The US dollar has moved to the upside after the stronger-than-expected US jobs report. The unemployment rate dipped to 4.1%. The nonfarm payroll was much stronger than expected at 254K versus 140K estimate. That’s a highest level since March when nonfarm payrolls rose by 310K and is the third highest for the year (January rose by 256K). The revisions added 72K to the prior month’s.

- 78K in leisure and hospitality

- 76K in healthcare

Looking at the yields:

- 2 year yield is 3.861%, +14.8 basis points. Last Friday it was at 3.56%

- 5 year yield 3.763%, +13.1 basis points

- 10 year yield 3.945%, plus not .6 basis points

- 30 year yield 4.236%, +5.7 basis points

The chance of a 50 basis point hike is down to around 11%. It seems certain that if the Fed does cut to recalibrate the Fed funds rate to inflation it would be a 25 basis point cut.

In the US stock market, the major indices are higher:

- Dow +190.41 points from +88.41 points just before the number

- S&P +39 points from +17.31 points just before the number

- Nasdaq +188.16 point from +72.91 points just before the number

In the forex:

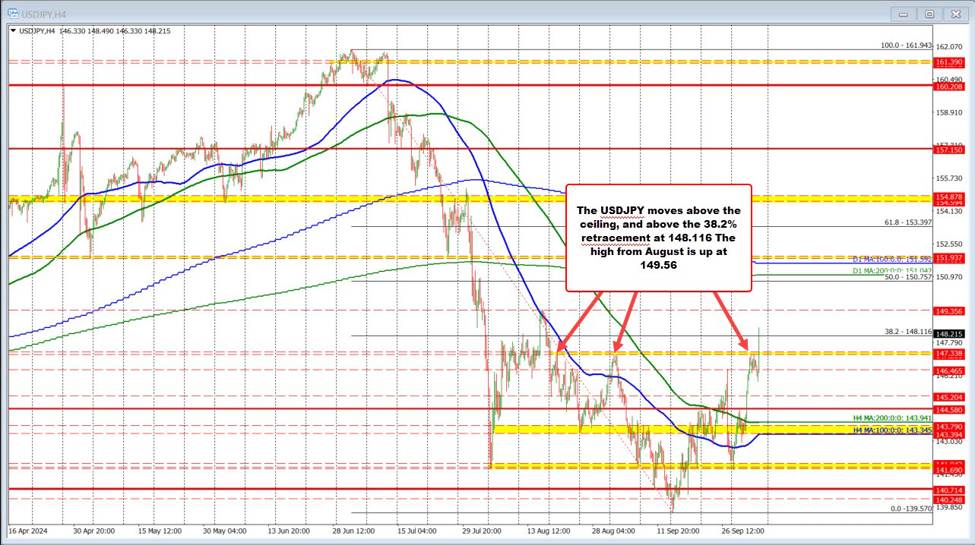

- USDJPY is broken above the ceiling at 147.20 – 147.338, and days next targeting the high price from August 16 at 149.390. Looking at the four-hour chart, the price also broke above the 38.2% retracement of the move down from the 2024 high. That level comes in at 148.116.

- EURUSD: The EURUSD fell below the swing area between 1.1001 and 1.10145 and also the 50% midpoint of the move up from the August 1 low at 1.0995. That is now close risk. On the downside, the 61.8% retracement and swing area near 1.0944 is the next target. Below that the rising 100-day moving average of 1.0928 is targeted.

This article was originally published by Forexlive.com. Read the original article here.