Sterling rises broadly today, driven by unexpectedly strong retail sales figures for September. This recovery suggests that the negative impact of weaker-than-expected CPI data earlier in the week has been fully absorbed by the market. While it now seems likely that BoE will proceed with interest rate cuts in November, the pace of monetary easing is expected to be more cautious compared to ECB or Fed, unless the UK economy experiences a more pronounced downturn.

Meanwhile, Yen also gained some strength today after USD/JPY pair briefly broke through the 150 psychological support. This triggered verbal intervention from Japanese officials, with Vice Finance Minister Atsushi Mimura cautioning about “one-sided, sudden moves” in the currency market. He emphasized that Japan is monitoring the situation closely for signs of speculative activity, signaling the government’s readiness to act if needed.

In broader market movements, sentiment across Asia received a lift following People’s Bank of China’s implementation of specialized lending facilities aimed at supporting share buybacks and providing liquidity to institutional investors. These moves were part of the central bank’s broader efforts to stabilize financial markets, initially outlined in a major announcement at the end of September.

For the week, Dollar is leading as the strongest currency, followed by Loonie and Sterling. On the other end of the spectrum, Swiss Franc is the weakest performer, with Euro and Kiwi not far behind. Aussie and Yen are positioning in the middle. However, with the current surge in momentum, Sterling has the potential to climb higher as the week comes to a close.

Technically, Gold powers through 2700 handle as its record run continues. Further rise is expected as long as 2673.04 minor support holds, to 61.8% projection of 2471.76 to 2685.34 from 2604.53 at 2736.62. Decisive break there could trigger upside acceleration to 100% projection at 2818.21 next.

In Asia, Nikkei rose 0.18%. Hong Kong HSI is up 2.84%. China Shanghai SSE is up 2.72%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield rose 0.0061 to 0.971. Overnight, DOW rose 0.37%. S&P 500 fell -0.02%. NASDAQ rose 0.04%. 10-year yield rose 0.080 to 4.096.

UK retail sales rises 0.3% mom in Sep, extended rebound in consumption

UK retail sales volumes rose by 0.3% mom in September, defying expectations of -0.3% decline. This marked the highest retail sales index level since July 2022, reflecting stronger-than-anticipated rebound in consumer activity.

Looking at the broader picture, sales volumes in Q3 surged by 1.9% compared to Q2, the joint-largest quarterly rise since July 2021. This upward momentum, shared with March 2024.

Japan’s CPI core slows to 2.4%, core-core edges up

Japan’s core CPI, which excludes fresh food, eased from 2.8% yoy to 2.4% yoy in September, slightly above expectations of 2.3% yoy. Despite the slowdown, core inflation has remained above BoJ’s 2% target for well over two years.

The deceleration in price gains is largely attributed to government utility subsidies, which have helped lower household expenses. Headline CPI fell from 3.0% yoy to 2.5%, with gas prices subtracting 0.55 percentage points from the overall figure. This indicates that without government intervention, inflation would have remained higher.

Meanwhile, CPI measure that excludes both food and energy costs—often referred to as core-core CPI—increased from 2.0% yoy to 2.1% yoy, suggesting underlying inflation remains firm. However, service prices saw a slight decrease in momentum, slowing from 1.4% yoy to 1.3% yoy.

China’s Q3 GDP growth slows to 4.6%, stimulus impact yet to solidify

China’s economy grew 4.6% yoy in Q3, slowing slightly from 4.7% in Q2 but in line with market expectations. This marks the slowest pace of growth since early 2023, as external pressures and a challenging global environment continue to weigh on the country’s economic performance. On a quarterly basis, GDP expanded by 0.9%.

The National Bureau of Statistics noted that the economy remained “generally stable with steady progress,” highlighting continued increase in production and demand, alongside stable employment and prices.

The NBS emphasized that the effects of the government’s stimulus policies were beginning to show, with “major indicators displaying positive changes recently.”

However, the bureau also cautioned that the external environment was becoming “increasingly complicated and severe,” underscoring the need to further solidify the foundation for sustained recovery.

Key economic data released alongside the GDP report suggested signs of resilience in some sectors. Industrial production increased by 5.4% yoy in September, surpassing expectations of 4.6% yoy. Retail sales also exceeded forecasts, rising 3.2% yoy compared to the expected 2.4% yoy. Fixed asset investment saw a 3.4% year-to-date increase, slightly above 3.3% expected by analysts.

GBP/USD Daily Outlook

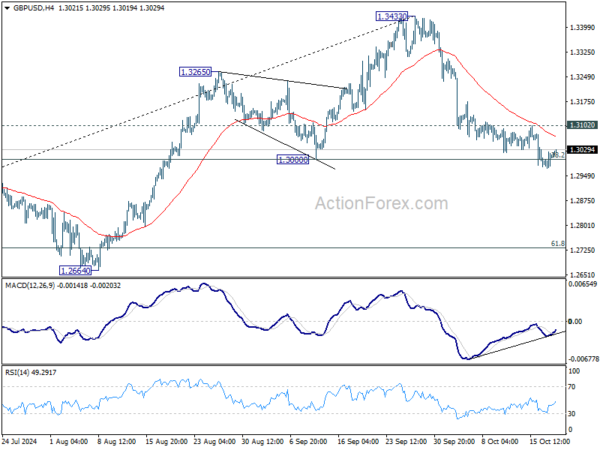

Daily Pivots: (S1) 1.2982; (P) 1.3003; (R1) 1.3031; More…

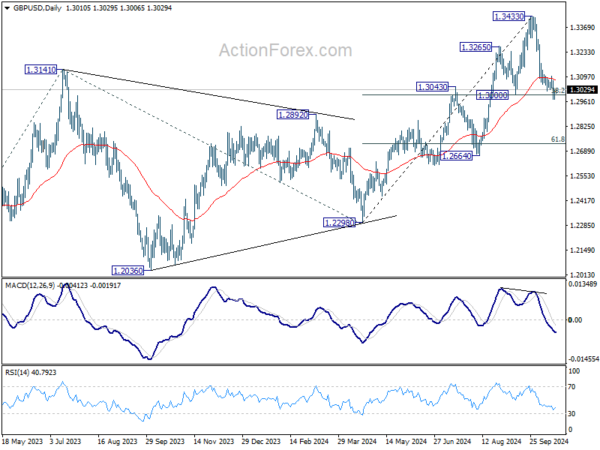

Intraday bias in GBP/USD is turned neutral with current recovery. On the downside, sustained trading below 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999) will argue that whole rise from 1.2298 has completed and bring deeper fall to 61.8% retracement at 1.2732. Nevertheless, strong bounce from current level, followed by break of 1.3102 minor resistance, will turn bias back to the upside for stronger rebound towards 1.3433.

In the bigger picture, as long as 1.3000 support holds, the up trend from 1.0351 (2022 low) is still in progress. Next target is 61.8% projection of 1.0351 to 1.3141 from 1.2298 at 1.4022. However, considering mild bearish divergence condition in D MACD, decisive break of 1.3000 will argue that a medium term top is already in place, and bring deeper fall back to 1.2664 support next.