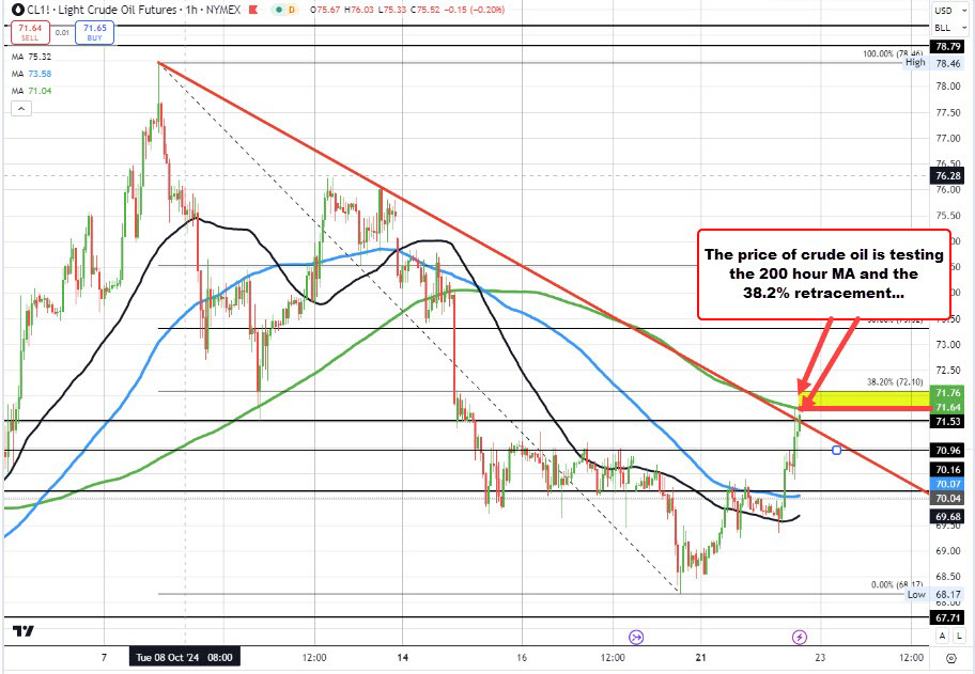

The price of crude oil futures are trading higher by $1.73 or 2.47% at $71.78.

The move to the upside has the price testing its 200-hour moving average at $71.76. A move above is needed to increase the bullish bias with the 38.2% retracement of the move down from the October 7 high at $72.10 as the next target.

Sellers looking for a level/area to sell would not want to see the price move materially above the 200-hour moving average and 38.2% retracement. Risk is defined.

Buyer need these levels to increase the bullish bias from a technical perspective.

This article was originally published by Forexlive.com. Read the original article here.