deepen, safe-haven currencies like Dollar, Yen and Swiss Franc may find additional support in the coming sessions.

Technically, price actions from 18671.06 are seen as a three-wave corrective pattern with rebound from 15708.53 as the second leg. The gap down in NASDAQ yesterday and the subsequent steep selloff is the first sign of rejection by 18671.06 resistance. Further break of 17767.79 support would indicate that the third leg of the pattern has started, and bring deeper fall back towards 15708.53 support.

In Asia, at the time of writing, Nikkei is down -2.44%. Hong Kong HSI is up 1.09%. China Shanghai SSE is up 0.36%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is up 0.0085 at 0.950. Overnight, DOW fell -0.90%. S&P 500 fell -1.86% NADSAQ fell -2.76%. 10-year yield rose 0.018 to 4.284.

Sterling drops as market questions growth impact of Reeves’ budget

Sterling fell sharply overnight, alongside with 10-year government bond and FTSE, as markets reacted to Chancellor Rachel Reeves’ new budget. Critics argue the budget is being heavy on spending, tax hikes, and borrowing but light on measures to stimulate economic growth. Beside, the higher short-term borrowing plans outlined in the budget are casting doubts on whether BoE can proceed with a robust rate-cutting cycle.

The Office for Budget Responsibility revised its economic outlook, forecasting GDP growth of 2.0% in 2025, only a slight improvement over the previous 1.9% projection. Additionally, the OBR raised its inflation forecast for next year to an average of 2.6%, up sharply from the previous estimate of 1.5%.

Although BoE is still expected to implement a 25 bps rate cut next week, taking the rate to 4.75%, the budget’s spending and borrowing plans may limit the central bank’s ability to lower rates further. Market pricing now reflects fewer anticipated rate cuts, with expectations that the BoE’s base rate will only fall to around 4% by the end of 2025, higher than previously projected.

While a slower pace of monetary policy easing could be supportive of the Pound, traders are increasingly worried about the UK’s growth prospects under the new fiscal strategy.

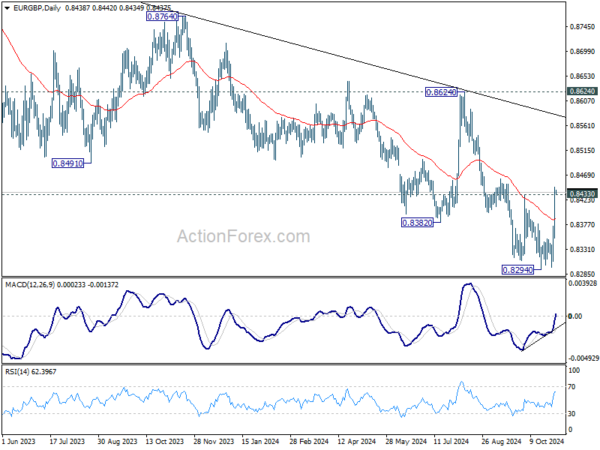

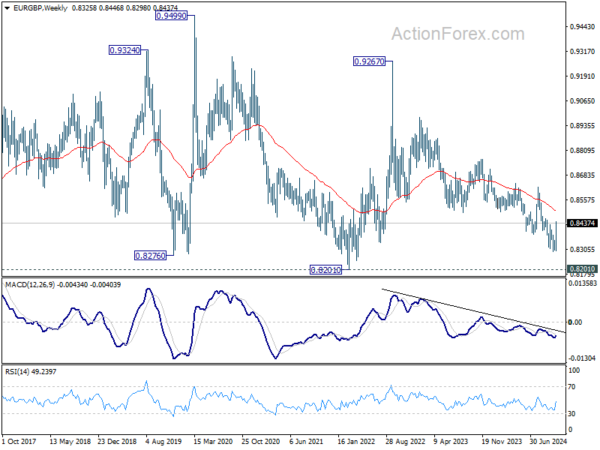

Technically, EUR/GBP’s break of 0.8433 resistance should confirm short term bottoming at 0.8294, on bullish convergence condition in D MACD. Stronger rally should be seen to 55 W EMA (now at 0.8502) Decisive break there will be the first sign of medium term bullish trend reversal, and target 0.8624 resistance for confirmation.

Japan’s PMI manufacturing finalized at 49.2, weak domestic and global demand

Japan’s PMI Manufacturing was finalized at 49.2 in October, a decline from September’s 49.7, signaling continued contraction in the sector.

Usamah Bhatti at S&P Global Market Intelligence noted that while output fell only slightly, it was at the sharpest rate since April, with new orders contracting at their fastest pace in three months. Companies cited “weakness in domestic and global demand” as weighing heavily on sales and output, particularly in the semiconductor and auto industries.

Bhatti added that “near-term outlook is clouded” as firms worked through backlogs, suggesting that incoming orders are insufficient to support ongoing production. Business confidence also remained subdued, hovering near a two-year low, with firms expressing concerns about the timeline for recovery from the current “economic malaise.”

China’s Caixin PMI manufacturing rises to 50.3, domestic demand recovery amid weak exports

China’s Caixin Manufacturing PMI improved to 50.3 in October, up from 49.3 and surpassing expectations of 49.5.

According to Wang Zhe, Senior Economist at Caixin Insight Group, October brought a mix of positive developments, including “growth in manufacturing supply and demand, increases in prices, proactive inventory replenishment by companies, and logistics delays.”

However, challenges persist as external demand remains soft; new export orders contracted for the third consecutive month. Wang added that declining employment levels and weak foreign demand continue to weigh on the sector.

Distorted NFP data to challenge Dollar’s strength

US non-farm payrolls report takes center stage in global financial markets today. Expectations are for an increase of 106k jobs in October, which would mark the lowest monthly gain in nearly four years. Unemployment rate is projected to remain unchanged at 4.1%, and average hourly earnings are anticipated to rise by 0.3% mom. However, given one-off factors like recent strikes and storms impacting the numbers, markets may largely discount the report’s implications for the broader employment trend.

Recent economic indicators offer a mixed picture. ADP Employment report showed a robust gain of 233k net new jobs in October, up from the previous month’s upwardly revised 159k. Conversely, the four-week moving average of initial unemployment claims increased to 236k from 224k, suggesting some softening in the labor market. The employment components of the ISM manufacturing and services reports are yet to be released.

Regarding the Fed’s policy outlook, two additional 25 basis point rate cuts are expected by year-end, one this month and another in December. Under the Fed’s dual mandate, resurgence in inflation—not strong employment data—is more likely to prompt a slowdown or pause in the rate-cutting cycle. Even a significant downside surprise in today’s NFP report is unlikely to bring a 50bps cut back into consideration at the next meeting. However, it would factor into Fed’s deliberations in December, alongside upcoming inflation and employment data.

Technically, Dollar Index could have formed a short term top at 104.63 already. Nevertheless, consolidations should be relatively brief as long as 23.6% retracement of 100.15 to 104.63 at 103.57 holds. Break of 104.63 will resume the rally from 100.15 towards 106.13 resistance next.

However, firm break of 103.57 will open up deeper correction to 38.2% retracement at 102.91, which is close to 55 D EMA (now at 102.86).

Looking ahead

Swiss CPI, retail sales, and PMI manufacturing will be released in European session. UK PMI manufacturing final will be published too. Later in the day, US non-farm payroll and ISM manufacturing are the highlights.

GBP/USD Daily Outlook

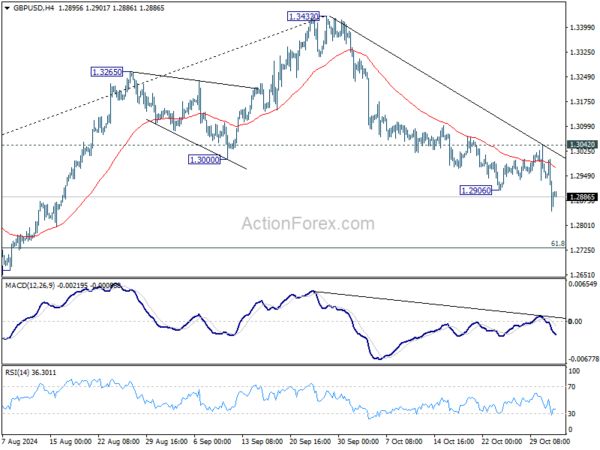

Daily Pivots: (S1) 1.2830; (P) 1.2915; (R1) 1.2984; More…

GBP/USD’s decline from 1.3433 resumed by breaking through 1.2906 temporary low. Intraday bias is back on the downside for 61.8% retracement of 1.2298 to 1.3433 at 1.2732. Sustained break there will pave the way back to 1.2298 key support level next. On the upside, break of 1.3042 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

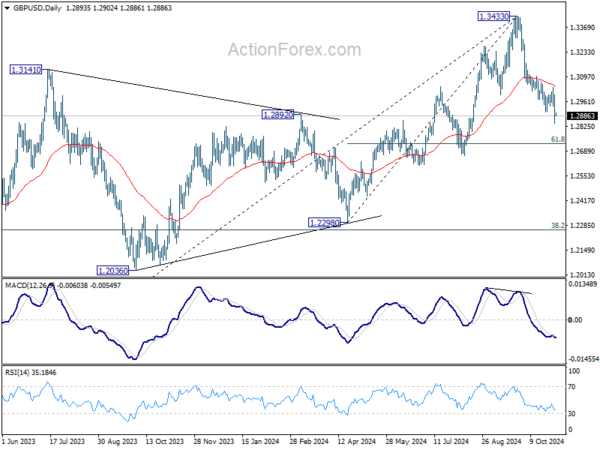

In the bigger picture, considering mildly bearish divergence condition in D MACD, a medium term top is likely in place at 1.3433 already. Price actions from there are seen as correction to whole up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. Strong support should be seen there to bring rebound.