Fundamental

Overview

Copper has been on

a sustained downtrend since reaching its peak in May. A lot of the weakness has

been attributed to the struggling economic recovery in China.

Copper is

sensitive to the manufacturing cycle, and after a pickup in the first half of

the year, we’ve been seeing a notable pullback as tight monetary policy

continued to weigh.

That could reverse

in the next months as the Fed is finally starting its easing cycle today. A 50

bps cut would be better in the bigger picture as it would indicate that the Fed

wants to get ahead. More easing from the Chinese officials would also boost the

copper market.

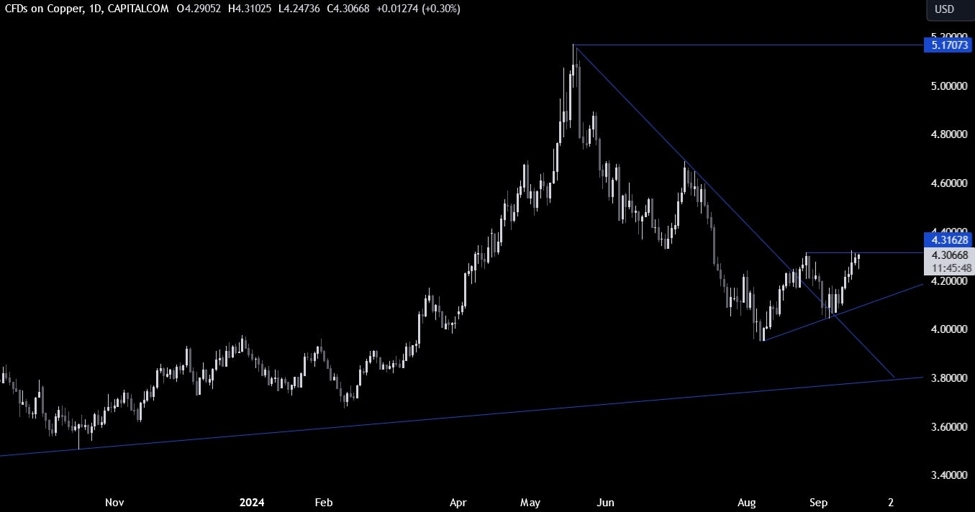

Copper

Technical Analysis – Daily Timeframe

Copper Daily

On the daily chart, we can

see that copper broke above the major trendline and after a retest, rallied back to

the 4.32 level. This level is acting as a strong resistance.

We can expect the sellers to step in here with a defined risk above the level

to position for a drop into new lows. The buyers, on the other hand, will want

to see the price breaking higher to increase the bullish bets into the 4.70

level.

Copper Technical

Analysis – 4 hour Timeframe

Copper 4 hour

On the 4 hour chart, we can

see that we have an upward trendline defining the current bullish momentum. The

buyers will likely keep on leaning on the trendline to position for new highs,

while the sellers will want to see the price breaking lower to increase the

bearish bets into new lows.

Copper Technical

Analysis – 1 hour Timeframe

Copper 1 hour

On the 1 hour chart, we can

see that the price action has been rangebound between the 4.25 support and the

4.32 resistance. The buyers will want to see the price breaking to the upside

to increase the bullish bets into new highs, while the sellers will look for a

break lower to position for a drop into new lows. The red lines define the average daily range for today.

Upcoming

Catalysts

Today, we have the FOMC Rate Decision and tomorrow, we get the latest US

Jobless Claims figures.