Euro strengthened broadly after Eurozone’s flash CPI revealed stronger-than-expected increase in headline inflation, while the decline in core inflation has come to a halt. This data, coupled with the better-than-anticipated GDP figures released yesterday, has provided substantial support to the hawks within ECB. There appears to be no immediate need for ECB to accelerate monetary easing efforts. A 25 basis point rate cut at the December meeting is being solidified as the baseline.

Yen is also displaying firmness following BoJ decision to maintain its current monetary policy earlier today. Additional support emerged from Governor Kazuo Ueda’s remarks during the post-meeting press conference. Markets continue to anticipate the next rate hike to occur in the first quarter of next year. with some interpret Ueda’s comments as leaving the possibility open for a December hike. However, two significant uncertainties remain: the formation of Japan’s new government after the recent indecisive elections, and the outcome of the US presidential elections next week and their implications for Japan.

Conversely, Dollar is on the softer side stronger-than-expected core PCE inflation reading. For the greenback to regain the dominance observed in recent weeks, robust non-farm payroll data due tomorrow would be essential, especially ahead of next week’s elections.

In terms of currency performance for the week, the Euro currently sits at the top of the chart, followed by Sterling and Swiss Franc. Aussie remains at the bottom, followed by Yen and Loonie. Dollar and Kiwi are mixed, occupying middle positions.

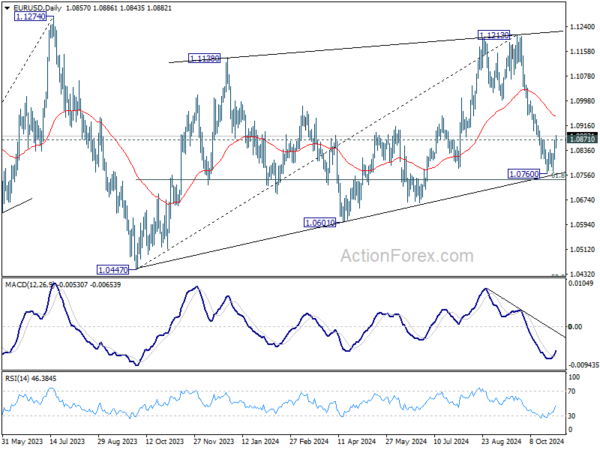

Technically, EUR/USD’s break of 1.0871 resistance should confirm short term bottoming at 1.0760, after drawing support from 61.8% retracement of 1.0447 to 1.1213 at 1.0740. Stronger rebound should be seen to 55 D EMA (now at 1.0945). The immediate question is whether other major currency pairs will follow suit and validate the greenbacks’ broad pullback.

In Europe, at the time of writing, FTSE is down -0.65%. DAX is down -0.41%. CAC is down -0.79%. UK 10-year yield is up 0.100 at 4.462. Germany 10-year yield is up 0.032 at 2.427. Earlier in Asia, Nikkei fell -0.50%. Hong Kong HSI fell -0.31%. China Shanghai SSE rose 0.42%. Singapore Strait Times fell -0.88%. Japan 10-year JGB yield fell -0.0114 to 0.941.

US core PCE price index unchanged at 2.7% yoy in Sep

In September, US personal income rose by 0.3% mom, or USD 71.6B, slightly below the expected 0.4% mom increase. Meanwhile, personal spending grew by 0.5% mom or USD 105.8B, exceeding forecasts of a 0.4% mom rise.

PCE price index rose 0.2% mom, while core PCE price index, which excludes food and energy, increased by 0.3% mom, both aligning with expectations. Breaking down price components, goods prices decreased by -0.1% mom, and services prices increased by 0.3% mom. Food prices rose by 0.4% mom, while energy prices saw a significant -2.0% mom decline.

On a year-over-year basis, the headline PCE price index edged down from 2.2% yoy to 2.1% yoy, meeting forecasts. However, core PCE price index remained unchanged at 2.7% yoy, slightly above the anticipated 2.6% yoy. Goods prices dropped by -1.2% yoy, while services prices rose by 3.7% yoy. Food prices increased by 1.2% yoy, and energy prices saw a sharp decline of -8.1% yoy.

US initial jobless claims falls to 216k, vs exp 231k

US initial jobless claims fell -12k to 216k in the week ending October 26, below expectation of 231k. Four-week moving average of initial claims fell -2k to 237k.

Continuing claims fell -26k to 1862k in the week ending October 19. Four-week moving average of continuing claims rose 11k to 1869k., highest level since November 27, 2021.

Canada’s August GDP stalls as goods production declines

Canada’s GDP growth was flat month-over-month in August, missing the anticipated 0.1% mom growth.

Services sector provided some support, increasing by 0.1% mom, with notable gains in finance, insurance, and public administration.

However, the goods-producing sector contracted by -0.4% mom, marking its lowest point since December 2021, driven by declines in manufacturing and utilities.

Despite the overall stagnation, 12 out of 20 sectors showed growth, indicating resilience across much of the economy.

Early estimates for September indicate a modest recovery, with real GDP expected to rise by 0.3% mom.

Eurozone CPI rises to 2% in Oct, core unchanged at 2.7%

Eurozone CPI rose from 1.7% yoy to 2.0% yoy in October, above expectation of 1.9% yoy. CPI core (energy, food, alcohol & tobacco) was unchanged at 2.7% yoy, above expectation of 2.6% yoy.

Looking at the main components, services is expected to have the highest annual rate in October (3.9%, stable compared with September), followed by food, alcohol & tobacco (2.9%, compared with 2.4% in September), non-energy industrial goods (0.5%, compared with 0.4% in September) and energy (-4.6%, compared with -6.1% in September).

ECB’s Lagarde: Inflation target in sight but prudence warranted

In an interview with Le Monde, ECB President Christine Lagarde expressed cautious optimism about Eurozone’s inflation path, noting that the target is “in sight” but stressing that inflation is not yet fully subdued. While headline CPI dipped to 1.7% in September, core inflation, excluding energy and food, remained elevated at 2.7%.

Lagarde acknowledged satisfaction with the recent drop in headline inflation but warned that “inflation is going to rise again in the coming months” due to base effects. Thus, she emphasized that “prudence is warranted.”

She reiterated the importance of reaching the 2% target “on a sustained and durable basis,” projecting that, barring any major shocks, the ECB expects this goal to be achieved by 2025.

ECB’s Panetta calls for easing as inflation declines and economic weakness persists

Italian ECB Governing Council member Fabio Panetta emphasized the need for further easing of restrictive monetary conditions in the Eurozone, citing concerns about economic softness amid declining inflation.

Panetta highlighted in a speech today that as inflation moderates, it’s essential to consider “the weakness of the real economy” and avoid deepening the downturn.

“In the absence of a firm recovery we would run the risk of pushing inflation well below target, a situation that monetary policy would struggle to counter, and which must be avoided,” he added.

BoJ maintains rate at 0.25% on unanimous vote

BoJ kept its uncollateralized overnight call rate steady at approximately 0.25% in a unanimous decision, aligning with market expectations. The central bank indicated that if the outlook for economic activity and prices materializes as anticipated, it will “accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation.” This signals readiness to tighten monetary policy further, contingent on economic developments.

Nevertheless, BoJ emphasized the necessity of paying close attention to the “future course of overseas economies,” particularly the US, along with developments in financial and capital markets due to their impact on Japan’s economic activity and price outlook.

In its latest economic projections, the BoJ made the following adjustments:

Real GDP Growth:

- Fiscal 2024: Unchanged at 0.6%.

- Fiscal 2025: Revised upward from 1.0% to 1.1%.

- Fiscal 2026: Unchanged at 1.0%.

CPI Core (excluding fresh food):

- Fiscal 2024: Unchanged at 2.5%.

- Fiscal 2025: Revised downward from 2.1% to 1.9%.

- Fiscal 2026: Unchanged at 1.9%.

CPI Core-Core (excluding fresh food and energy):

- Fiscal 2024: Increased from 1.9% to 2.0%.

- Fiscal 2025: Unchanged at 1.9%.

- Fiscal 2026: Unchanged at 2.1%.

BoJ’s Ueda has no preset idea on the timing of next hike

Following BoJ’s decision to maintain its current interest rate, Governor Kazuo Ueda said at the press conference that the central bank has “no preset idea” on the timing of its next rate increase. He added that each policy decision will be based on a thorough assessment of the latest economic data and outlook revisions.

Ueda highlighted promising signs from the latest Tokyo CPI data, observing that the “pass-through of rising wages on services prices is broadening.” He added that BoJ will closely monitor whether this trend spreads across the nation.

Domestically, wages and prices are generally moving in line with BoJ forecasts, and recent changes in companies’ wage- and price-setting behaviors over the past two years point to a potential structural shift. However, Ueda acknowledged that it’s uncertain whether this shift will gain momentum or fade over time.

Ueda also pointed out the importance of currency volatility and commodity prices, as these factors significantly impact domestic import prices.

While recent political developments in Japan are unlikely to alter BoJ’s price forecasts, Ueda noted that substantial policy changes could prompt revisions as needed.

Japan’s industrial production rises 1.4% mom in Sep, continues to fluctuate indecisively

Japan’s industrial production increased by 1.4% mom in September, exceeding expectations of 0.8%. This recovery follows a sharp -3.3% mom drop in August when a typhoon disrupted operations across various sectors.

Out of the 15 industrial sectors surveyed, 10, including motor vehicles and chemical production, recorded growth. Five sectors, such as production machinery, saw declines.

Despite this recovery, the Ministry of Economy, Trade and Industry maintained its cautious view, describing industrial production as “fluctuating indecisively.”

Looking ahead, manufacturers polled by the ministry expect a robust 8.3% mom increase in output for October, followed by a -3.7% mom decline in November, indicating ongoing volatility in Japan’s production.

Meanwhile, Japan’s retail sales rose by a modest 0.5% yoy in September, falling significantly short of the anticipated 2.3% yoy growth.

China’s NBS PMI manufacturing rises to 50.1, first expansion in six months

China’s NBS Manufacturing PMI increased to 50.1 in October, meeting expectations and marking the first expansion since April. The improvement was led by large enterprises, which rose to 51.5 from 50.6, while medium-sized firms inched up to 49.4. Small enterprises, however, saw a further contraction, declining to 47.5 from 48.5.

Key subindices pointed to slight domestic improvement: production reached a six-month high of 52.0, and new orders returned to neutral at 50.0 after five months of contraction.

Though still below 50, subindices for employment (48.4), purchases (49.3), imports (47.0), and backlog of orders (45.4) showed smaller declines, suggesting a gradual stabilization.

However, new export orders continued to weaken, reaching an eight-month low at 47.3, underscoring soft external demand.

Non-Manufacturing PMI edged up from 50.0 to 50.2, just shy of the 50.5 forecast, with the employment subindex rising by 1.1 points to 45.8.

NZ ANZ business confidence hits 10-yr high , optimism grows on lower interest rates

New Zealand’s ANZ Business Confidence surged from 60.9 to 65.7 in October, marking its highest level in a decade and reflecting a wave of optimism among businesses.

This renewed confidence is supported by a range of positive indicators: the outlook for own activity increased slightly from 45.3 to 45.9, while export intentions jumped from 13.8 to 17.1, the highest since September 2018. Investment intentions also surged from 9.2, reaching 20.0, the highest level since June 2021, and employment intentions rose from 11.8 to 14.2, the highest since November 2021.

Several key metrics highlight this optimism. Cost expectations dropped from 66.8 to 64.2, indicating some relief in business expenses, while wage expectations edged up slightly from 76.4 to 77.0. Pricing intentions also rose, climbing from 42.8 to 44.2, suggesting businesses may feel confident in passing some costs to consumers. Profit expectations strengthened from 22.2 to 27.0, and inflation expectations continued their downward trend, dipping from 2.92% to 2.82%.

According to ANZ, “steady falls in interest rates” have provided a strong boost to business sentiment, encouraging growth across multiple sectors.

Australia’s retail sales show modest 0.1% mom growth in Sep

Australia’s retail sales turnover increased by a modest 0.1% mom in September, reaching AUD 36.46B but falling short of the expected 0.4% mom rise. This follows a 0.7% gain in August and a flat outcome in July.

Commenting on the data, Robert Ewing, Head of Business Statistics at ABS, noted that “retail spending held firm in September” following a boost in August from warmer-than-usual weather.

The report also highlighted quarterly retail sales volumes, which grew by 0.5% in Q3, marking a recovery after back-to-back declines of -0.4% in both Q2 and Q1.

Ewing added that this increase in volumes reflects “some of the lost ground in discretionary spending this year,” marking only the second quarterly rise in retail volumes over the past two years.

GBP/USD Mid-Day Outlook

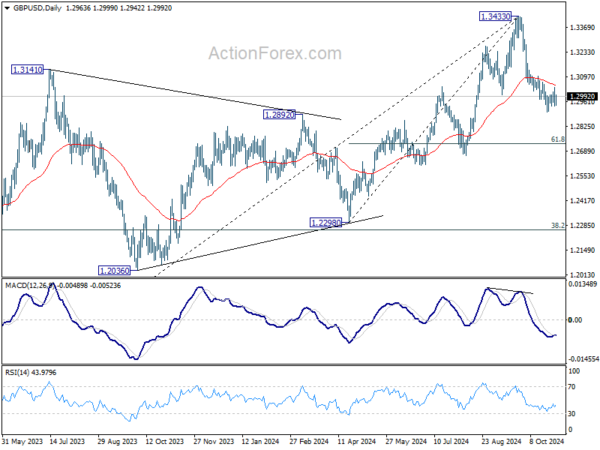

Daily Pivots: (S1) 1.2919; (P) 1.2981; (R1) 1.3025; More…

Intraday bias in GBP/USD remains neutral as range trading continues above 1.2906 temporary low. Further decline is expected as long as 1.3070 minor resistance holds. Below 1.2906 will target 61.8% retracement of 1.2298 to 1.3433 at 1.2732. However, considering bearish divergence condition in 4H MACD, firm break 1.3070 resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, considering mildly bearish divergence condition in D MACD, a medium term top is likely in place at 1.3433 already. Price actions from there are seen as correction to whole up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. Strong support should be seen there to bring rebound.