UPCOMING

EVENTS:

- Monday: Eurozone Retail Sales. (China on holiday)

- Tuesday: Japan Average Cash Earnings, RBA Meeting Minutes,

US NFIB Small Business Optimism Index. - Wednesday: RBNZ Policy Decision, FOMC Meeting Minutes.

- Thursday: Japan PPI, ECB Meeting Minutes, US CPI, US

Jobless Claims, New Zealand Manufacturing PMI. - Friday: UK GDP, Canada Labour Market report, US PPI, US

University of Michigan Consumer Sentiment, BoC Business Outlook Survey.

Tuesday

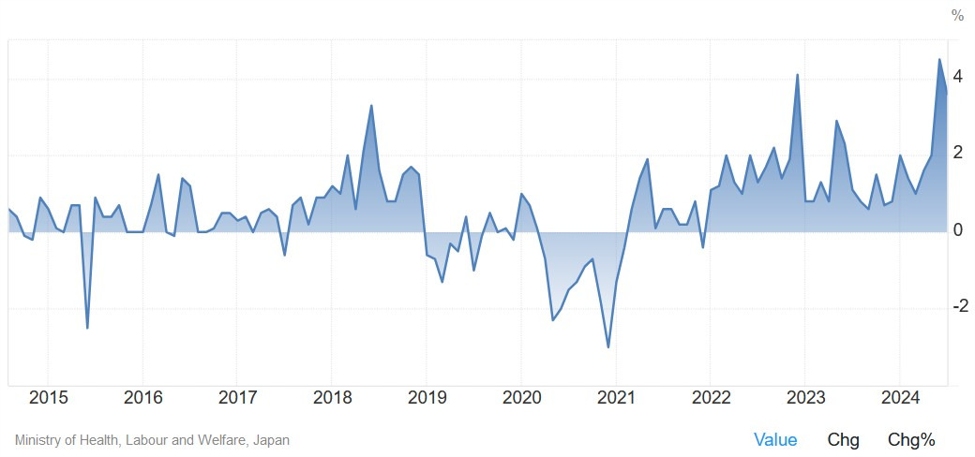

The Japanese

Average Cash Earnings Y/Y is expected at 3.1% vs. 3.6% prior. Wage growth has

turned positive lately in Japan and that’s something the BoJ always wanted to

see to meet their inflation target sustainably. The data shouldn’t change much for the

central bank for now as they want to wait some more to assess the developments

in prices and financial markets following the August rout.

Japan Average Cash Earnings YoY

Wednesday

The RBNZ is

expected to cut the OCR by 50 bps and bring it to 4.75%. The reason for such

expectations come from the unemployment rate being at the highest level in 3

years, the core inflation rate being inside the target range and high frequency

data continuing to show weakness. Moreover, Governor Orr in the last press

conference said that they considered a range of moves in the last policy

decision and that included a 50 bps cut.

RBNZ

Thursday

The US CPI Y/Y is

expected at 2.3% vs. 2.5% prior, while the M/M figure is seen at 0.1% vs. 0.2%

prior. The Core CPI Y/Y is expected at 3.2% vs. 3.2% prior, while the M/M

reading is seen at 0.2% vs. 0.3% prior.

The last US labour

market report came out much better than expected and the market’s pricing for a

50 bps cut in November evaporated quickly. The market is now finally in line

with the Fed’s projection of 50 bps of easing by year-end.

Fed’s Waller

mentioned that they could go faster on rate cuts if the labour market data

worsened, or if the inflation data continued to come in softer than everybody

expected. He also added that a fresh pickup in inflation could also cause the

Fed to pause its cutting.

Given the recent

NFP report, even if the CPI misses slightly, I don’t think they would consider

a 50 bps cut in November anyway. That could be a debate for the December

meeting if inflation data continues to come below expectations.

US Core CPI YoY

The US Jobless

Claims continues to be one of the most important releases to follow every week

as it’s a timelier indicator on the state of the labour market.

Initial Claims

remain inside the 200K-260K range created since 2022, while Continuing Claims

after rising sustainably during the summer improved considerably in the last

weeks.

This week Initial

Claims are expected at 230K vs. 225K prior, while there’s no consensus for

Continuing Claims at the time of writing although the prior release showed a

decrease to 1826K.

US Jobless Claims

Friday

The Canadian

Labour Market report is expected to show 28K jobs added in September vs. 22.1K

in August and the Unemployment Rate to increase to 6.7% vs. 6.6% prior. The

market is pricing an 83% probability for a 25 bps cut at the upcoming meeting

but since inflation continues to surprise to the downside, a weak report will

likely raise the chances for a 50 bps cut.

Canada Unemployment Rate

The US PPI Y/Y is

expected at 1.6% vs. 1.7% prior, while the M/M figures is seen at 0.1% vs. 0.2%

prior. The Core PPI Y/Y is expected at 2.7% vs. 2.4% prior, while the M/M

reading is seen at 0.2% vs. 0.3% prior.

Again, the data is

unlikely to get the Fed to debate a 50 bps cut at the November meeting even if

it misses. The risk now is for inflation to get stuck at a higher level or even surprise to the upside.

US Core PPI YoY