The US looks like it’s heading for a soft landing.

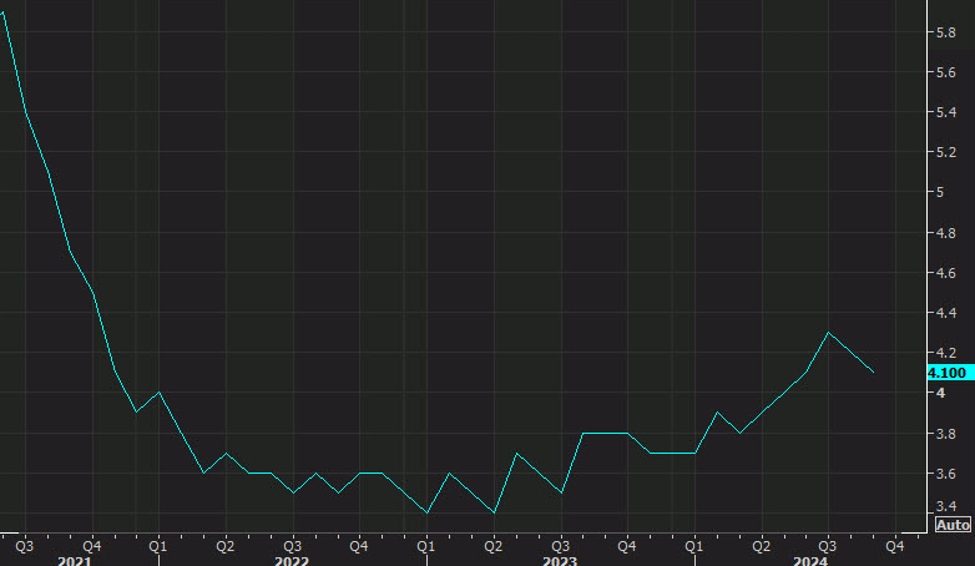

The unemployment rate fell to 4.0510% compared to 4.220% previously and adds downside risks to the Fed’s year-end dot at 4.4%. It also reverses some recent upwards momentum.

US unemployment rate

The rates market is now pricing in just a 9% chance of a 50 basis point cut on November 7.

There are times when the market demands a dovish Fed and prefers soft economic data but this isn’t one of those times. The Fed has been clear that it’s going to slowly cut rates down to neutral (or close) so it’s on autopilot. That had the market trading on fears of a recession but that’s looking far less likely after this week’s data.

It wasn’t just the jobs report today but yesterday’s ISM services survey rose to the best levels since February 2023.

S&P 500 have jumped by 50 points, or 0.8% following the data. That should put the cash market around 25 points from a fresh record high.