Dollar extended its broad gains today, bolstered by the jump in US 10-year Treasury yield, which surpassed 4.3% as expectations grow for an expansive fiscal agenda following the US presidential election. In parallel, Bitcoin has surged past 70K for the first time since June, driven by speculation that post-election developments could accelerate efforts to expand the US cryptocurrency market and clear regulatory paths for broader crypto adoption.

Amid Dollar’s rally, British Pound stands out as the only major currency to hold resilient. In contrast, Australian Dollar and Swiss Franc are today’s weakest performers. For Aussie, traders are eyeing tomorrow’s crucial CPI data, hoping for progress in disinflation that would support RBA’s shift towards a more neutral stance on inflation. Yen remains weak, with a close watch on whether Japanese officials might intervene if USD/JPY nears the next psychological level at 155.

Technically, further rally is expected in Bitcoin as long as 69514 resistance turned support holds. Decisive break of 73812 high will confirm long term up trend resumption. Next near term target will be 100% projection of 52703 to 66854 from 58846 at 81742.

In Europe, at the time of writing, FTSE is down -0.15%. DAX is up 0.18%. CAC is up 0.19%. UK 10-year yield is up 0.039 at 4.303. Germany 10-year yield is up 0.048 at 2.338. Earlier in Asia, Nikkei rose 0.77%. Hong Kong HSI rose 0.49%. China Shanghai SSE fell -1.08%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield rose 0.0021 to 0.977.

US goods trade deficit widens to USD -108.2B vs exp USD -96.1B

US goods exports fell USD -3.6B or -0.2% mom to USD 174.2B in September. Goods imports rose USD 10.4B or 3.8% mom to USD 282.4B. Trade deficit widened from USD -94.2B to USD -108.2B, larger than expectation of USD -96.1B.

Wholesale inventories fell -0.1% mom to USD 905.0B. Retail inventories rose 0.8% mom to USD 824.3B.

Germany’s Gfk consumer sentiment rises to -18.3, remains fragile

Germany’s GfK Consumer Climate index for November improved from -21.0 to -18.3, exceeding forecast of -20.5 and marking its highest level since April 2022. However, the underlying sentiment remains subdued, as economic expectations continued to trend downward for the third consecutive month, dropping -0.5 to -0.2, the lowest level since March.

Rolf Bürkl, consumer expert at the NIM, cautioned that while consumer sentiment has improved, it remains historically low due to persistent uncertainties driven by “crises, wars and rising prices”.

He noted that rising company insolvencies, job cut plans, and discussions around shifting production abroad are “preventing a more significant recovery in consumer sentiment.”

Japan’s unemployment rate falls to 2.4%, job availability remains strong

Japan’s unemployment rate fell from 2.5% to 2.4% in September, below expectations of 2.5%.

While the total number of employed individuals declined slightly by -0.1% to seasonally adjusted 67.82m, the number of unemployed fell -2.3% to 1.68m, marking the second consecutive monthly decrease.

Additionally, job availability ratio rose 0.01 to 1.24, meaning there were 124 job openings for every 100 job seekers, reflecting strong demand for labor.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8633; (P) 0.8667; (R1) 0.8686; More…

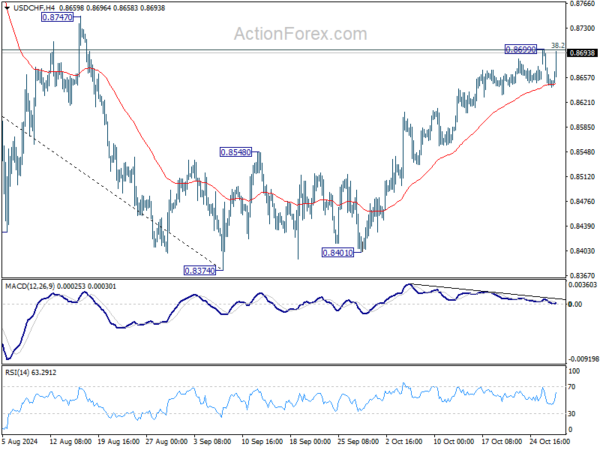

USD/CHF rebounded strongly after drawing support from 55 4H EMA (now at 0.8649), but stays below 0.8699 temporary top. Intraday bias remains neutral first. Further rally remains in favor as long as 55 D EMA (now at 0.8603) holds. On the upside, decisive break of 38.2% retracement of 0.9223 to 0.8374 at 0.8698 will argue that fall from 0.9223 has completed after defending 0.8332 low. Further rally should then be seen to 61.8% retracement at 0.8899 next.

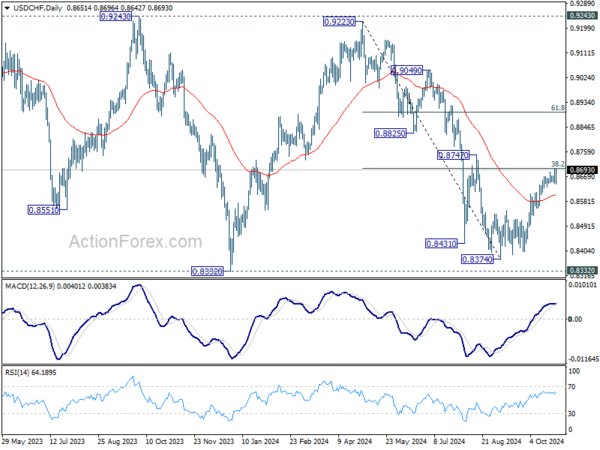

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading