The existing home sales yesterday came in weaker. The new home sales data today came in stronger. Existing home sales account for about 80% of home sales in the US.

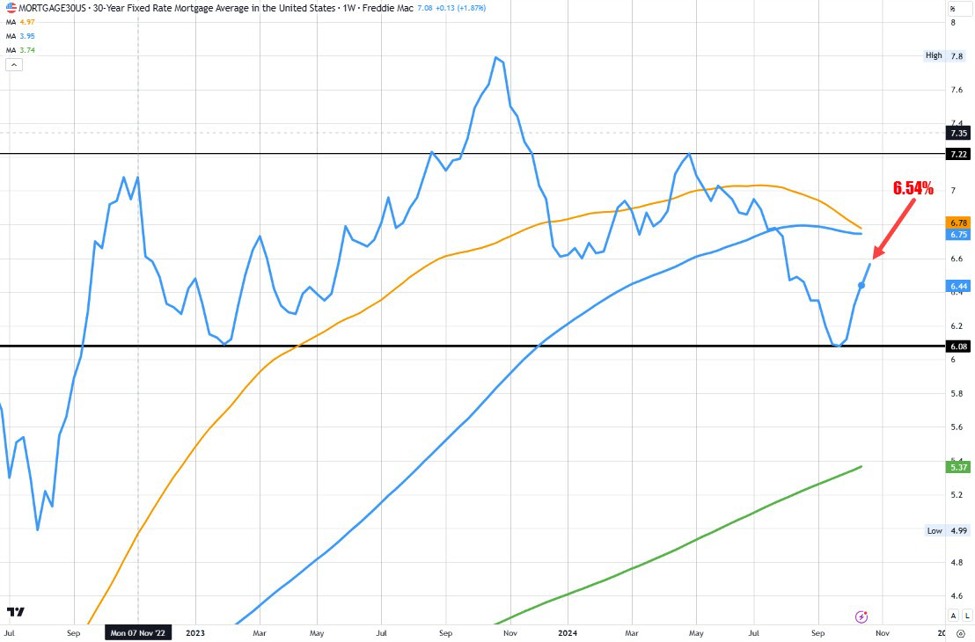

Today, the Freddie Mac 30 year mortgage rate rose to 6.54% from 6.44% last week. This is highest level since August 1 week.

The good news is that the rate is down sharply from the high of 7.22% reached at the end of April.

The not so good news is the rate is up from 6.08% reached in the middle of September or 46 basis points

The end-of-the-year rate was at 6.622% and the highs from 2023 was 7.8%

Of note looking at the chart above, the low mortgage rate this year was the low from 2023 (6.08%). The yield has not been below 6% since September 5, 2022 week.

Meanwhile. looking at the 10-year yield which mortgage rates tend to price off, the yield has moved up from 3.599% to 4.1196% currently. That is a rise and 52 basis points.The current spread of the 10 year yield, to the mortgage is 243 basis points

Looking at the high of the 10-year yield in April 2024 at 4.739%, the 30 year mortgage was at 7.22% at the time. The spread was at 248 basis points at the high in yields. In other words, the spread has been relatively stable in the near term at least.

However, looking back over the last 10 years, the spread is nearer high levels.

Spread Evolution of the 30 year mortgage to the 10 year yield:

- Pre-2020: The spread typically ranged from 1.5% to 1.8%

- Post-2020: The spread has been notably wider, often above 2%

- Peak spread occurred in 2023 at nearly 3%