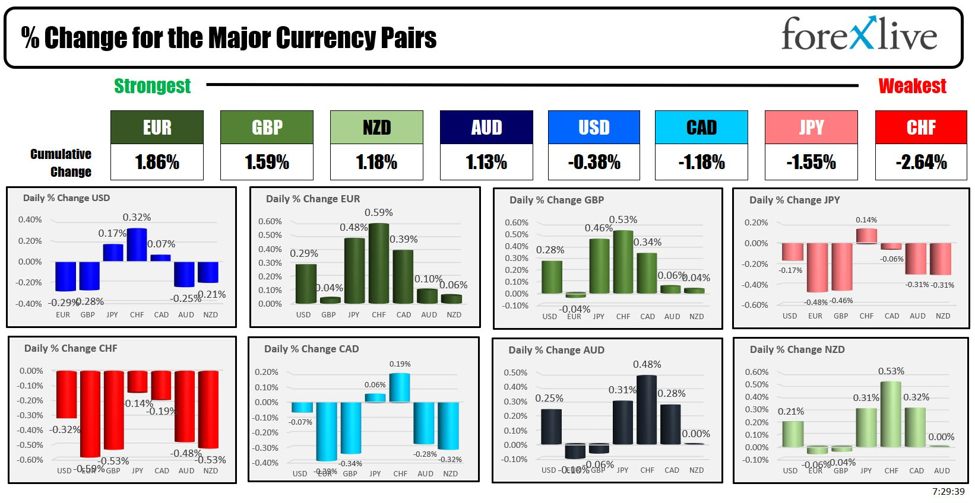

As the NA session begins, the EUR is the strongest and the CHF is the weakest. The USD is mixed to start the new trading week.

Last week, was filled with China stimulus announcements from both a fiscal and monetary policy. The stock market soared in response with the Shanghai composite index rising 12.81%. The Hong Kong Hang Seng index surged by 13.0%. Today, the advancements continued with Shanghai composite index up another 8% and the Hang Seng index up 2.4%. The punch bowl will be taken away however as China will be on holiday starting tomorrow for the week. We will have to wait until next week to see if the momentum can continue, but the stimulus has been strong and that has indices trading at the highest levels going back to the first half of 2023.

Over the weekend, the People’s Bank of China (PBOC) announced it is instructing banks to lower mortgage rates for existing home loans by October 31. Banks are directed to reduce interest rates to at least 30 basis points below the Loan Prime Rate (LPR), which currently stands at 3.85% for the five-year term used as a reference for long-term credit like mortgages. While the LPR was unchanged this month, it is expected to decrease, effectively lowering mortgage rates by about 50 basis points. This measure aims to alleviate the significant drag the struggling property sector has on the economy. Additionally, Guangzhou city will lift all restrictions on home purchases, while Shanghai and Shenzhen will ease housing purchase restrictions for non-local buyers and reduce the minimum down payment ratio for first-time homebuyers to no less than 15%.

In September, Chinese factory activity contracted, although it did slightly exceeded economists’ expectations. The official manufacturing PMI came in at 49.8 from 49.1 in August, and beat expectations of 49.4, but still indicating contraction as it remains below 50. The Caixin manufacturing PMI fell to 49.3 from 50.4, missing expectations of 50.5 and moving below the 50 level. Additionally, the official non-manufacturing PMI came in at 50, while the Caixin services PMI dropped to 50.3 from 51.6, reflecting ongoing challenges in China’s economic recovery efforts.

In geopolitical news, oil prices are higher on the possibility of a widening Middle East conflict after Israel stepped up its attacks on the Iranian-backed Hezbollah and Houthi militant groups.

Just released, Germany’s preliminary CPI for September rose by 1.6% year-over-year, slightly below the expected 1.7% and down from 1.9% in August. The HICP increased by 1.8%, also just below the forecast of 1.9%. Core inflation is expected to be 2.7%, only slightly down from August’s 2.8%, indicating that further efforts are needed to establish a stronger disinflation trend in Germany. Expectations for a cut by the ECB at the October meeting started to heat up last week.

In the US, the chance of 50 bps in November is down to about 40.5%.

This week, the US jobs report will be the key release. That will be released at the typical Friday at 8:30 AM time. The expectation is for nonfarm payroll to rise by 144K summer to last month 142K gain. The unemployment rate is expected to remain steady at 4.2%. If whatever report there will be other employment hints. The manufacturing ISM data will be released tomorrow including the employment component. The JOLTS job openings will also be released on Tuesday. On Wednesday, the ADP employment report will be released and finally on Thursday, the most recent weekly initial and continuing claims data will be released.

Today, the Dallas at manufacturing syntax will be released at 10:30 AM Fed chair Powell is also scheduled to speak at 1:55 PM ET.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.25 at $67.88. At this time yesterday, the price was at $67.81

- Gold is trading down $16.24 or -0.61% had $2641.72. At this time yesterday, the price was $2665.67

- Silver is trading down $0.33 or -1.10% at $31.28. At this time yesterday, the price is at $31.99

- Bitcoin is trading at $63,813. At this time yesterday, the price was at $65,439

- Ethereum is trading at $2629.80. At this time yesterday, the price was at $2653.30

In the premarket, the snapshot of the major indices trading lower

- Dow Industrial Average futures are implying a decline of-$69.02. On Friday, the index rose 137.89 points or 0.33% at 42313.00

- S&P futures are implying a loss of -18.17 points. On Friday, the index fell -7.20 points or -0.13% at 5738.17

- Nasdaq futures are implying a loss of -93.20 points. On Friday, the index fell -70.70 points or -0.39% at 18119.59

Yesterday, the small-cap Russell 2000 rose 14.83 points or less 0.67% at 2224.70.

European stock indices are trading lower

- German DAX, -0.76%

- France CAC, -1.75%

- UK FTSE 100, -0.68%

- Spain’s Ibex, -0.69%

- Italy’s FTSE MIB, -1.77%

Shares in the Asian Pacific markets China and Hong Kong continue to search after aggressive China stimulus:

- Japan’s Nikkei 225, -4.80%

- China’s Shanghai Composite Index, is 8.06%

- Hong Kong’s Hang Seng index, +2.43%

- Australia S&P/ASX index, +0.70%

Looking at the US debt market, yields are higher

- 2-year yield 3.608%, +4.5 basis points. At this time yesterday, the yield was at 3.612%

- 5-year yield 3.539%, +3.6 basis points. At this time yesterday, the yield was at 3.548%

- 10-year yield 3.777%, +2 point basis points. At this time yesterday, the yield is at 3.779%

- 30-year yield 4.120%, +2.2 basis points..At this time yesterday, the yield is at 4.111%

Looking at the treasury yield curve, is similar to Friday’s levels at this time

- The 2-10 year spread is at 17.1 basis points. At this time yesterday, the yield spread was +16.7 basis points.

- The 2-30 year spread is at +51.5 basis points. At this time yesterday, the yield spread was +49.8 basis points.

In the European debt market, the 10 year yields are mostly higher: