As the NA session begins, the CAD is the strongest and the NZD is the weakest. The USD is stronger a day after Fed Chair Powell tapped the brakes saying that two 25 basis point cuts were likely if the trends continue. Powell indicated that monetary policy will gradually move toward a neutral stance if the economy continues to meet projections. He highlighted that the risks are balanced and that decisions will be made on a meeting-by-meeting basis. Powell also pointed to an upward revision in Gross Domestic Income (GDI), which showed stronger growth than initially reported, with GDI growing at a 3.4% rate in the recent quarter. This revision suggests consumers may have more spending power, which could help sustain the economy’s strength.

Meanwhile, one proxy for consumer appetite, Apple’s iPhone 16 pre-sales are estimated to have dropped by over 12% compared to last year, with just 37 million units sold during the first weekend, according to analyst Ming-Chi Kuo. Demand for the higher-priced iPhone 16 Pro models saw a significant decline compared to the previous iPhone 15 launch. Wedbush analyst Dan Ives estimated slightly higher pre-sales at 40 million units, but CFRA Research’s Angelo Zino confirmed the overall trend, indicating a year-over-year decline in preorder sales.

In other potentially impactful new in the US overnight saw the billions in trade coming to a halt at U.S. East Coast and Gulf Coast ports after members of the International Longshoremen’s Association (ILA) began a strike, following the expiration of their master contract with the United States Maritime Alliance (USMX).

Around 50,000 longshoremen walked off the job at 14 major ports, including New York/New Jersey, Baltimore, and Houston, after failing to reach an agreement over wage increases and automation. Despite a last-minute offer of a nearly 50% wage hike over six years from USMX, the ILA rejected the proposa (they are looking for 70%)l. The strike, the first large-scale eastern dockworker strike in 47 years, could significantly impact the U.S. economy, with major ports losing hundreds of millions of dollars daily.

Supply chain inflation? NO!

The market is pricing in a near 40% chance of a 50 bp cut by the Fed in November in their recalibration process.

China is on holiday for the rest of the trading week. So no major news coming out, nor are there any changes in major stock indices. .

A summary of the economic data from the European Union this morning, was focused on PMI (Purchasing Managers’ Index) results, and which showed mixed performance across countries. Below is a summary organized by those that beat expectations and those that missed expectations:

Countries that Beat Expectations:

- Spain: Manufacturing PMI came in at 53.0, beating the forecast of 50.2 and the previous reading of 50.5.

- France: Final Manufacturing PMI reported 44.6, slightly above the forecast of 44.0 and matching the previous value of 44.0.

- Germany: Final Manufacturing PMI recorded 40.6, beating the forecast of 40.3, which matched the previous result.

Countries that Missed Expectations:

- Italy: Manufacturing PMI came in at 48.3, below the forecast of 49.0 and down from the previous reading of 49.4.

- Eurozone (overall): Final Manufacturing PMI at 45.0, just missing the forecast of 44.8 but down from the previous reading of 44.8.

UK Data (for reference):

- UK: Final Manufacturing PMI matched both the forecast and previous reading, coming in at 51.5.

Additionally, the Core CPI Flash Estimate year-over-year for the Eurozone matched the forecast at 2.7%, slightly lower than the previous 2.8%, while the heasdline CPI Flash Estimate year-over-year matched expectations at 1.8%, but lower than the previous 2.2%.

From the ECB, policymaker Olli Rehn stated that the direction of monetary policy is clear, with the stance becoming less restrictive as rate cuts have already begun. He indicated that the pace and scale of future cuts will be decided on a meeting-by-meeting basis. Rehn expects inflation to stabilize at the 2% target by 2025. While he sees growing justification for a rate cut in October due to slowing inflation and a weakening growth outlook, Rehn emphasized the need to monitor upcoming data closely before making any final decisions. This marks the first explicit suggestion from an ECB policymaker about a potential October rate cut.

Although there was some PMI data that beat expectations, most of the country numbers are still below the 50.0 level indicative of contraction in manufacturing activity. The CPI data is also encouraging for a continuation of lower rates.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$0.51 or -0.75% at $67.67. At this time yesterday, the price was at $67.88

- Gold is trading up $20.02 or 0.77% at $2654.75. At this time yesterday, the price was $2641.72.

- Silver is trading up $0.27 or 0.86% at $31.41. At this time yesterday, the price is at $31.28

- Bitcoin is trading at $63,769. At this time yesterday, the price was at $63,813

- Ethereum is trading at $2630.80. At this time yesterday, the price was at $2629.80

In the premarket, the snapshot of the major indices trading mixed:

- Dow Industrial Average futures are implying a decline of-$117.10. Yesterday, rose 17.15 points or 0.04% at 42330.15.

- S&P futures are implying a loss of -4.98 points. Yesterday, the index rose 24.31 points or 0.42% at 5762.48.

- Nasdaq futures are implying a gain of 3.31 points. Yesterday, the index rose 69.58 points or 0.38% at 18189.17

Yesterday, the small-cap Russell 2000 rose up 26 points or 0.24% at 2229.97.

European stock indices are trading mixed/mostly higher

- German DAX, +0.52%

- France CAC, +0.07%

- UK FTSE 100, +0.57%

- Spain’s Ibex, -0.64%

- Italy’s FTSE MIB, +0.09% (delayed by 10 minutes)

Shares in the Japan were higher and Australia lower. China and Hong Kong were closed for the Golden week holiday:

- Japan’s Nikkei 225, +1.93%

- China’s Shanghai Composite Index, on holiday for Golden week

- Hong Kong’s Hang Seng index, on holiday for Golden week

- Australia S&P/ASX index, -0.74%

Looking at the US debt market, yields are higher

- 2-year yield 3.628%, -2.2 basis points. At this time yesterday, the yield was at 3.608%

- 5-year yield 3.529%, -4.8 basis points. At this time yesterday, the yield was at 3.539%

- 10-year yield 3.744%, -5.7 basis points. At this time yesterday, the yield is at 3.777%

- 30-year yield 4.074%, -5.9 basis points. At this time yesterday, the yield is at 4.102%

Looking at the treasury yield curve, is similar to Friday’s levels at this time

- The 2-10 year spread is at 11.6 basis points. At this time yesterday, the yield spread was +17.1 basis points.

- The 2-30 year spread is at 44.4 basis points. At this time yesterday, the yield spread was +51.5 basis points.

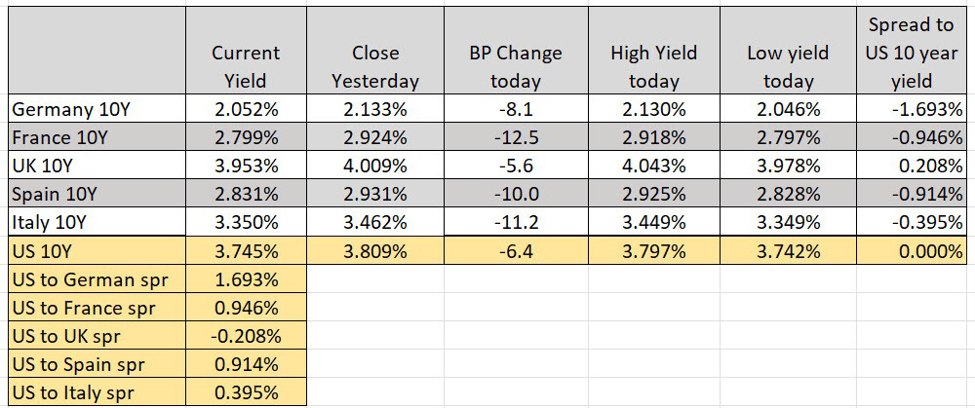

In the European debt market, the 10 year yields are sharply lower: